“Adulting” Across the Generations

“Adulting” Across the Generations

What does it mean to be an adult, and at what age does it actually happen for people? Life Happens sought the answers through a generational lens, with some surprising results.

Here’s what we found:

For more information on this study, view our press release.

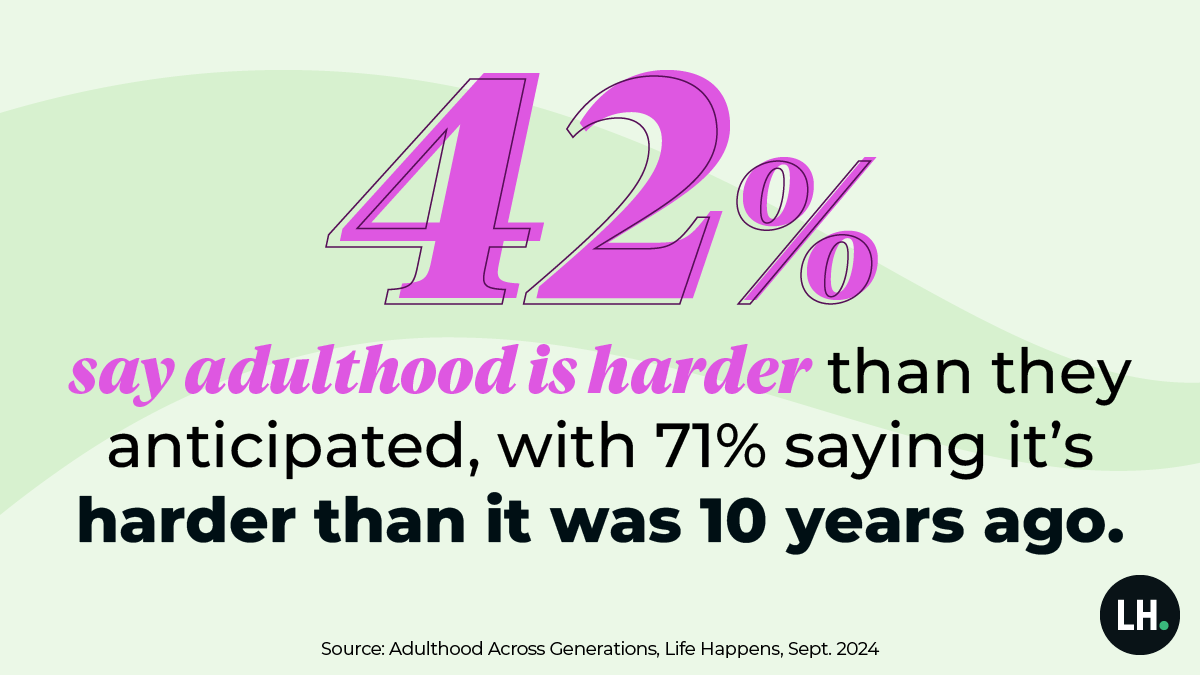

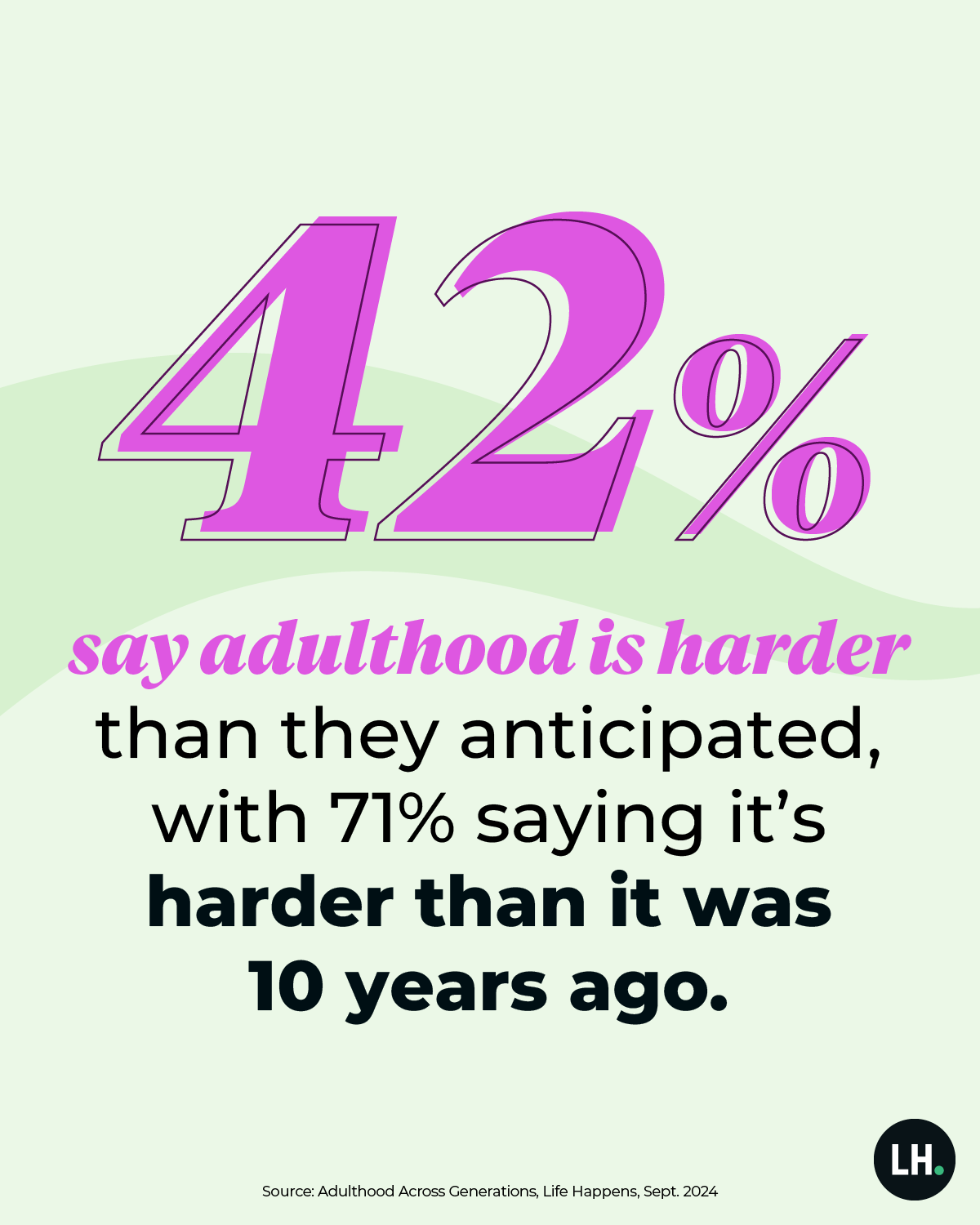

“Adulting” is hard—and it seems to be getting harder, with 71% of people agreeing that it’s harder to be an adult now than it was 30 years ago. Almost the same number—72%—attributes it to the higher cost of living than ever before.

In fact, being an adult doesn’t automatically start the day you turn 18. Instead, the age when life, money and the future start to feel “real” is 27 years old.

This data comes from the Life Happens survey “Adulthood Across Generations.” It was conducted by Talker Research and polled 2,000 Americans split evenly by generation: 500 each of Gen Z adults, Millennials, Gen Xers and Baby Boomers.

So, how do people define “adulting”? The top two answers were related to finance, with half saying it meant being able to pay their own bills (56%) and being financially independent (45%). In addition, many people said they “felt” like an adult when they moved out of their parents’ home (46%).

Gen Z Is Making Strides

Interestingly, the age of “feeling” like an adult—age 27—coincides with the age when people started taking finances seriously—around age 28. That said, the older generations admit they wished they’d taken their finances more seriously in their 20s (76%).

And while the oldest of Gen Z is just reaching that age of “adulting,” they are actually on the same page with the older generations with the top three pieces of financial advice they’d share. Here’s the consensus across generations: Start saving early (64%); create a budget (46%) and start building credit as soon as you can (41%).

Gen Z is also ahead of the financial curve, as many are paying their own bills, getting credit cards, learning how to budget and opening savings accounts around age 22—younger than any of the other generations. However, half of Gen Z admit that they have not started contributing to a retirement plan.

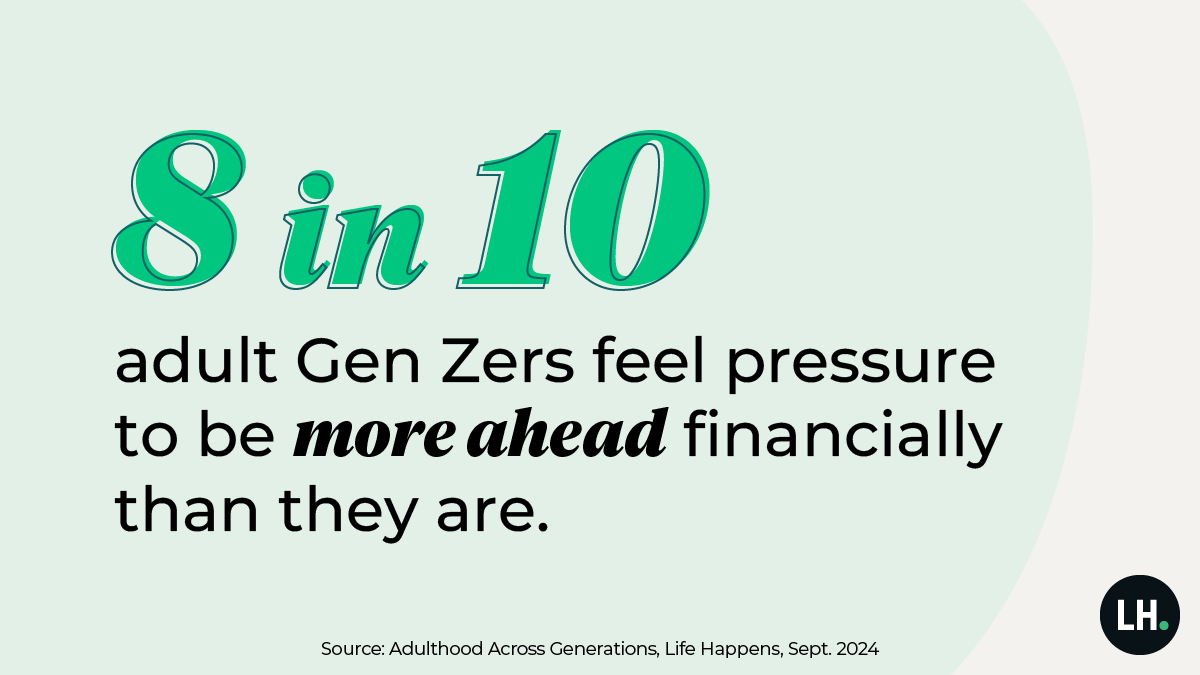

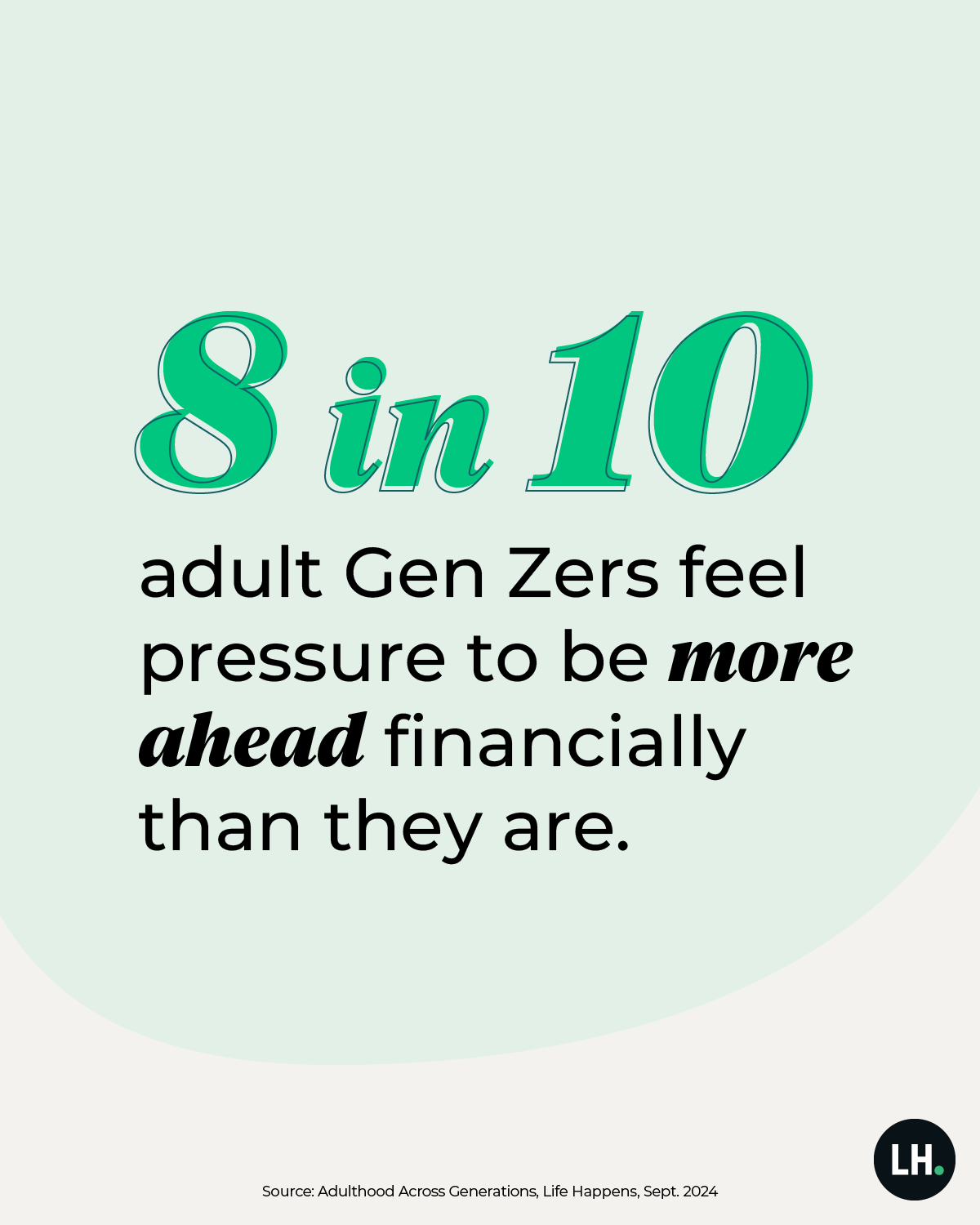

So, what financial “adulting” moves does Gen Z feel they cannot afford? Buying a home or apartment tops the list (47%), along with having kids (39%). Plus, more than half (56%) say they have more financial responsibility than they can handle.

Being Financially Prepared

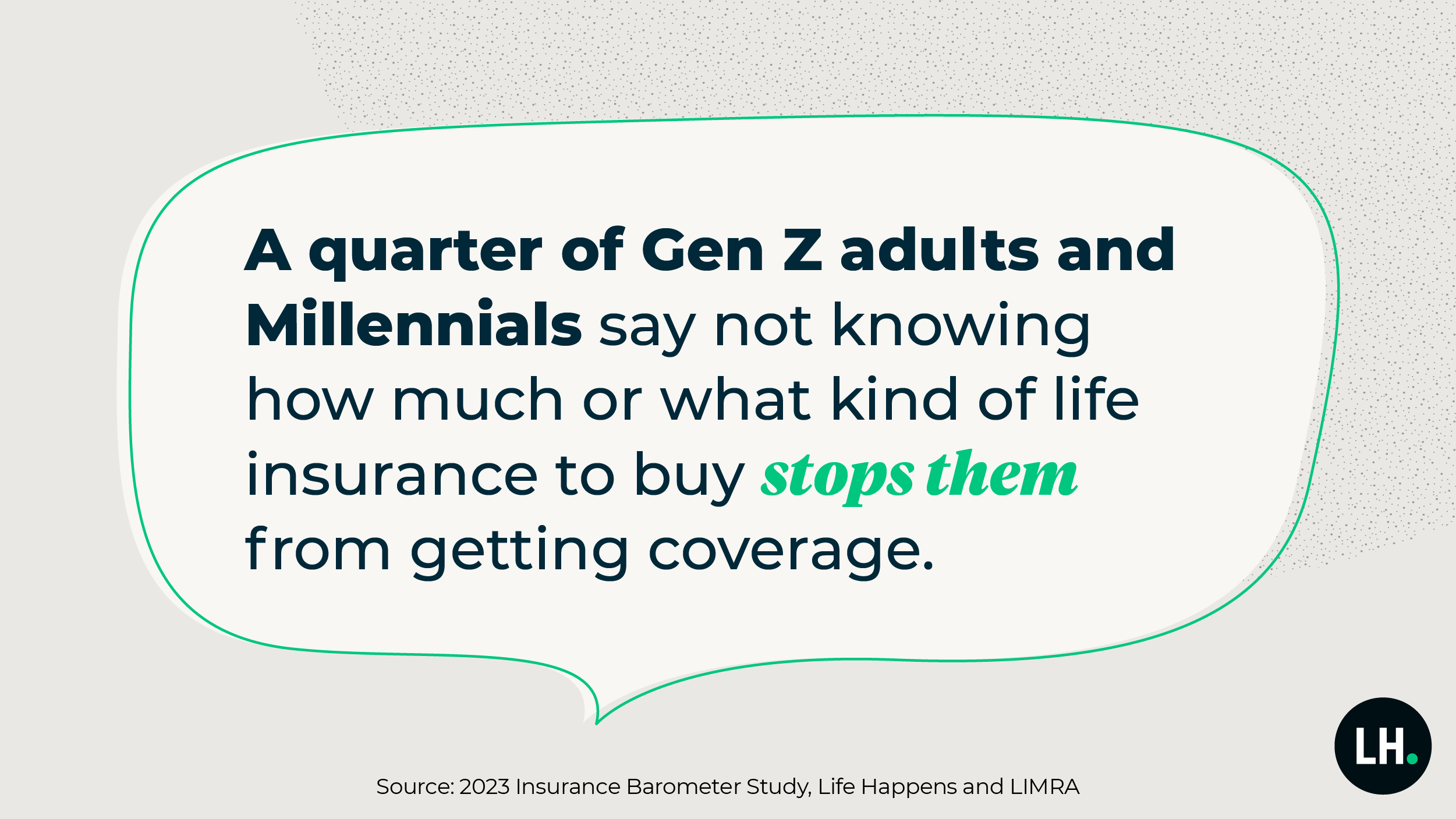

When it comes to working with a financial professional, the average age when they first started was 30, but keep in mind that more than half (56%) say they have never taken this step.

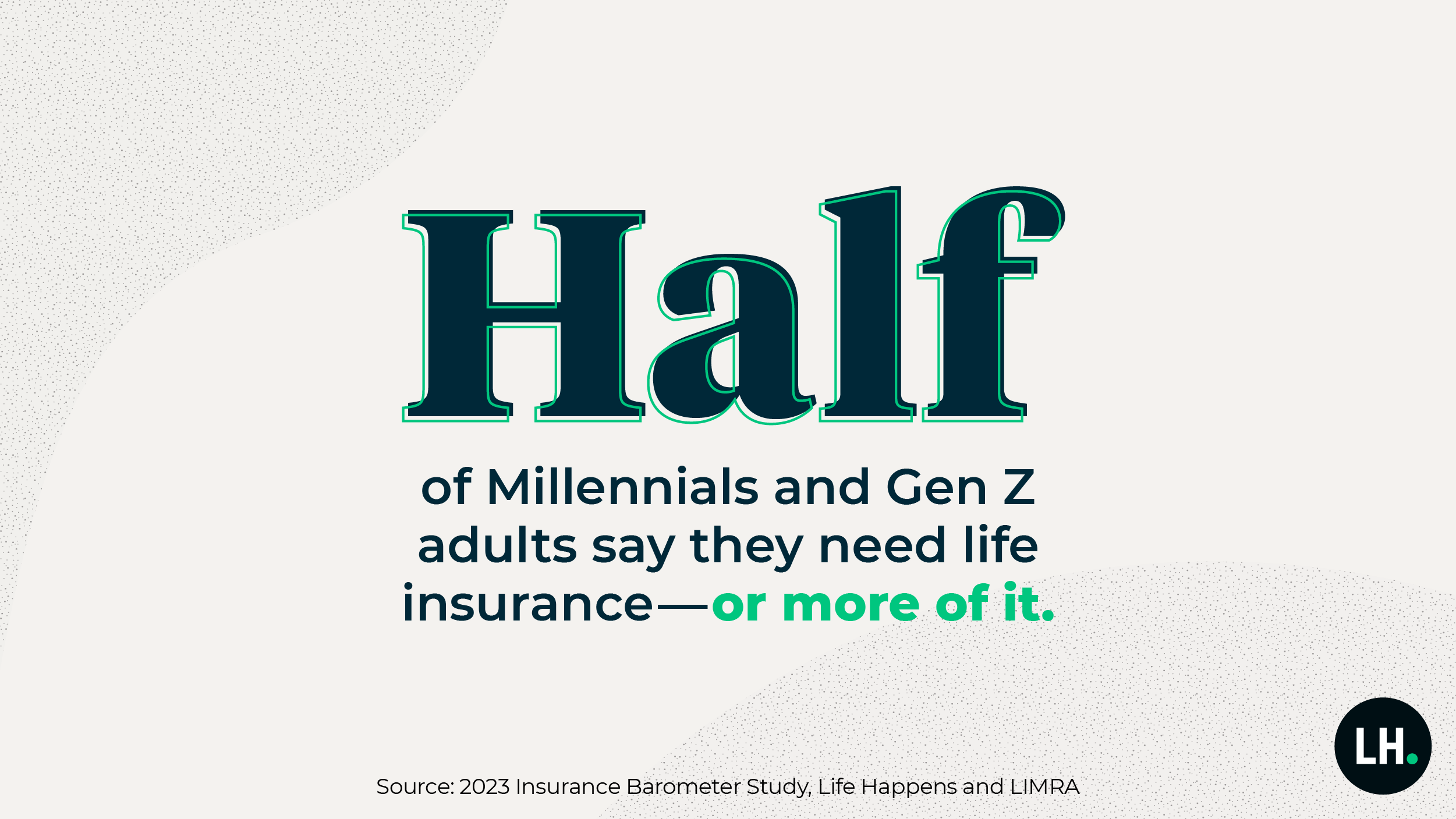

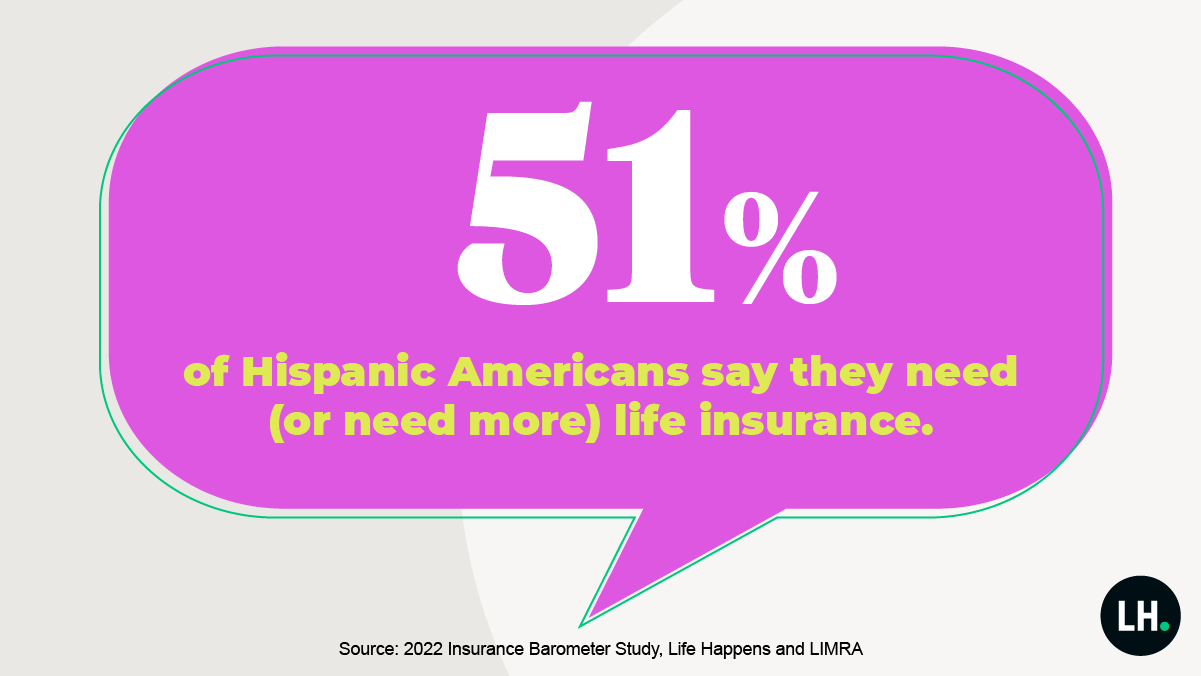

There is good news regarding retirement savings: with each generation, the average age when people started contributing to a retirement plan keeps getting younger, giving them a longer time to save and invest. The same can be said for life insurance. The younger generations are purchasing their first policy earlier than previous ones. In addition, four in 10 agree that getting life insurance “makes you an adult,” with more than half of Gen Z saying so (53%).

| Age when you | … started saving for retirement | … bought life insurance |

| Gen Z: | 22 | 22 |

| Millennials: | 27 | 28 |

| Gen X: | 31 | 33 |

| Baby Boomers: | 34 | 34 |

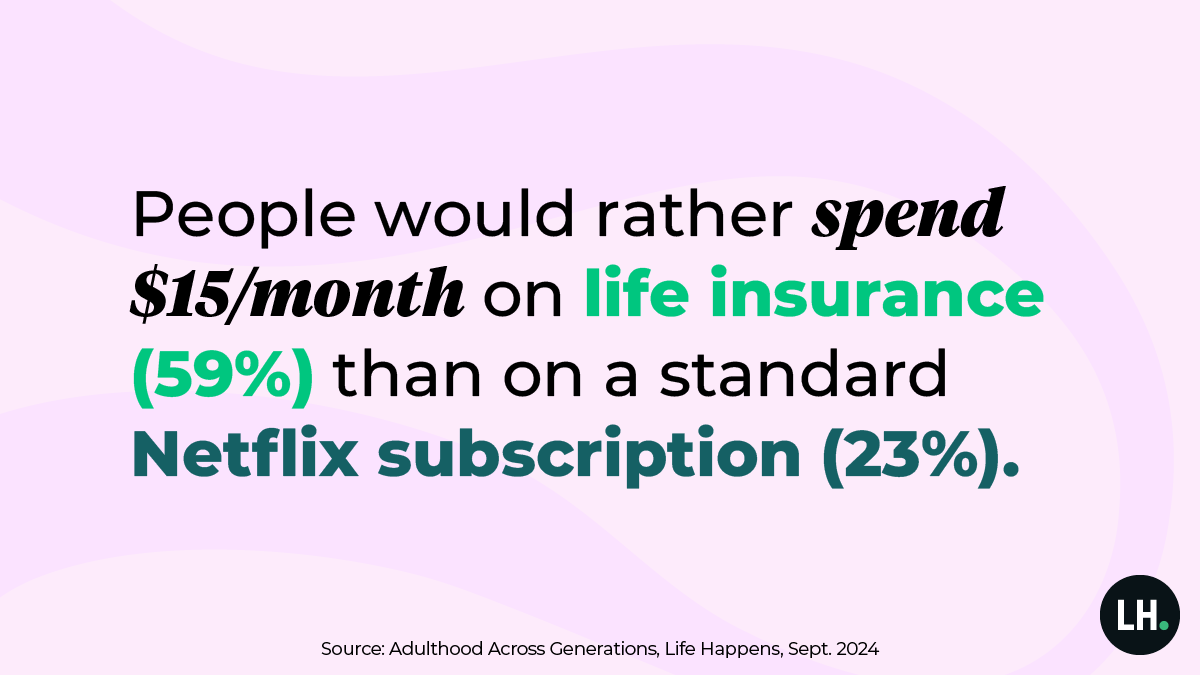

And some encouraging information: When asked if they would rather use $15/month for life insurance or a Netflix subscription, they all chose life insurance across generations.

View the infographic and animation from this study.

Survey methodology: Talker Research surveyed 2,000 Americans split evenly by generation (500 Gen Z, 500 millennials, 500 Gen X and 500 baby boomers); the survey was commissioned by Life Happens and administered and conducted online by Talker Research between August 12 to August 16, 2024 and released on Sept. 11, 2024.

For media inquiries, contact lifehappens@kwtglobal.com.

Discover more

For more information on this study and its methodology, view our press release.