2023 Insurance Barometer Study: Report 2

The Future of Life Insurance: Millennials, Gen Z and Technology

In this second report of the 2023 Insurance Barometer Study, by Life Happens and LIMRA, our aim is to highlight demographic differences and trends for Millennials and Gen Z in relation to life insurance and financial education.

For more information on this study, view our press release.

Keep in mind that almost half of Millennials (48%) and 40% of adult Gen Z (those 18 and older) own life insurance. In addition, there is a discernible need for life insurance, with 49% of Millennials and 47% of Gen Z saying they either need life insurance or more of it if they already own some.

Here are some trends that are shaping the younger generations of life insurance purchasers:

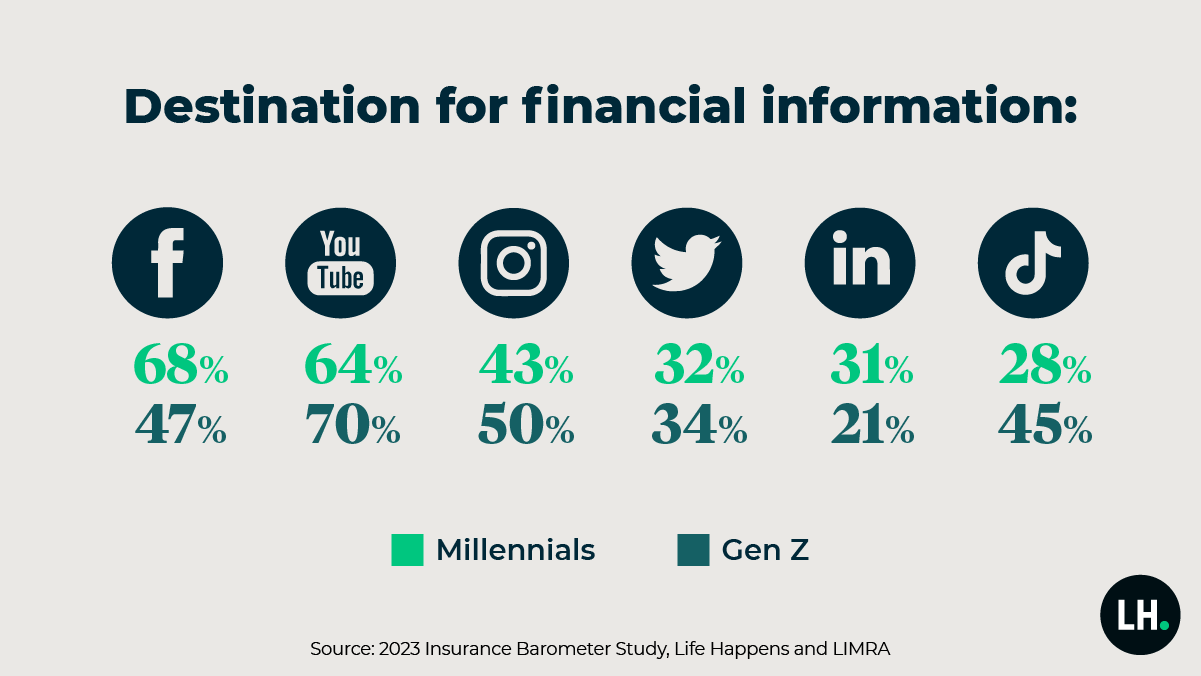

The Destination for Financial Information: Social Media

Younger generations rely heavily on social media for financial education: Of those ages 18-42, about two-thirds use YouTube for financial information, followed by Instagram, Facebook and TikTok. In addition, half of Gen Z sought information about life insurance online and have visited a life insurance company’s social media vs. 27% of all generations.

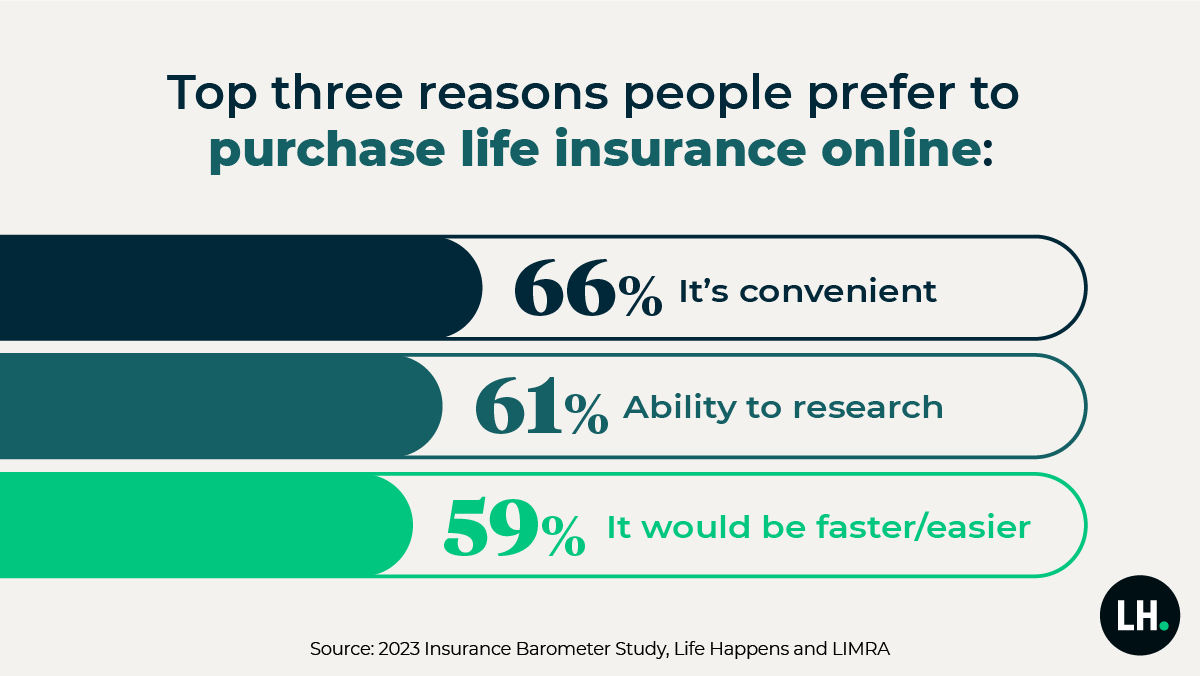

The Move to Buying Life Insurance Online

For the first time since the study began in 2010, people now say they prefer to research and buy life insurance online (32%) vs. in-person (29%). A quarter of people say they expect to complete a life insurance purchase entirely online. Ease and efficiency are top reasons people cite for wanting to purchase online, including: convenience (66%), ability to research (61%) and that it’s faster/easier (59%).

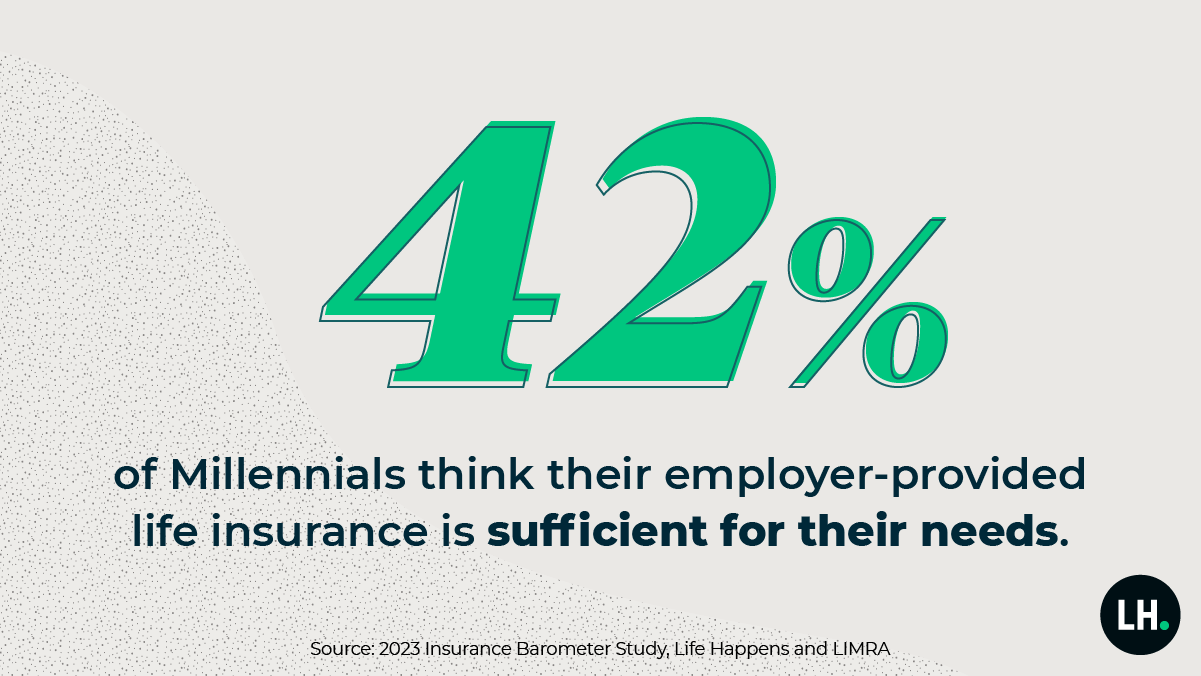

Misconceptions About Coverage

Common myths and misunderstandings keep Millennials and Gen Z from getting the life insurance coverage they need, including an overestimation of the adequacy of coverage employers provide and the true cost of life insurance. More than two in five Millennials believe the life insurance their employer provides is sufficient for their needs. While it often offers one to three times a person’s annual salary, it’s not generally viewed as sufficient for a family or family-to-be.

Financial Concerns and Privacy

Compared to older generations, Gen Z and Millennials say they face heightened financial worries, with their priorities centered around self-sufficiency, bill payments and managing expenses such as rent and mortgage. While these concerns tend to vary according to economic conditions and the job market, the levels of financial concern are higher than they were for those of similar age when the study started.

Maintaining privacy and establishing trust continue to be crucial considerations when purchasing life insurance: 50% of all respondents said they were “extremely” or “very” concerned about privacy. The numbers drop somewhat for Millennials (45%) and Gen Z (42%). Only 6% of respondents said they are “not at all concerned.”

Please source all statistics: 2023 Insurance Barometer Study, Life Happens and LIMRA

All the reports from the 2023 Insurance Barometer Study are available to Life Happens partner companies and can be accessed here. If you have issues accessing it, please contact partnerships@lifehappens.org. For media inquiries, contact lifehappens@kwtglobal.com.

Discover more

For more information on this study and its methodology, view our press release.