Life Insurance Is More Valuable Than You Think

Life Insurance Is More Valuable Than You Think

For more information on this study, view our press release.

That said, a new report “Black Americans: Life Insurance Ownership and Attitudes” shows that the Black Community is ahead when it comes to understanding the importance of having life insurance, particularly for covering final expenses.

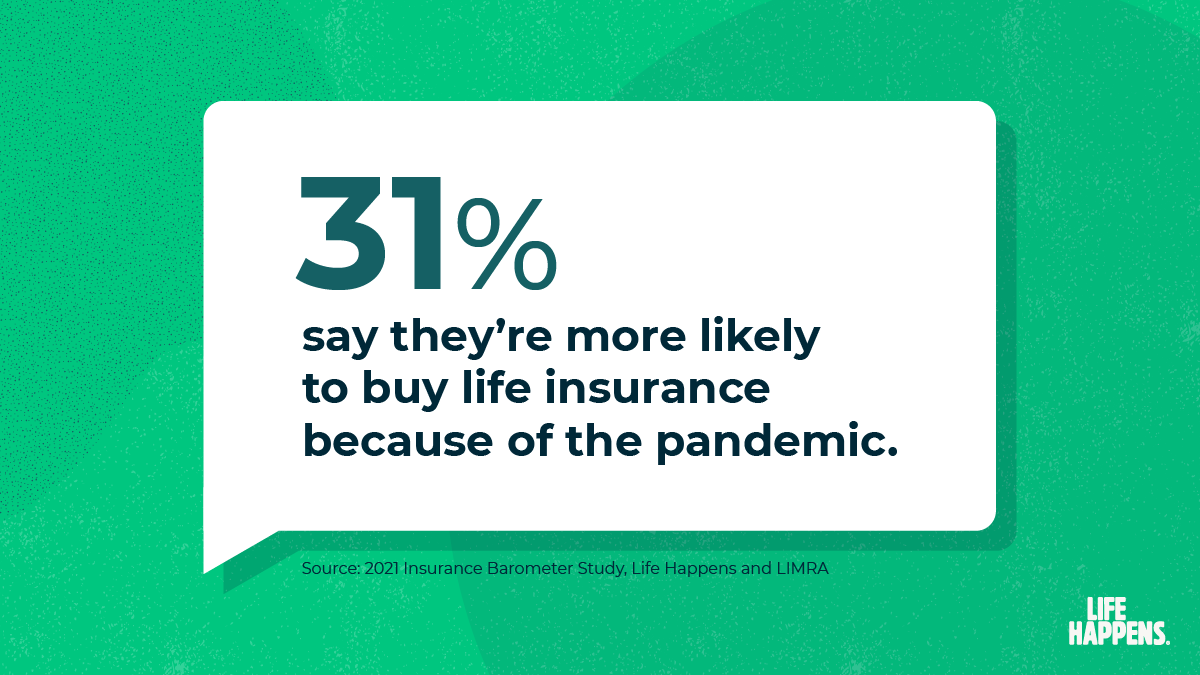

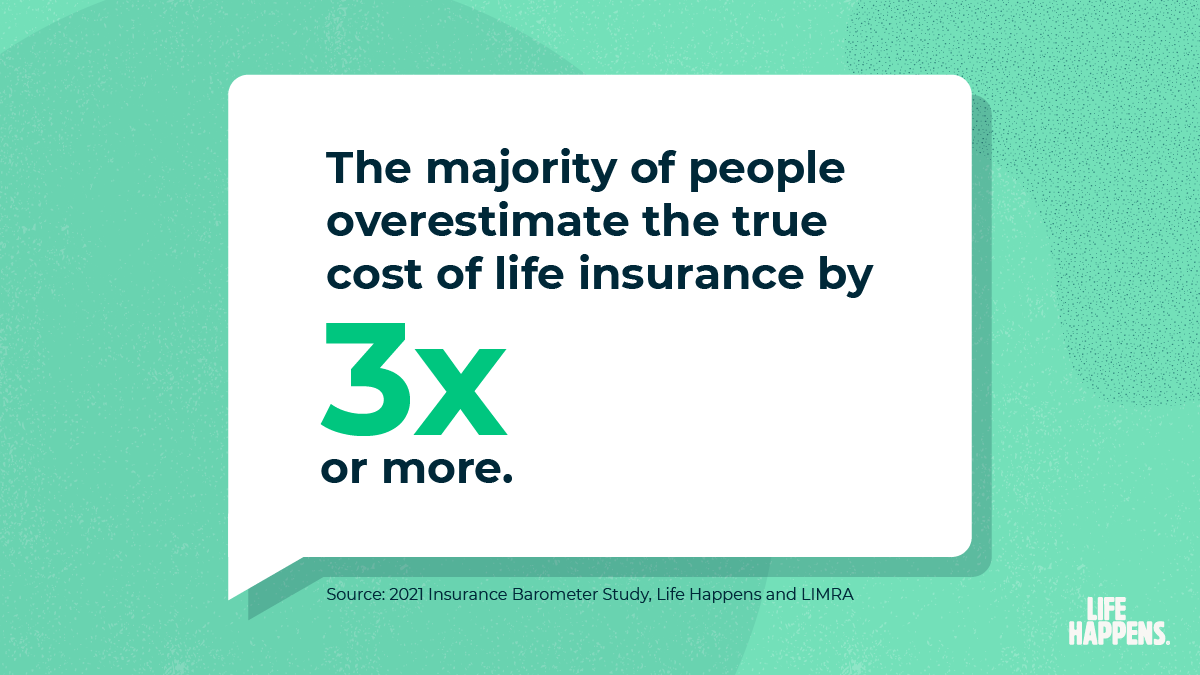

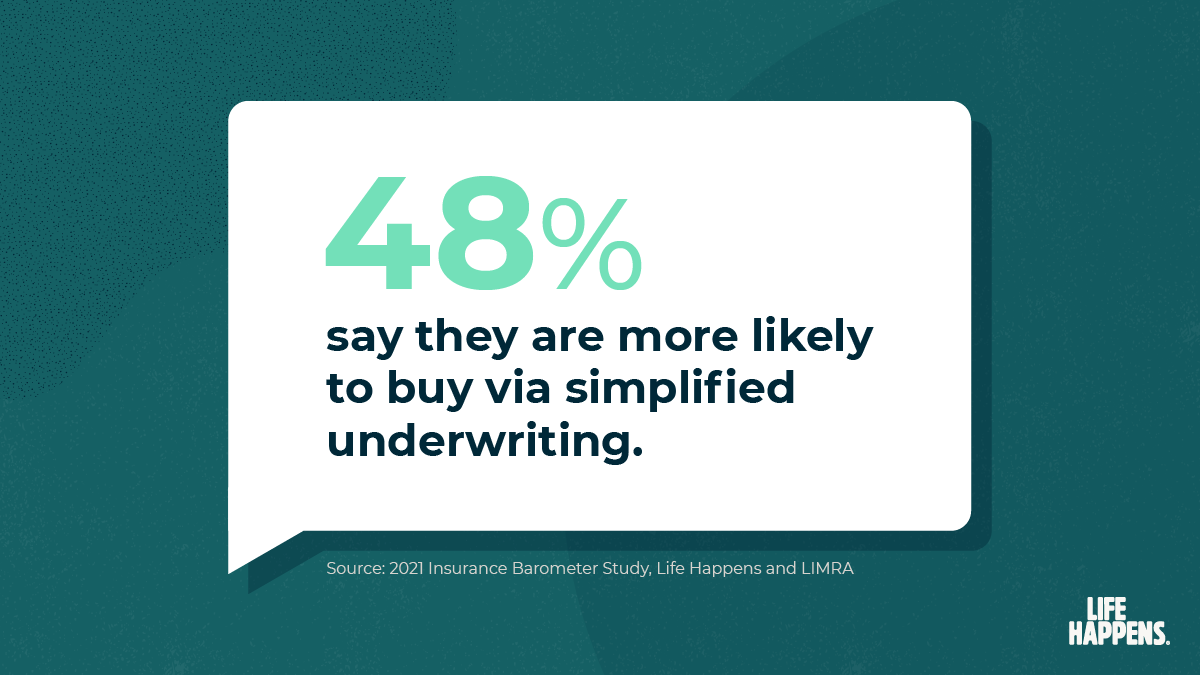

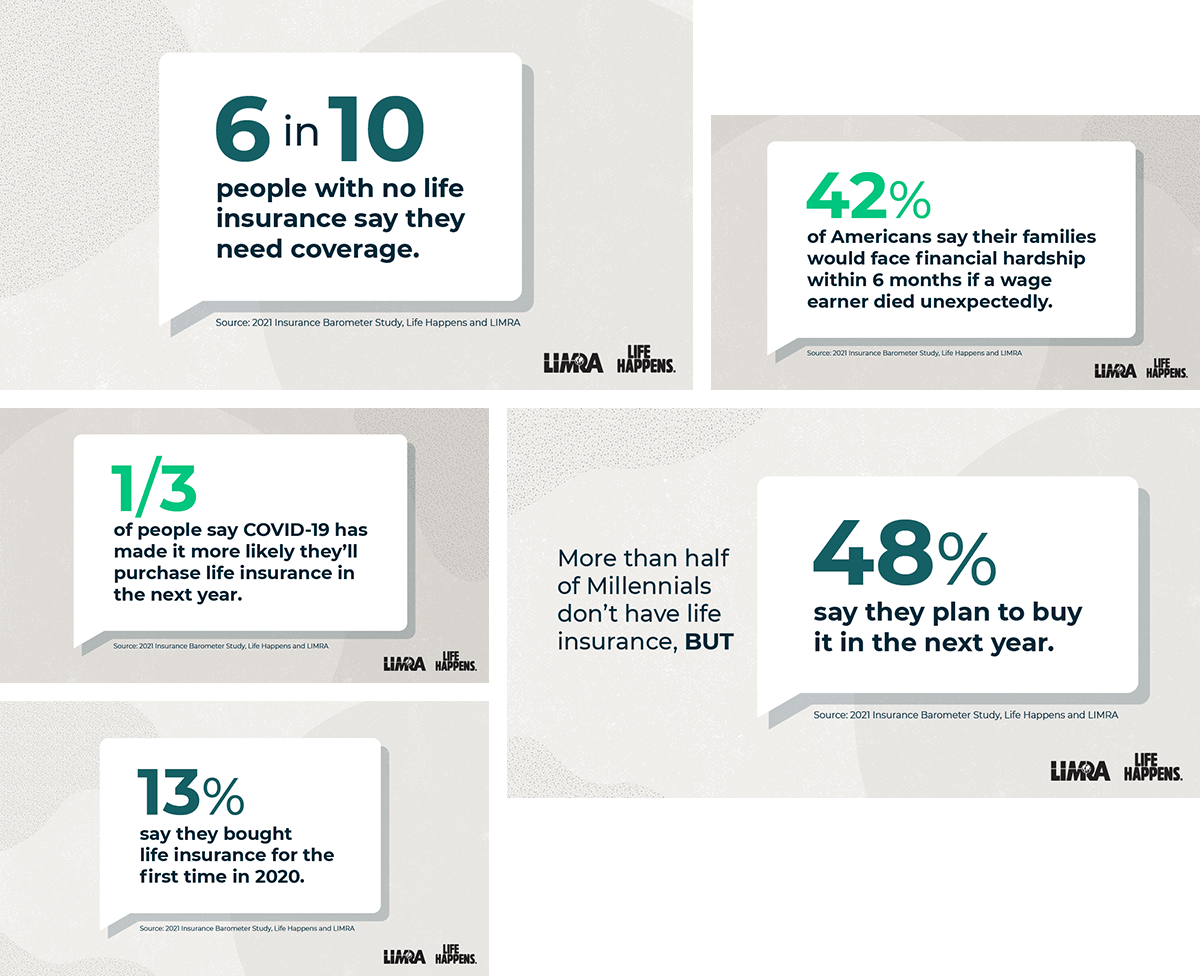

The report, a supplement to the 2021 Insurance Barometer Study conducted by Life Happens and LIMRA, also highlights misconceptions surrounding the true benefits and cost of life insurance that persist.

Motivation for life insurance is high:

- Black Americans own life insurance at a higher rate: 56%; in the general population that number tops out at 52%

- 75% of Black Americans say they need life insurance

- Of those in the Black community who do have life insurance, 14% say they need more coverage

Knowledge can turn motivation into action:

- 75% of Black Americans overestimate the cost of life insurance

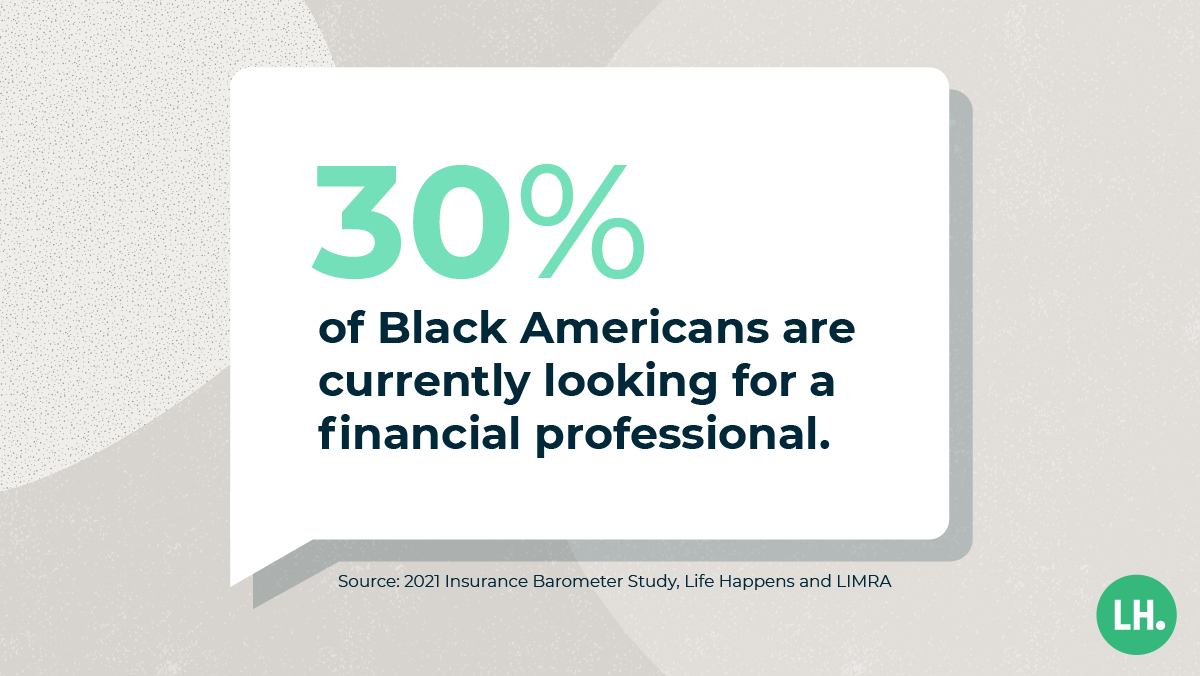

- 1 in 3 Black Americans are looking for help with their financial and insurance needs, which is 5 points above the general population

- Nearly 6 in 10 Black Americans report they use social media as a source of financial information

Life insurance is more valuable than many think:

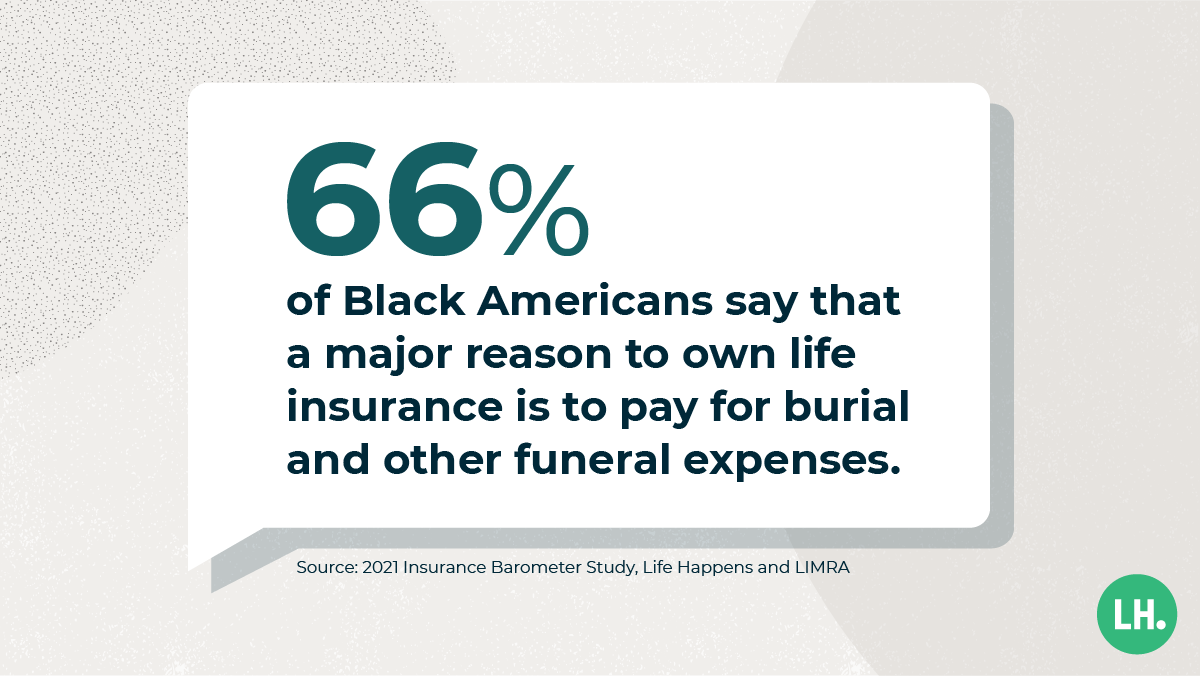

- 66% of Black Americans say that a major reason to own life insurance is to pay for burial and other funeral expenses. For the population in general, it’s less than half (48%)

- Less than a third of Black Americans cite the need to cover lost wages/income (31%) or mortgage/rent (32%) as reasons for owning life insurance.

- More Black Americans report concern about saving for an emergency, reducing student loan debt, leaving an inheritance, and paying monthly bills than Americans overall

The full 2021 Insurance Barometer Study and this new report “Black Americans: Life Insurance Ownership and Attitudes”, is available to Life Happens member companies and can be accessed here. If you have issues accessing it, please contact Erik at esvensson@lifehappens.org. For media inquiries, contact lifehappens@kwtglobal.com.

Complete the form below to download the Engaging the Black Community With Life Insurance Marketing Guide. Consider this your go-to as you explore the new content and plan your ongoing outreach to the Black community.

We’re committed to educating Americans about life insurance

Discover more

For more information on this study and its methodology, view our press release.