by Devin Pascoe | September 8, 2022

Supplemental Report: 2022 Insurance Barometer Study

The Life Insurance “Need Gap” for Hispanic Americans

Owning life insurance gives people financial peace of mind. In fact, among those with dependents who have life insurance, 68% say they feel financially secure, compared with less than half (47%) of those with no coverage.

Why, then, do so many not have the coverage they need? Only half of adult Americans say they have life insurance, and that number is even more pronounced in the Hispanic community, where just 42% have coverage. This represents a decline of 9 points for Hispanic Americans compared to last year.

A new report, “Hispanic Americans: Life Insurance Ownership and Attitudes,” gives insight into this disparity and how this gap can be overcome. This report is a supplement to the 2022 Insurance Barometer Study, by Life Happens and LIMRA.

The need for life insurance

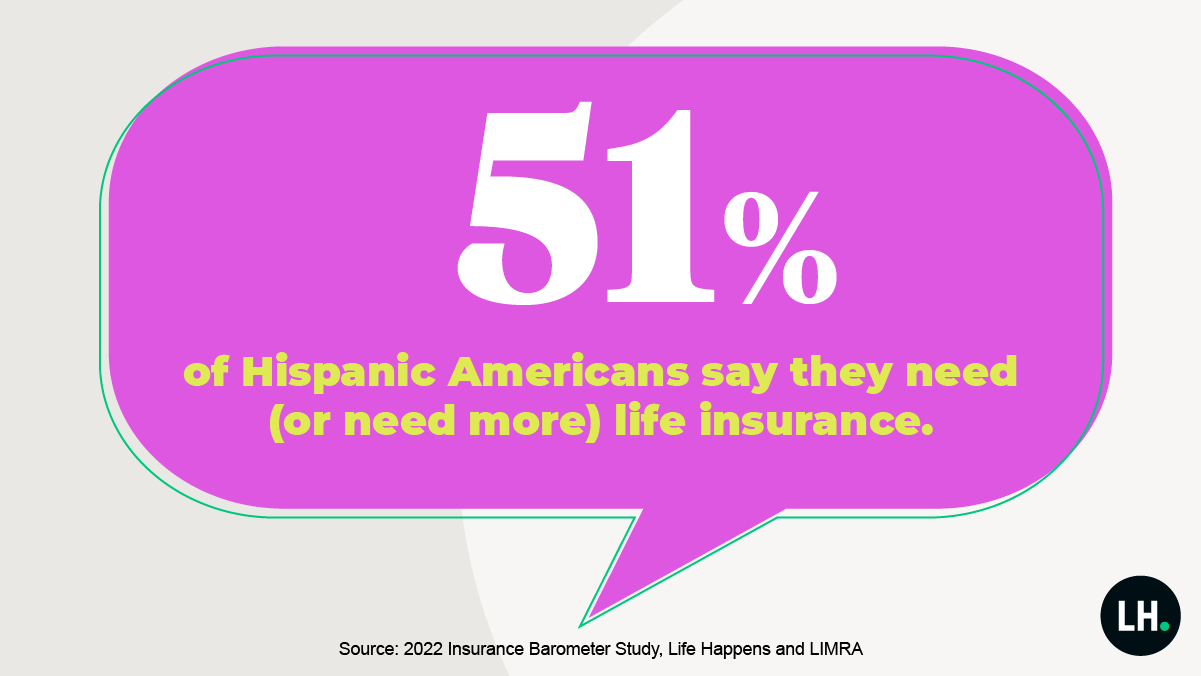

More than half of Hispanic Americans (51%) say they have a life insurance need:

- 40% are uninsured and say they need life insurance

- 11% have some life insurance and say they need more

- This suggests 22 million Hispanics in the U.S. have a need for life insurance (based on U.S. Census data)

Why do Hispanic Americans want life insurance?

The most universal reason to own life insurance—across race and ethnicity—is to cover burial and final expenses, and Hispanic Americans are no exception.

- 7 in 10 Hispanic Americans cite this as the major reason they own life insurance (69%)

- The next two “major” reasons for owning it are to replace lost wages (41%) and to leave an inheritance (39%)

What’s stopping them from getting coverage?

Hispanic Americans say that cost (38%) and competing financial priorities (38%) are the top reasons that they don’t have life insurance or more of it.

On average, Hispanic Americans are feeling more financial strain than other Americans: They report more concern about a wider range of financial issues than other races and ethnicities. Cost may be a perceived barrier to ownership, however, as 75% of people overestimate the true cost of life insurance.

Engaging and educating about life insurance

Hispanic Americans are open to advice and education. More than a quarter (26%) say they are unsure of how much and what type of life insurance to buy. In addition,

- 27% of Hispanic Americans are looking for a financial advisor, vs. 20% of the general population

- They use social media for financial info more than other races and ethnicities (66% of Hispanic Americans vs. 53% of the general population)

- They prefer to use newer social-media platforms like Instagram and TikTok for financial knowledge

We’re committed to educating Americans about life insurance

At Life Happens, we establish and lead several annual campaigns, including Life Insurance Awareness Month and the

Help Protect Our Families campaign, to help people overcome perceived barriers and motivate them to purchase life insurance to protect their loved ones financially. Check out our free

Life Insurance Needs Calculator in

English or

Spanish to evaluate your own coverage needs and take action.

Discover more

For more information on this study and its methodology, view our press release.

by Devin Pascoe | April 25, 2022

2022 Insurance Barometer Study

Owning Life Insurance Provides a Clear Path to Financial Security

The 2022 Insurance Barometer Study, conducted annually by

Life Happens and

LIMRA, reveals that financial security is a concern for all generations, but one that can be addressed with a stronger understanding of life insurance and its value. Still, misconceptions around life insurance persist among consumers, with 80% overestimating the cost of a life insurance policy. This problem is also exacerbated by a general discomfort with end-of-life discussions surrounding death and financial planning, allowing the life insurance need gap to persist.

Establishing financial security is a challenge spanning all generations

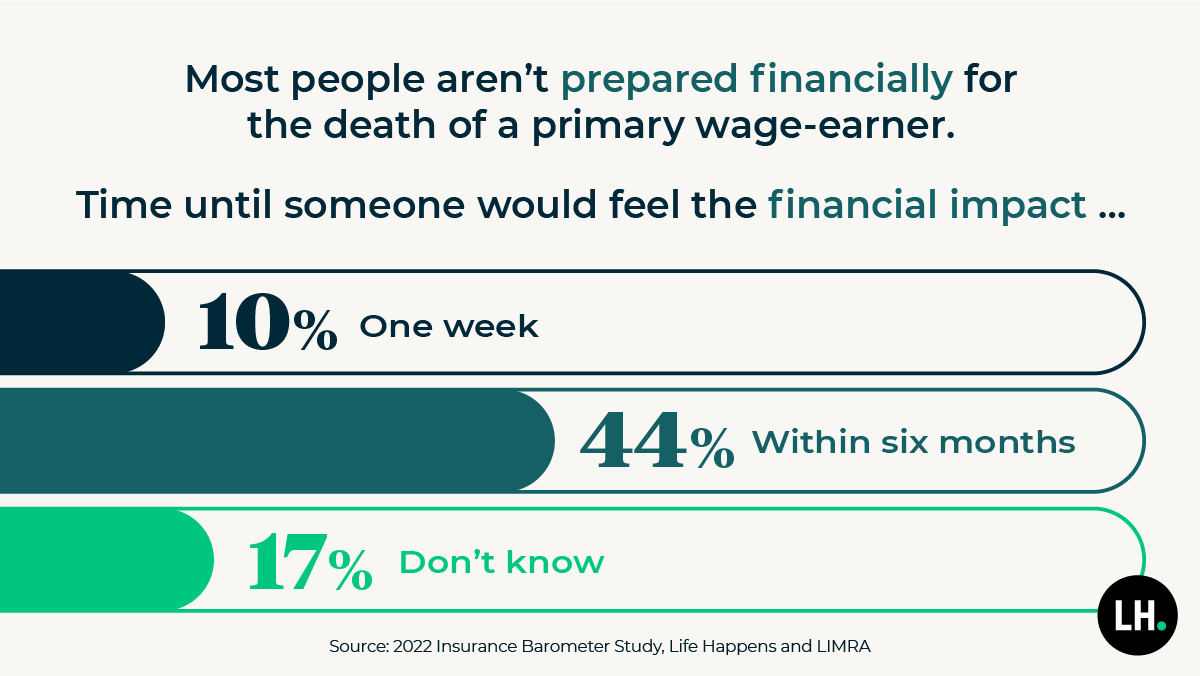

Financial insecurity is highest among Gen X (49%), followed by Millennials (44%), Gen Z (42%), and Baby Boomers (33%). And according to the survey, most households have not prepared for the loss of a primary wage earner.

- 1 in 10 respondents report they’d feel financial strain in one week if their household’s primary earner died

- Over 2 in 5 parents say it would take less than six months for financial hardship to set in

- Only 1 in 5 respondents say they have a safety net of five years or more

We know we need life insurance, yet the need gap persists

Life insurance is a key element in feeling financially secure, yet the need gap – what people have vs. what they say they need – is at an all-time high (18 points) and more than double what it was 12 years ago.

- 68% of life insurance owners feel financially secure compared to just 47% of non-owners

The unmet need for coverage rose significantly with the pandemic and remains elevated in 2022, revealing the lasting impact of COVID is still felt by many.

- 31% of respondents say they are more likely to buy life insurance in 2022

A lack of knowledge may lead some to avoid important conversations

Consumers, especially Millennials and Gen Z, report feeling uncertainty about life insurance, which may be why some haven’t gotten coverage.

- Almost half (42%) of respondents say they are somewhat or not at all knowledgeable about life insurance

- Millennials (16%) and Gen Z (16%) are more likely than other generations to say they would not qualify for coverage, which is often not the case.

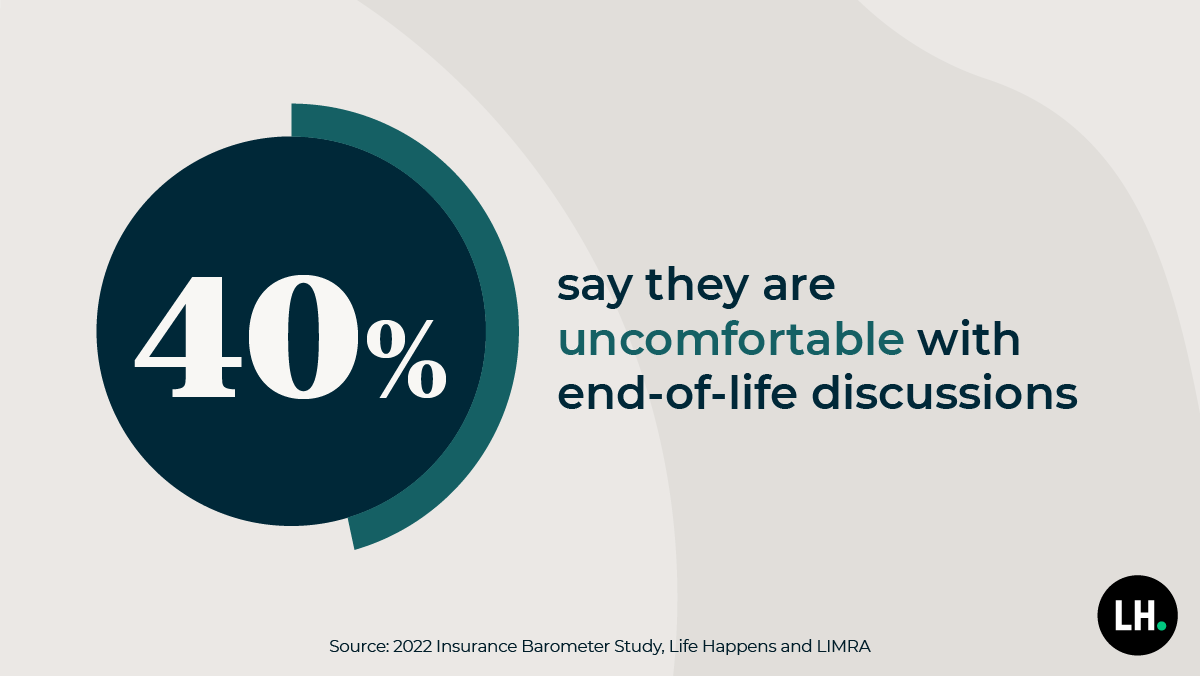

At the same time, respondents are largely uncomfortable talking about end-of-life planning with their loved ones, revealing the importance of education and the need to reframe conversations about life insurance to focus on long-term health and wellness in order to build trust and close the need gap.

We’re committed to educating Americans about life insurance

At Life Happens, we establish and lead several annual campaigns, including Life Insurance Awareness Month and the

Help Protect Our Families campaign, to help people overcome perceived barriers and motivate them to purchase life insurance to protect their loved ones financially. Check out our free

Life Insurance Needs Calculator to evaluate your own coverage needs and take action.

Discover more

For more information on this study and its methodology, view our press release.

by Natalie Chambliss | March 25, 2022

Interest in Life Insurance Stays Strong

New data shows that half of American adults (50%) say they have life insurance and that COVID continues to drive interest in securing coverage, according to initial findings from the 2022 Insurance Barometer Study, by Life Happens and LIMRA.

Nearly 1/3 of people (31%) say COVID-19 has made it more likely they’ll purchase life insurance within the next 12 months. When looking at interest by age or race/ethnicity, it is highest among Millennials (44%), Black Americans (38%) and Hispanics (37%).

Purchase intent is also at a record high: 37% of Americans say they plan to buy life insurance this year.

Need Gap

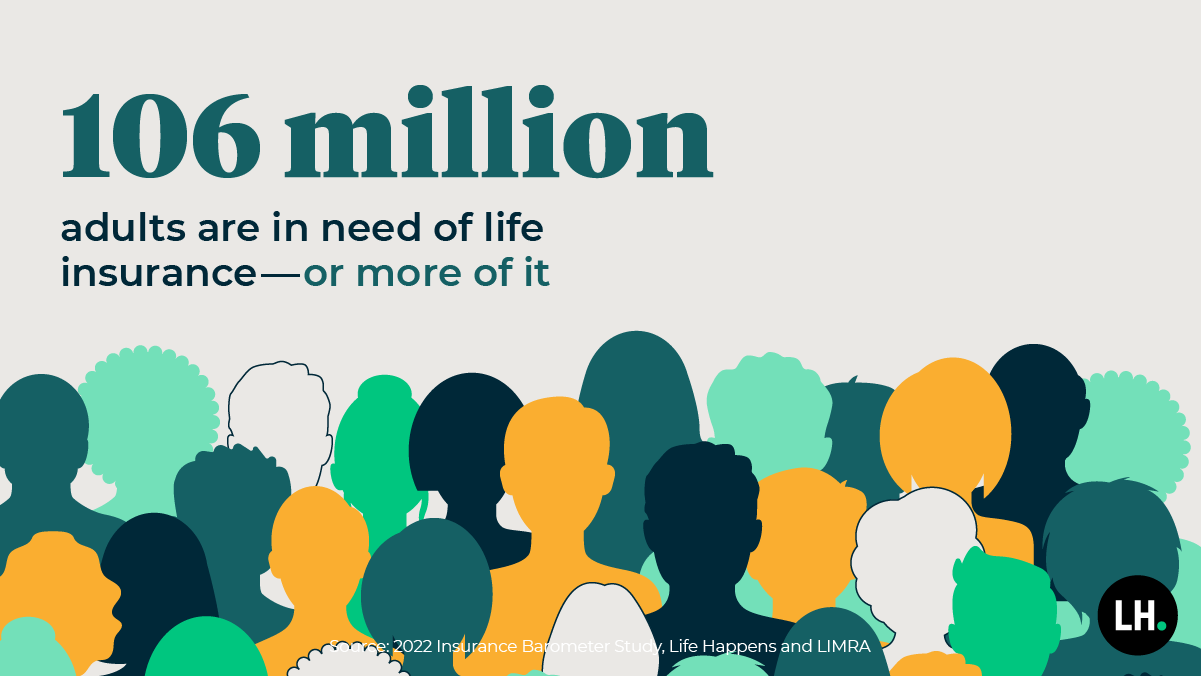

In addition, 41% of those surveyed say they need life insurance—or more of it. (That equals 106 million adult Americans). Those who are younger are most likely to believe they have a coverage gap: 47% of Millennials and 49% of Gen Z say they need (or need more) life insurance. In addition, 44% of women believe they have a need gap.

Life insurance is critical for many, as 4 in 10 households say they’d face financial hardship in six months if a wage-earner died. Nearly a quarter say they would struggle financially within a month.

For more on these initial findings, watch this video with Faisa Stafford, president and CEO of Life Happens, and David Levenson, president and CEO of LIMRA, LOMA and LL Global.

Stay Tuned

The full 2022 Insurance Barometer Study will be available on April 25. In addition, there will be a comprehensive supplement published in early summer covering Hispanics’ perception about life insurance, motivations for buying coverage, financial priorities and more.

In the last decade, the Hispanic population in the U.S. has grown 23% to 62.1 million. Their collective wealth has also skyrocketed, up 87% from 2010 to $1.9 trillion.

And according to this year’s Barometer Study, six in 10 Hispanic adults are uninsured. But, they are keenly aware of the importance of life insurance, with seven in 10 saying they need life insurance and 42% say they plan to buy within the next year, which is higher than any other race or ethnicity.

We’re committed to educating Americans about life insurance

At Life Happens, we created and coordinate

several campaigns, including Life Insurance Awarenes Month, every year to motivate people to purchase life insurance to protect their loved ones financially. To take action for your loved ones, we have a free

Life Insurance Needs Calculator to help evaluate your own life insurance needs.

by Devin Pascoe | February 1, 2022

American relationships are changing, and finances are playing a key role. In fact, the new study “For Love and Money” from Life Happens found that

those in a relationship are talking openly about their finances even before saying “I love you.”

And people are attracted to partners who can plan ahead—and that includes financial preparedness, with 4 in 10 describing financial security as one of the most attractive traits to have in a romantic partner.

- 67% of those in a relationship agree there is nothing sexier than saving money.

- 59% would feel more secure in their relationship if they discussed getting life insurance with their partner, and 51% say the right time to do that is before marriage.

- 74% said it took between one and eight months to be comfortable talking about their finances with their partner, while in that same period, only 42% would say “I love you.

- 42% describe financial security as one of the most attractive traits to have in a romantic partner.

Falling head over heels, but maybe not so traditionally

- The majority (70%) said they discussed (or will discuss) getting married with their partner less than a year into a relationship.

- 80% believe it’s more socially acceptable today for women to earn more than their male partners, and 77% don’t think relationships need one “breadwinner” anymore.

- 61% believe it’s no longer a “relationship requirement” to have a joint bank account when you’re married.

- 64% say they’d rather talk about finances with their partner than discuss having children.

Finances are big in a relationship

- 72% are willing to assist with paying down their partner’s debt.

- Finances are also factoring into how people show their love, with respondents saying they do so by saving money (24%) and budgeting (23%).

- When asked what financial decisions would demonstrate their love to someone, 36% said purchasing a life insurance policy, with men more likely to say that than women (40% vs 33%).

- But there are still taboos. The most taboo financial topics to talk about with your partner were prenups (31%) and joint bank accounts (21%) and the least taboo was life insurance (2%).

Discover more

To source this study, please use: “For Love and Money,” Life Happens, Jan. 2022

For more information on this study and its methodology, view our press release. And for media inquiries, contact lifehappens@kwtglobal.com.

We’re committed to educating Americans about life insurance

At Life Happens, we created and coordinate the Insure Your Love campaign every year to motivate people to purchase life insurance to protect their loved ones financially. To take action for your loved ones, we have a free Life Insurance Needs Calculator to help evaluate your own life insurance needs.

by Natalie Chambliss | April 12, 2021

2021 Insurance Barometer Study

Life Insurance Is on People’s Minds

The 2021 Insurance Barometer Study, by Life Happens and LIMRA, shows that while myths around life insurance persist, COVID-19 has shown people that they have a clear need for life insurance, with the industry making it easier than ever before to obtain coverage. In fact, 31% of consumers said they are more likely to buy life insurance because of the pandemic.

There is a heightened awareness of the need for life insurance

- 59% who don’t own life insurance say they need it

- 31% say they’re more likely to buy life insurance because of the pandemic

- 48% of Millennials say they plan to buy coverage in the next year

- 42% of Americans would face financial hardship within 6 months if the primary wage-earner were to die unexpectedly

Awareness has led some to take action with 13% of consumers saying they purchased life insurance for the first time in 2020.

According to the survey, about a quarter of people accepted five common myths and misconceptions about life insurance. Some of the top reasons they have for not owning life insurance (they can choose more than one)

- 81% – It’s too expensive

- 75% – Have other financial priorities

- 65% – Not sure how or what type to buy

- 62% – Haven’t gotten around to it

- 51% – Don’t like thinking about death

One of the biggest myths around life insurance is that it’s expensive, but the majority of people overestimate the true cost of life insurance by 3x or more and 44% of Millennials thought the cost of term life insurance policy was more than $1,000 a year when it’s closer to $160.*

Another misconception is that it’s difficult to obtain life insurance, and so people procrastinate. But in response to the pandemic, life insurance companies have pivoted to help consumers expedite the buying process online, from their homes. They are also streamlining the process with simplified underwriting, which influences the consumer’s likelihood to buy coverage: 48% say they are more likely to buy via simplified underwriting, with the top benefits of this process being that it is fast and easy (64%) and avoids the medical exam, blood and urine samples (56%).

The data shows that people don’t regret purchasing life insurance – in fact, they regret not purchasing it earlier: 39% say they wished they’d purchase their life insurance at a younger age.

*20 year, $250,000 level term life insurance policy for a healthy 30-year-old

We’re committed to educating Americans about life insurance

At Life Happens, we created and coordinate

several campaigns, including Life Insurance Awarenes Month, every year to motivate people to purchase life insurance to protect their loved ones financially. To take action for your loved ones, we have a free

Life Insurance Needs Calculator to help evaluate your own life insurance needs.

Discover more

For more information on this study and its methodology, view our press release.