COVID Has Changed Americans’ View of Life Insurance

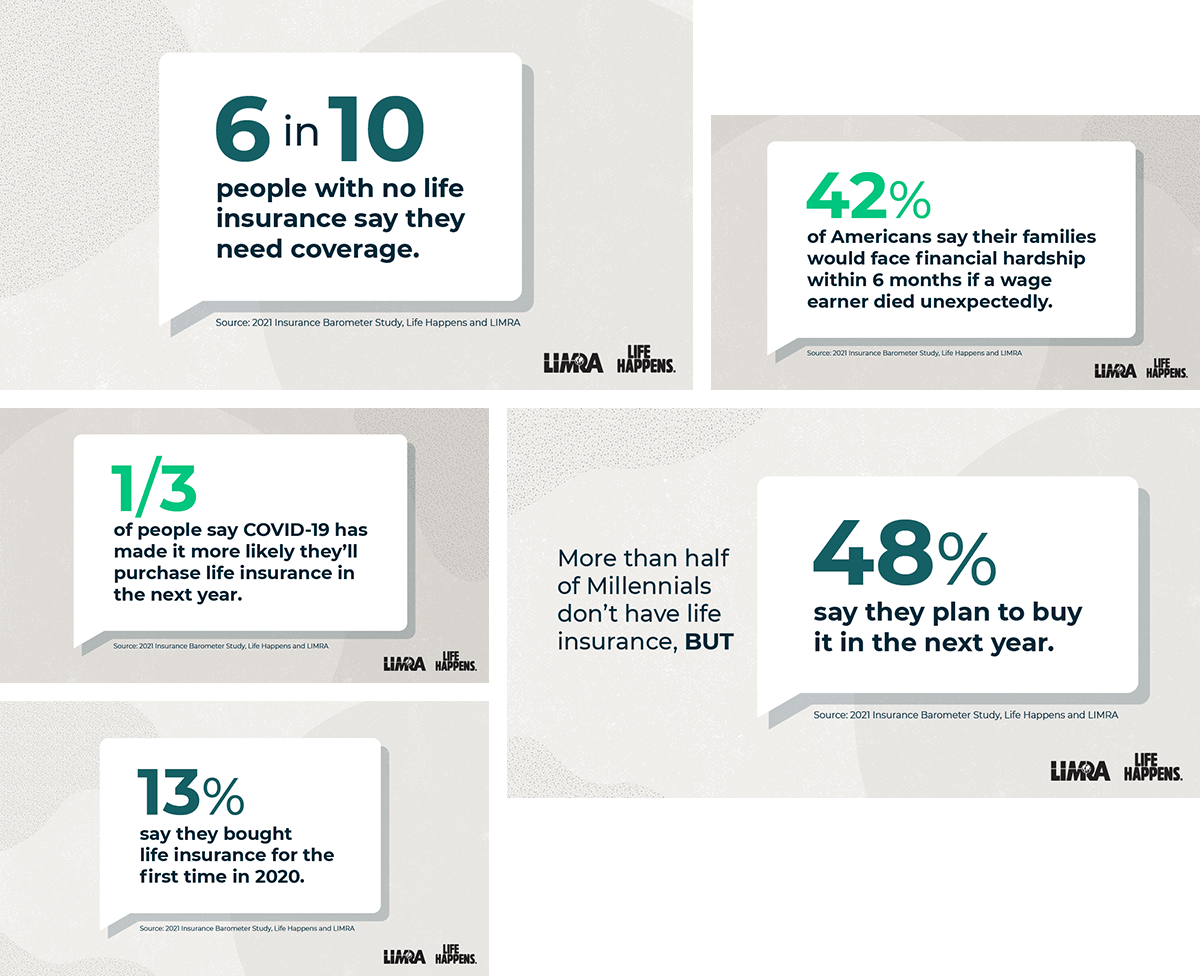

New data shows that nearly one-third of consumers (31%) say COVID-19 has made it more likely they will purchase life insurance within the next 12 months, according to initial findings from the 2021 Insurance Barometer Study.

For more information on this study, view our press release.

In addition, 22% of Americans with life insurance (29 million) believe they need more, while 59% of those without life insurance say they do need coverage, which represents 73 million Americans. That means 102 million Americans say they need coverage, or more of it.

This year, the annual “tracking” study, which has been conducted jointly by Life Happens and LIMRA over the past 11 years, also explored how the pandemic has shaped attitudes toward life insurance.

Millennials (ages 22-40) seem to be most influenced by the pandemic when it comes to life insurance, with 45% of them saying they are more likely to buy it due to COVID-19, while 31% of Gen Xers and 15% of Baby Boomers said the same.

Watch as Faisa Stafford, LUTCF, president and CEO of Life Happens, and David Levenson, president and CEO, LL Global, LIMRA and LOMA, discuss initial findings from the 2021 Insurance Barometer Study.

These are just initial findings, with the full 2021 Insurance Barometer Study being released on April 12.

Complete the form below to download the social-media graphics that highlight these findings and support this industry initiative.

We’re committed to educating Americans about life insurance

Discover more

For more information on this study and its methodology, view our press release.