Annual Report

Message from the Executive Director

Life Happens’ nonprofit mission is to educate consumers about the importance of life insurance, disability insurance, long-term care insurance and annuities in a sound financial plan.

We do it for one fundamental reason: People will not buy what they do not understand.

Our goal is to bridge that barrier with unbiased educational material. Life Happens shares those messages via our website, press coverage, social media and public service announcements so we can directly reach the greatest number of people.

And most importantly, we partner with insurance companies like yours so you can amplify the messages through your channels and help people get the coverage they need. As a nonprofit, we do not sell anything, so our partnership with you is a crucial component to helping Americans get the coverage we know they so desperately need.

Last year also brought some great news for the industry. Life Happens, The National Association of Insurance and Financial Advisors (NAIFA) and the Society of Financial Service Professionals (FSP) came together as one organization under the NAIFA umbrella. The expanded organization leverages the strengths of each to create greater impact for the industry, financial service professionals and consumers.

Thank you for your continued support. We are looking forward to working closely with you this year, as we also share the successes of 2023.

Brian Steiner

Executive Director

2023 At a Glance

1.1+ billion

total impressions across all LIAM campaign touchpoints

4.1+ billion

impressions garnered from media coverage in 485 articles

59+ million

total impressions garnered from Life Happens’ social media posts

444K+

total supporters on social media

300+

educational assets created and made available to partners

361K+

total visitors to lifehappens.org including 84K+ to our Life Insurance Needs Calculator

Campaigns

Life Happens created and coordinates three major awareness campaigns each year to help achieve our mission of educating more people about insurance.

16.7 million

Life Insurance Awareness Month

In 2023, Life Happens celebrated the 20th anniversary of LIAM with the campaign message, Life Insurance: For Anyone Who Lives. Rather than using the voice of one LIAM spokesperson, we chose to highlight a chorus of voices to celebrate this 20-year milestone. We focused specifically on reaching an underinsured community with a clear need for life insurance: single parents.

1.1+ billion

Sirin Thada x Life Happens

We partnered with Thai-American artist Sirin Thada to create illustrations that reflect the theme, Life Insurance: For Anyone Who Lives.

“Life is unpredictable, but when you accept that unpredictability and face it without fear, and with a little bit of planning, you can appreciate those everyday moments with even greater ease and joy.”

![]()

Celebrating 20 Years, 20 Moments of LIAM

To commemorate the 20th anniversary of LIAM, we developed 20 Years, 20 Moments, a calendar of events for each weekday in September. From live virtual events with influencers to taking the Life Insurance Pledge, the calendar encouraged engagement from the industry and consumers.

Reaching Single Parents

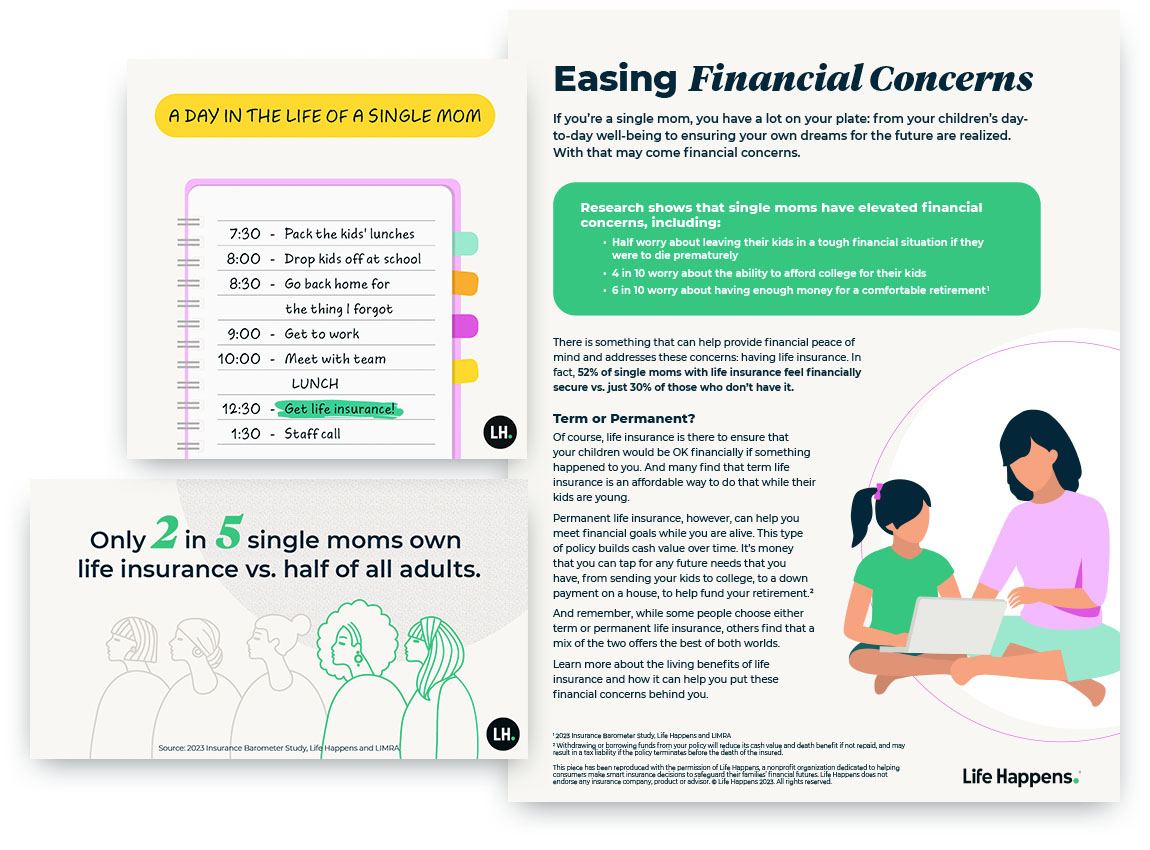

We created new educational resources that speak directly to single parents as part of a special LIAM content collection in tandem with market research that revealed single parents’ thoughts on their financial challenges.

Insure Your Love

Insure Your Love (IYL) takes place every February to remind Americans that the basic motivation behind the purchase of life insurance is love.

Life Happens shared the campaign message: Life Insurance: For Anyone Who Loves. We created new resources for our partners focused on the idea that no matter who you love, life insurance means they’re protected financially if something happens to you.

We also hosted our first-ever Facebook Chat to raise awareness and discuss important questions about life insurance with the industry and consumers.

Disability Insurance Awareness Month

Disability Insurance Awareness Month (DIAM) takes place every May because disability insurance is arguably the most misunderstood of all major insurances.

Life Happens shared the campaign message: Disability Insurance: For Anyone Who Works. We created new resources for our partners focused on the idea that if you have a job and depend on your paycheck, then you probably need disability insurance.

Content Highlights

Annuity 101

Long-Term Care Insurance Awareness Month

During Long-Term Care Insurance (LTCI) Awareness Month in November, the industry comes together to share the message that getting long-term care insurance can help cover the cost of care when you need it most.

Hispanic Heritage Month

Program Highlights

Social Media + Influencer Partnerships

59+ million

total impressions garnered from Life Happens’ social media posts

444K+

total supporters on social media

4.4+ million

total video views on Instagram

153 times

more public engagements on Life Happens’ Facebook than the average of the biggest life insurers in the U.S.

Life Happens collaborated with three diverse single-parent influencers who shared their personal stories and how life insurance did—or did not—play a part in their family’s financial situation.

32

influencer posts, including 6 Instagram Lives

garnered nearly

500K

organic impressions

and

4K+

engagements

Michael Allio

@michael_alliol4

widower whose wife did not have life insurance

“I got life insurance when I became a mom, back when I was in a relationship. When I became a single mom it was the one bill I always made sure is handled and continue to do so!”

– @daartistznt

Kim Williams

@singleblackmotherhood

single mom with life insurance coverage

“I just got my own life insurance policy outside of my employer this week it’s term life just to start but I will be exploring whole life once my finances are in better shape.”

– @xodani_mo

Real Life Stories

Our Real Life Stories program shares how real people have benefited from life, disability or long-term care insurance and annuities. These emotional stories show the value of different types of policies, as well as the financial professionals who helped their clients get coverage. In 2023, we shared a new Real Life Story featuring Jeanie Kazemier:

Jeanie Kazemier

For Jeanie Kazemier, life insurance did everything that her husband had planned for it to do. Jeanie and Tom had an idyllic life: a strong marriage and two children. But when Tom was tragically killed in a snowmobiling accident at just 45, the world collapsed for Jeanie and the kids. Grief overwhelmed them, but thanks to Tom’s life insurance, financial tragedy did not.

watch

her story

watch

his story

Mike Sizemore

A decade ago, Mike Sizemore was crossing the street when a drunk driver ran a red light and hit him. His injuries were so severe that doctors were unsure if he would survive. After countless surgeries and rehabilitation, Mike improved immensely, including being able to walk and talk again.

Life Happens first met with Mike in 2015, three years after the accident. This year, we had the opportunity to follow up on his story.

“My fiancée and I just bought a house, and I’ve been able to give my son the childhood he deserves. Disability insurance has been a lifesaver.”

– Mike Sizemore

Life Lessons

The Life Lessons Scholarship Program was established by Life Happens in 2005 to help students facing financial hardship due to the death of a parent with little or no life insurance.

Since its inception,

815 scholarships totaling $3.4+ million

have been awarded to students at more than 400 schools.

Mya Stinson

Christopher Johnson

Nathan Cruz

When most 17-year-olds hear the phrase ‘planning for the future,’ they immediately think of prom, graduation and choosing a college. Because of my dad’s unexpected death, I know planning for the future has a much broader meaning.

2023 Colburn Agency Recipient

We will start accepting applications for this year’s scholarships on February 1, 2024.

Research

2023 Insurance Barometer Study

The 2023 Insurance Barometer Study, conducted annually by Life Happens and LIMRA, revealed that younger Americans have the greatest need and desire to buy life insurance.

Key findings:

- Gen Z and Millennials express greater financial concerns than older generations.

- A quarter of Gen Z and Millennials say that not knowing how much or what kind of life insurance to buy stops them from getting coverage.

Additionally, this year’s study looked at the growing single mothers market and found that just 2 of 5 single moms (40%) own life insurance. That said, 6 in 10 know they have a life insurance need gap, equaling about 5 million single-mom households.

Single Parents and the Financial Future

This new study released in August 2023 by Life Happens showed that single parents certainly have one thing that’s weighing heavily on their minds: their children’s financial future.

Key findings:

- The average single parent says they’d need a minimum of $332,705 in savings to feel at ease about raising their child.

- 52% of single parents bought life insurance to provide financially for their children if they were to die unexpectedly.

- More than a quarter of single parents say they’d expect money from a crowd-funding site to support their kids financially if they died.

Awards

Life Happens received several prestigious awards in 2023 for our 2022 Life Insurance Awareness Month campaign, Life insurance—an easy decision.

Davos Communications Awards

Gold Winner for Best Influencer Marketing Campaign

Communicator Awards

Award of Excellence for Integrated Campaign

Award of Excellence for Nonprofit Campaign

The Drum Awards

Finalist for Social Purpose: Integrated Campaign — Not-For-Profit

Download a PDF of this report

For partnership inquiries: partnerships@lifehappens.org

For media inquiries: lifehappens@kwtglobal.com