2022 Insurance Barometer Study

Owning Life Insurance Provides a Clear Path to Financial Security

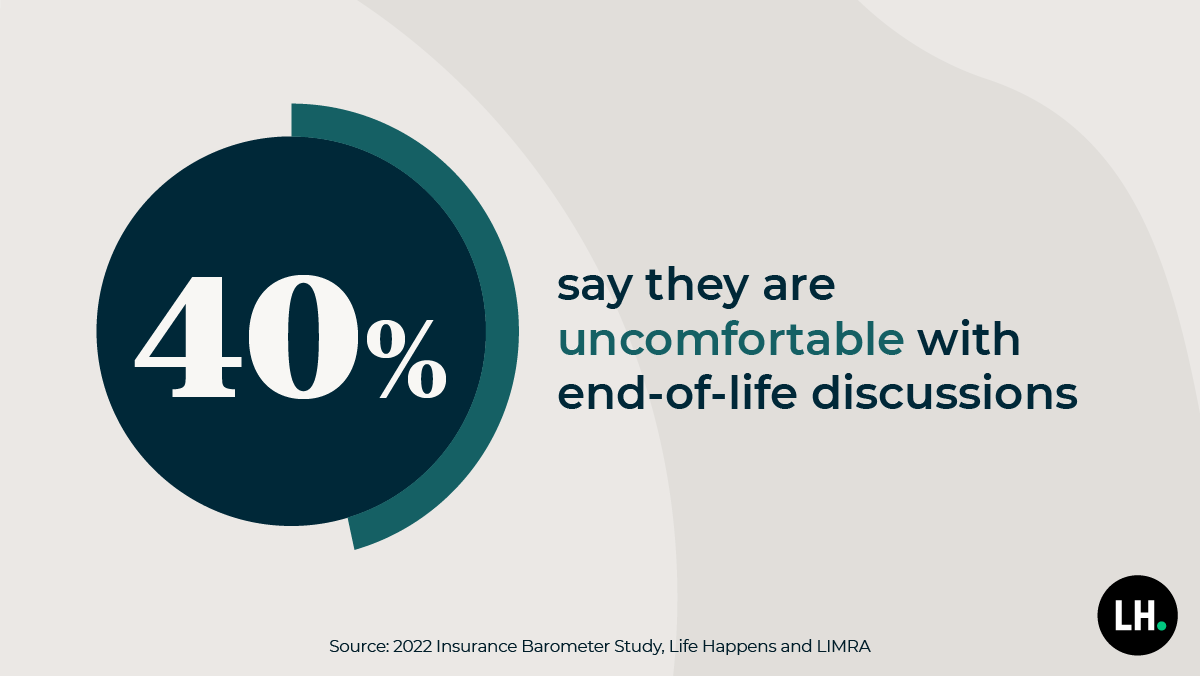

The 2022 Insurance Barometer Study, conducted annually by Life Happens and LIMRA, reveals that financial security is a concern for all generations, but one that can be addressed with a stronger understanding of life insurance and its value. Still, misconceptions around life insurance persist among consumers, with 80% overestimating the cost of a life insurance policy. This problem is also exacerbated by a general discomfort with end-of-life discussions surrounding death and financial planning, allowing the life insurance need gap to persist.

April 2022

For more information on this study, view our press release.

Establishing financial security is a challenge spanning all generations

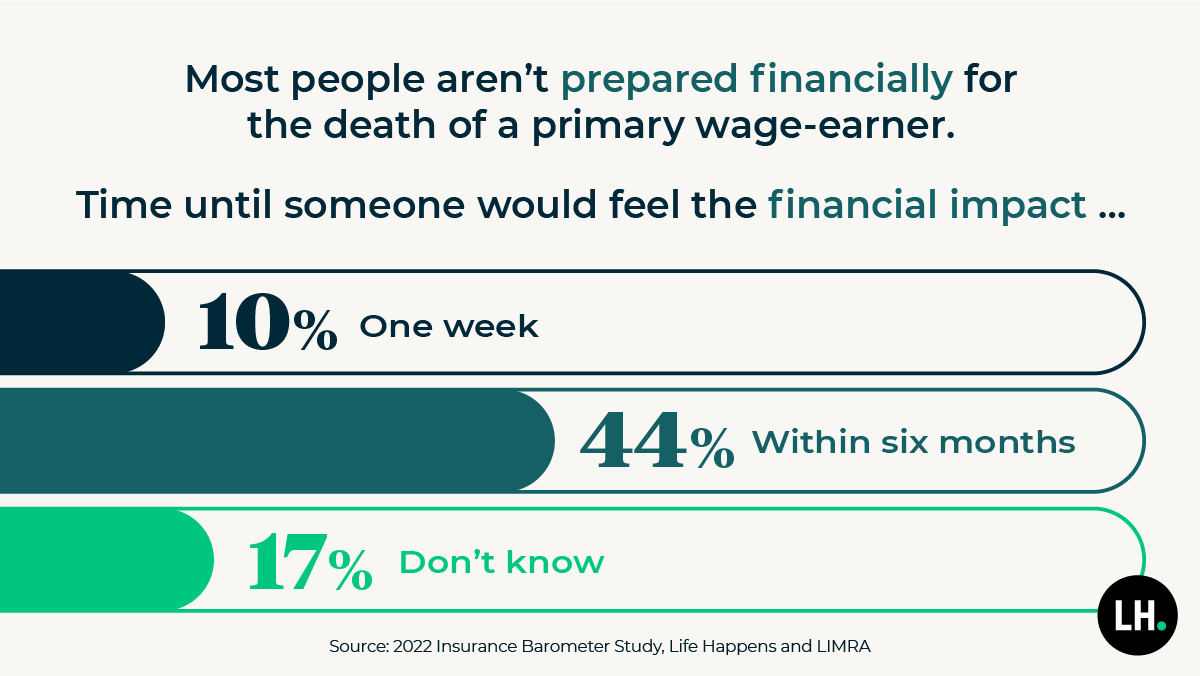

Financial insecurity is highest among Gen X (49%), followed by Millennials (44%), Gen Z (42%), and Baby Boomers (33%). And according to the survey, most households have not prepared for the loss of a primary wage earner.

- 1 in 10 respondents report they’d feel financial strain in one week if their household’s primary earner died

- Over 2 in 5 parents say it would take less than six months for financial hardship to set in

- Only 1 in 5 respondents say they have a safety net of five years or more

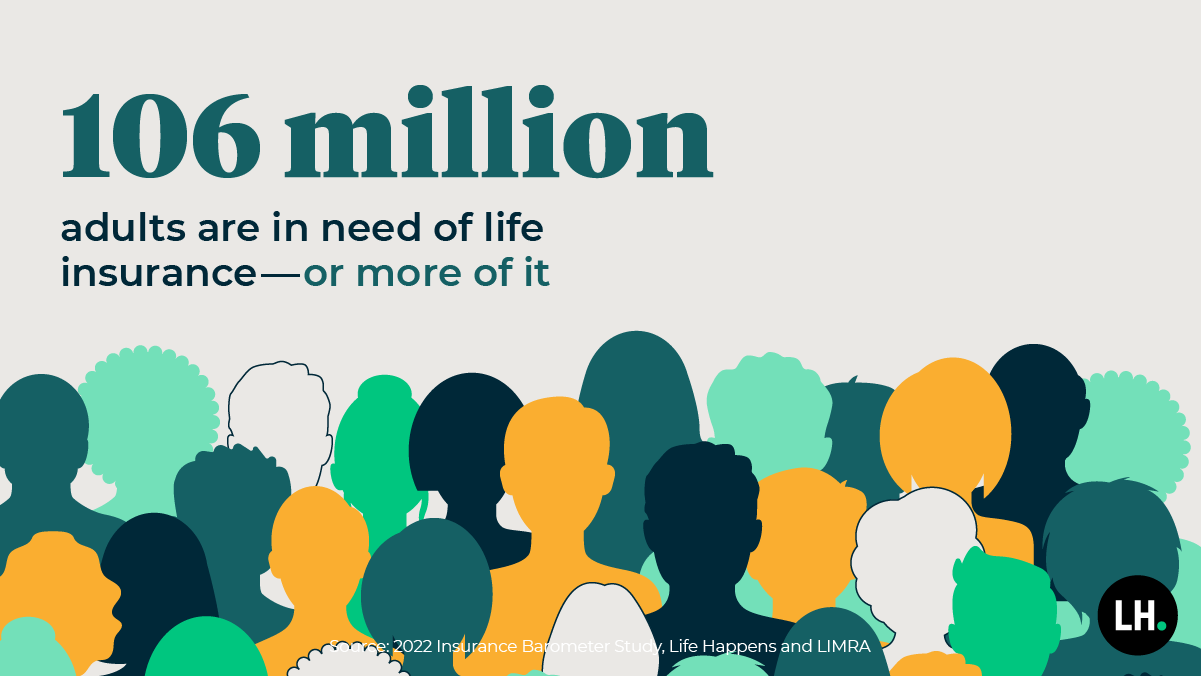

We know we need life insurance, yet the need gap persists

Life insurance is a key element in feeling financially secure, yet the need gap – what people have vs. what they say they need – is at an all-time high (18 points) and more than double what it was 12 years ago.

- 68% of life insurance owners feel financially secure compared to just 47% of non-owners

The unmet need for coverage rose significantly with the pandemic and remains elevated in 2022, revealing the lasting impact of COVID is still felt by many.

- 31% of respondents say they are more likely to buy life insurance in 2022

A lack of knowledge may lead some to avoid important conversations

Consumers, especially Millennials and Gen Z, report feeling uncertainty about life insurance, which may be why some haven’t gotten coverage.

- Almost half (42%) of respondents say they are somewhat or not at all knowledgeable about life insurance

- Millennials (16%) and Gen Z (16%) are more likely than other generations to say they would not qualify for coverage, which is often not the case.

At the same time, respondents are largely uncomfortable talking about end-of-life planning with their loved ones, revealing the importance of education and the need to reframe conversations about life insurance to focus on long-term health and wellness in order to build trust and close the need gap.

The full 2022 Insurance Barometer Study is available to Life Happens member companies and can be accessed here. If you have issues accessing it, please contact Erik at esvensson@lifehappens.org. For media inquiries, contact lifehappens@kwtglobal.com.

We’re committed to educating Americans about life insurance

At Life Happens, we establish and lead several annual campaigns, including Life Insurance Awareness Month and the Help Protect Our Families campaign, to help people overcome perceived barriers and motivate them to purchase life insurance to protect their loved ones financially. Check out our free Life Insurance Needs Calculator to evaluate your own coverage needs and take action.

Discover more

For more information on this study and its methodology, view our press release.