Annual Report

Message from the President & CEO

Life Happens is committed to educating more diverse audiences about the importance of insurance, because life insurance (and disability insurance, LTCI and annuities) is truly for everyone.

This year, we focused on reaching the Hispanic American market, which built on the successes and learnings we had last year as we reached out to the Black American market.

This commitment is a necessary one. According to the 2022 Insurance Barometer Study that Life Happens conducts in partnership with LIMRA, life insurance ownership among Hispanic Americans is at 42%, which is well below the U.S. average of 50%.

The Hispanic community also has the highest need: 51% say they need life insurance, or more of it. This suggests 22 million Hispanics in the U.S. need coverage (based on U.S. Census data).

This year, Life Happens focused on reaching more Hispanic Americans with the message that getting life insurance is an easy decision to make for the ones you love. This was accomplished through our:

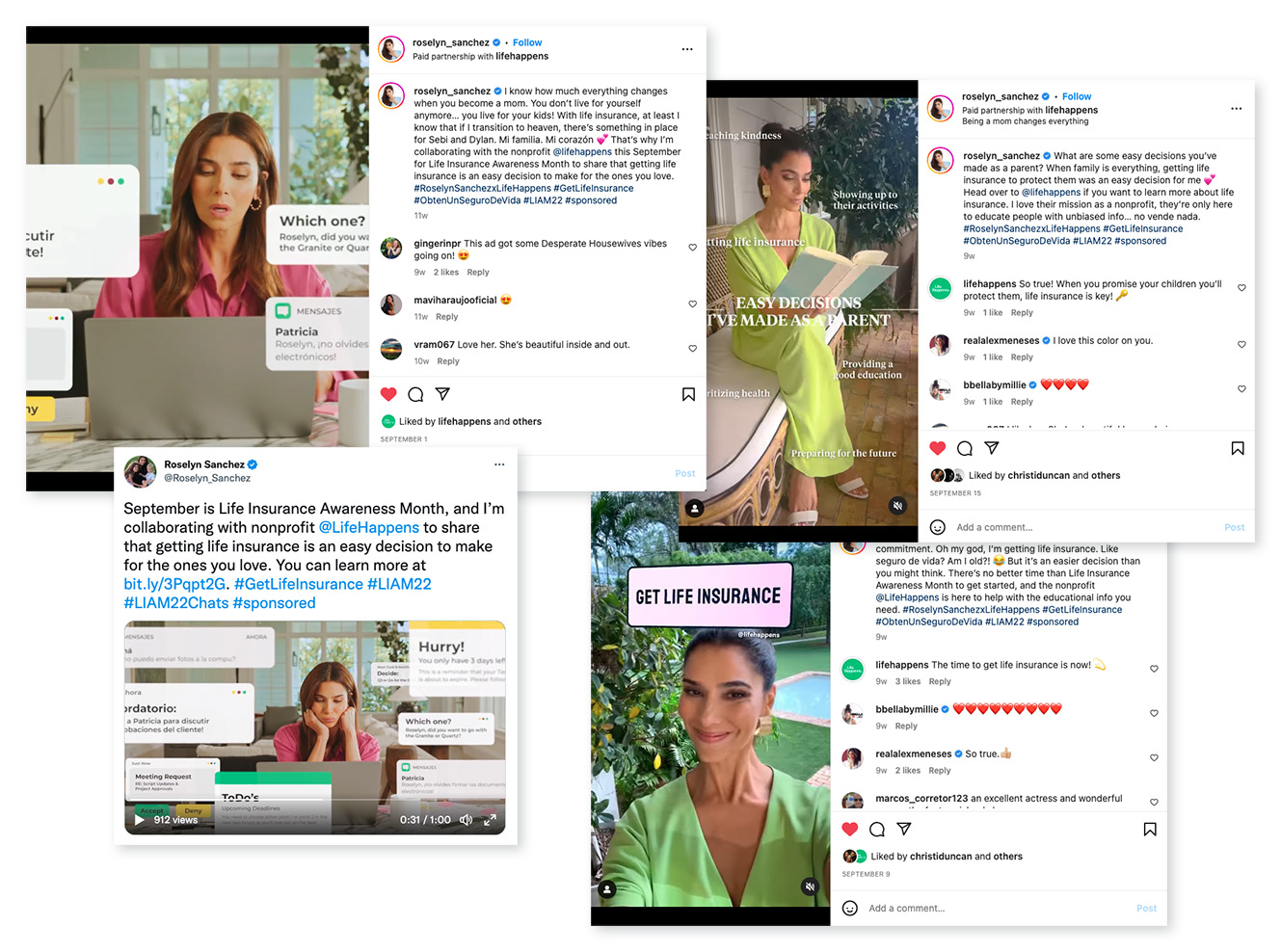

- collaboration with Roselyn Sánchez as the first bilingual spokesperson for Life Insurance Awareness Month

- a supplemental report of the Barometer Study focused specifically on the Hispanic market

- new content released for Hispanic Heritage Month with more resources than ever available in Spanish

- our work with Hispanic artists and content creators, and more.

I’m proud of these activations not just for their breadth but also for their attention to detail. We worked closely with our Diversity Advisory Group to create content that would speak to this audience in an authentic way. We will continue to build upon these efforts with a sustained commitment to educating diverse communities in the years to come.

These are just a few of the highlights from this year’s many initiatives, and we have more planned for 2023. I want to thank each of you who has supported Life Happens and shares our vision. Together we can achieve our nonprofit mission of giving all Americans unbiased information to help them make smart insurance choices—and then, with your help, get the coverage they need to protect their loved ones.

Mission

Life Happens’ mission as a nonprofit is to give you unbiased information to help you make smart insurance choices to protect your loved ones.

We don’t sell anything, and we don’t endorse any particular insurance products or companies. Our mission is only to help educate you.

We fulfill this mission in two ways:

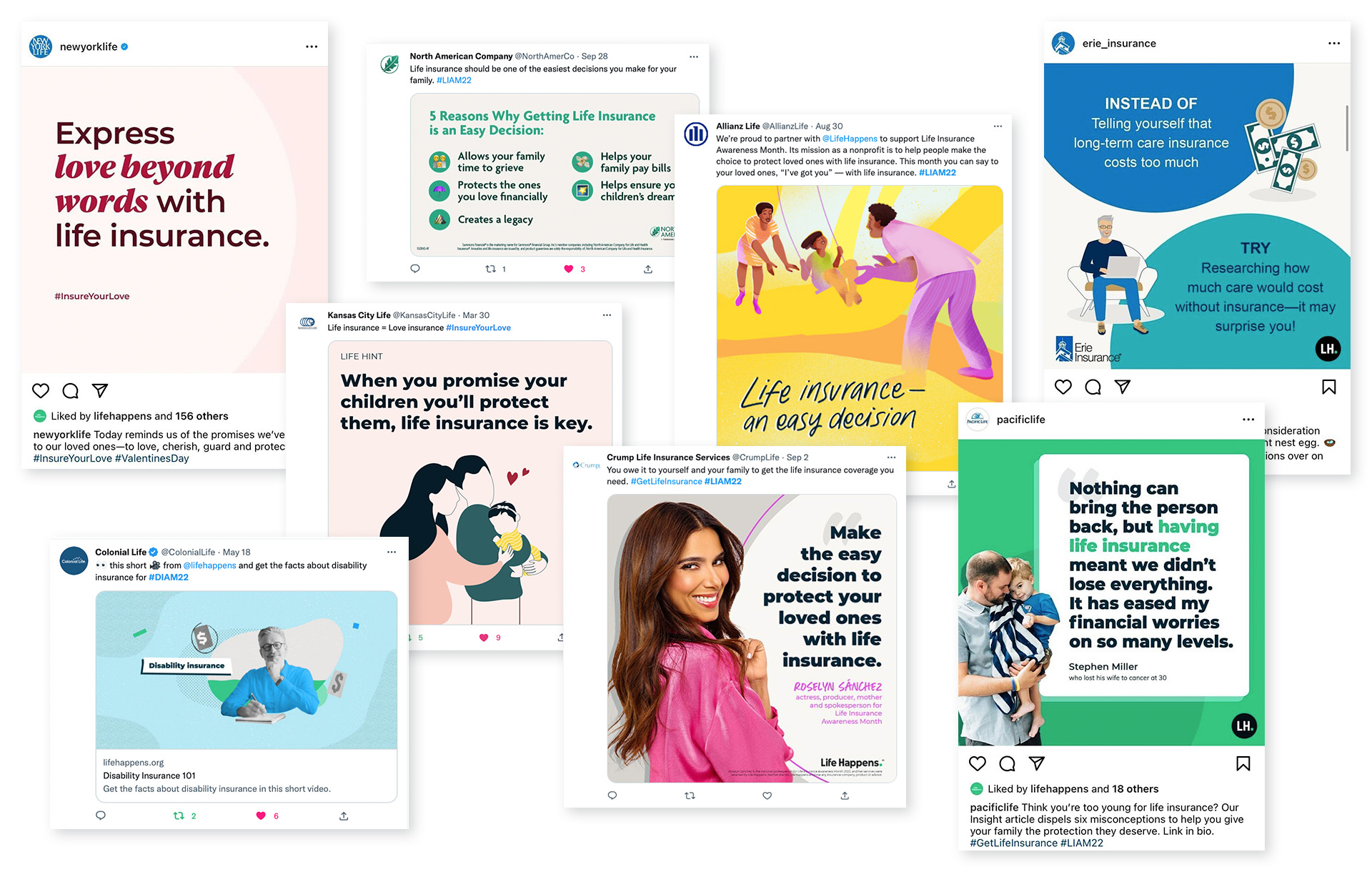

- by sharing our educational message via our website, press coverage and social media so we can directly reach the greatest amount of people possible

- by partnering with member insurance companies so they can share our content and message with their agents and clients

2022 At a Glance

461K+

total visitors to lifehappens.org

112K+

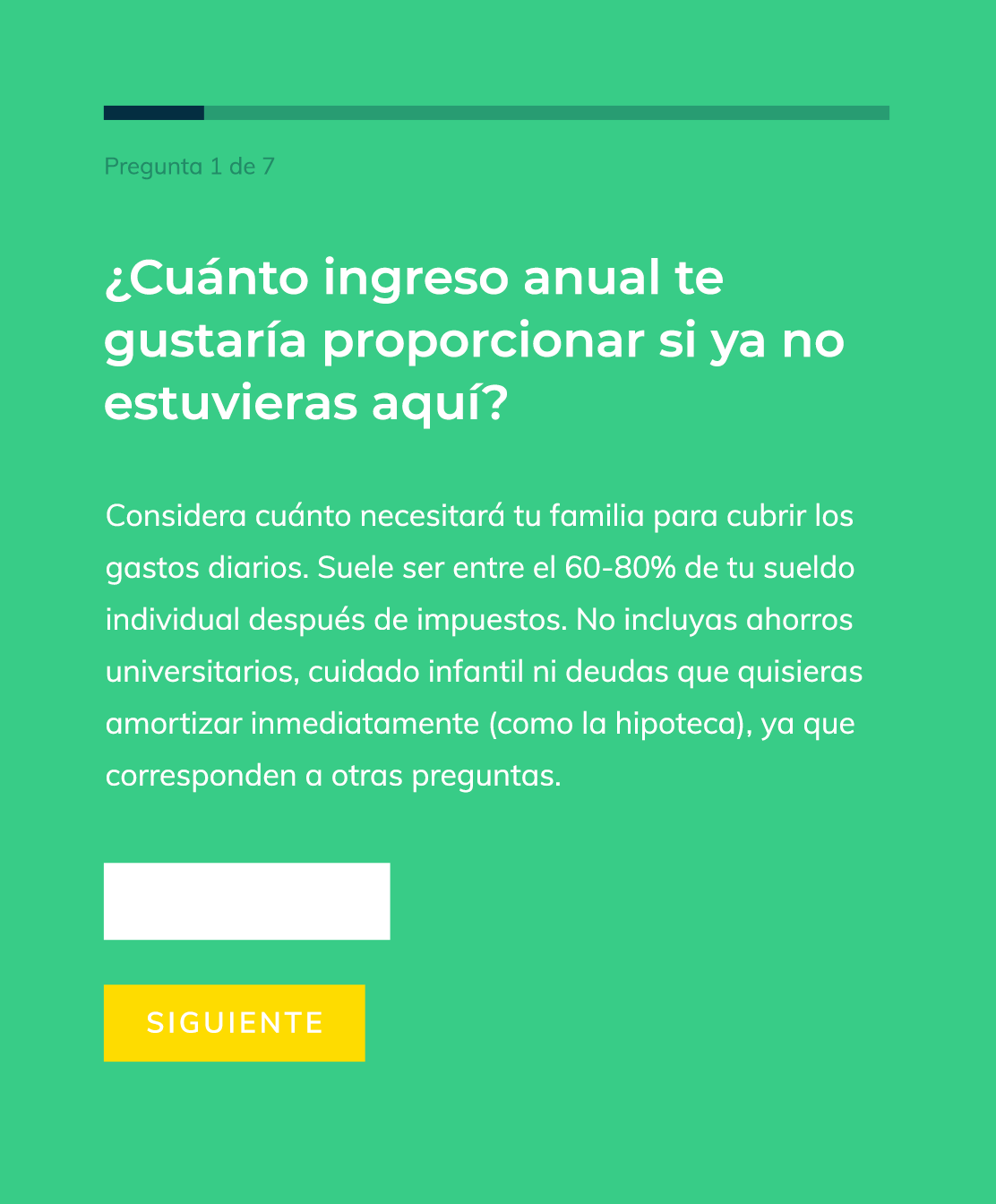

visits to our Life Insurance Needs Calculator

38+ million

total impressions garnered from Life Happens’ social media posts

388K+

total supporters on social media

300+

educational assets created and made available to members

Campaigns

58+ million

Life Insurance Awareness Month

Life Insurance Awareness Month (LIAM) takes place every September to remind Americans about the importance of life insurance for their financial security. It’s our biggest campaign of the year!

Life Happens collaborated with actress, producer, proud Puerto Rican and mother Roselyn Sánchez as our LIAM Spokesperson. She shared the campaign message: Life insurance—an easy decision. With a bilingual spokesperson, we were able to deliver this message in both English and Spanish for the first time.

1+ million

We also worked closely with our Diversity Advisory Group to develop educational assets in both English and Spanish that speak directly to the Hispanic community as part of a special release for Hispanic Heritage Month.

Insure Your Love

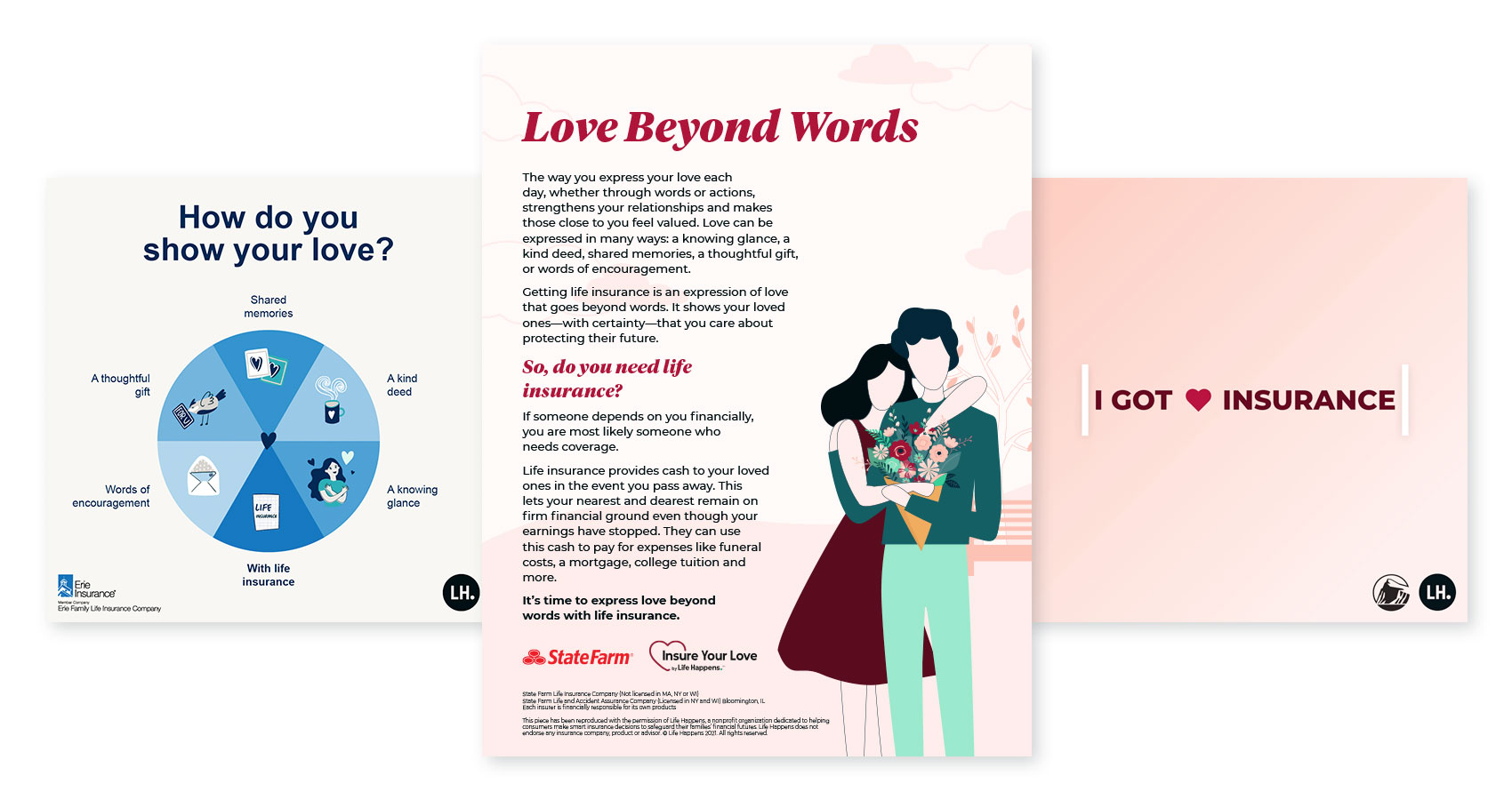

Insure Your Love (IYL) takes place every February to remind Americans that the basic motivation behind the purchase of life insurance is love.

Life Happens shared the campaign message: Love Beyond Words. We released new data in our “For Love and Money” consumer survey that revealed American relationships are changing, and finances are playing a key role.

More than 100

Disability Insurance Awareness Month

Disability Insurance Awareness Month (DIAM) takes place every May because disability insurance is arguably the most misunderstood of all major insurances.

Life Happens shared the campaign message: Rethink disabilities. Rethink disability insurance. We created new resources for agents and companies to use that were focused on reaching high-income earners.

Program Highlights

Dream On

Life Happens’ creates video public service announcements (PSAs) to fulfill our mission. Our latest PSA, Dream On, shows how life insurance can help those you would leave behind if something happened to you.

1+ million

Real Life Stories

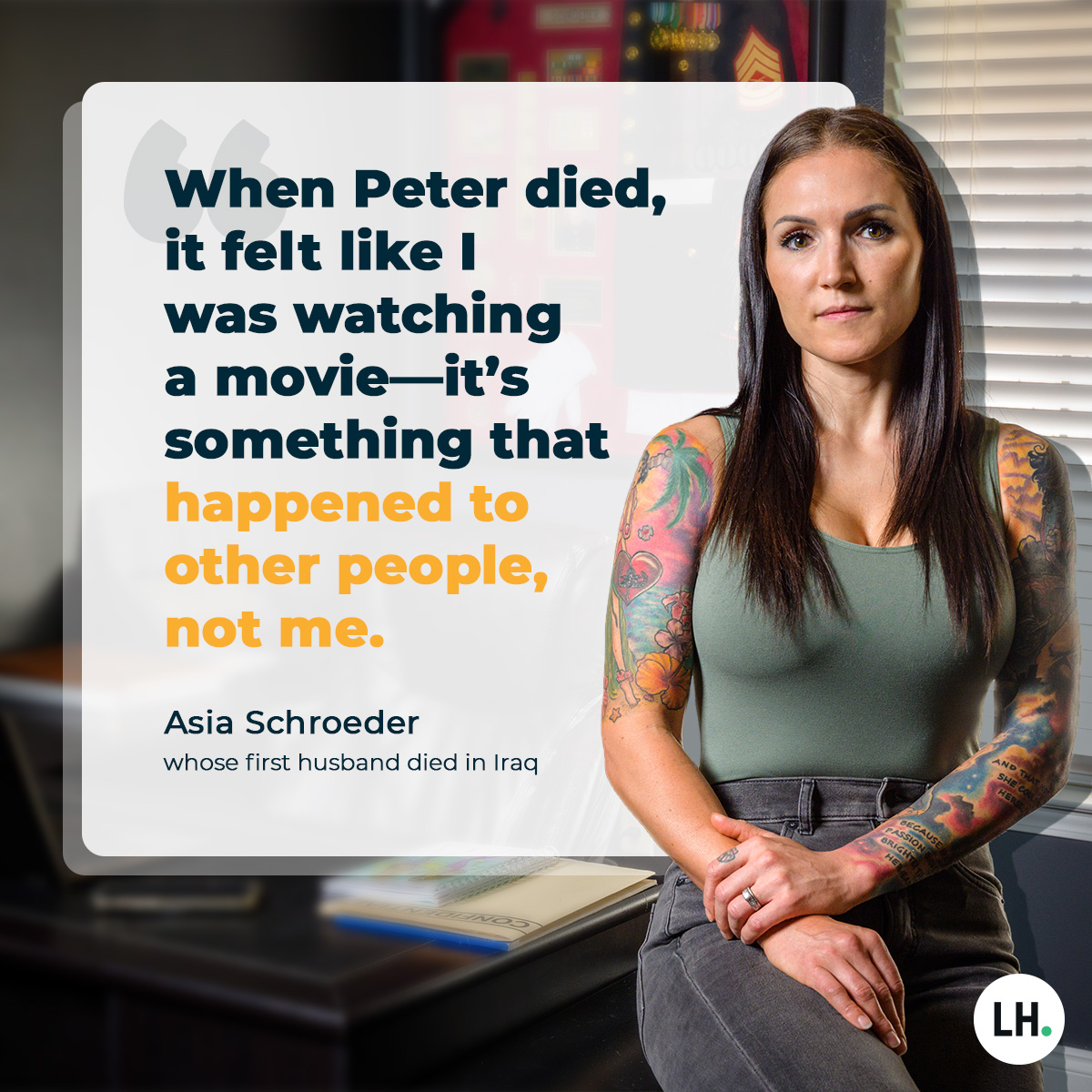

Our Real Life Stories program shares how real people have benefited from life, disability or long-term care insurance and annuities when adversity strikes. These emotional stories show the value of different types of policies, as well as the agents who helped their clients get coverage.

In 2022, we shared two new Real Life Stories.

Asia Schroeder first experienced the power of life insurance when her first husband, Peter, died in the line of duty. Later, she experienced living benefits when her family used the cash value to fund their gym. Throughout her lifetime, life insurance has provided her family with financial support.

For Sara Mathews Dixon, life insurance has meant she and her three children don’t have to worry financially while grappling with the sudden loss of their husband and father from a heart arrhythmia.

Eugenia Mello x Life Happens

We partnered with Argentine artist Eugenia Mello to create custom illustrations for Hispanic Heritage Month that reflected the theme: Life insurance—an easy decision.

Life insurance is “a multiplier of energy, where what you put in has the possibility of giving multiple possibilities to your loved ones.”

Influencer Partnerships

Life Happens worked with two diverse Instagram influencers to further our mission of reaching more Americans.

MyLin & Lindsay

Stokes Kennedy

Carolina

Andes

Life Lessons

Since its inception, more than

780 scholarships totaling $3+ million

have been awarded to students at more than 375 schools.

Taylor Bush

Rylee Martinez

Wyatt Lewallen

In all honesty, I didn’t know what life insurance was until ten years after my mom’s death. You can never put a dollar amount on someone’s life, but you can definitely feel how much you need their financial contributions when they are gone.

Wyatt Lewallen

2022 Legal & General Recipient

We will start accepting applications for this year’s scholarships on February 1, 2023.

Research

2022 Insurance Barometer Study

Key findings:

- 106 million adults are in need of life insurance—or more of it

- 68% of life insurance owners feel financially secure compared to just 47% of non-owners

Hispanic Americans: Life Insurance Ownership and Attitudes

This new report, a supplement to the 2022 Insurance Barometer Study by Life Happens and LIMRA, gives insight into the Hispanic market and how the life insurance need gap can be overcome.

Key findings:

- 51% of Hispanic Americans say they need (or need more) life insurance

- Hispanic Americans say that cost (38%) and competing financial priorities (38%) are the top reasons that they don’t have life insurance or more of it

For Love and Money

Key findings:

- 59% would feel more secure in their relationship if they discussed getting life insurance with their partner

- When asked what financial decisions would demonstrate their love to someone, 36% said purchasing a life insurance policy, with men more likely to say that than women (40% vs 33%)

In the News

44+ billion

impressions garnered from media coverage in 480+ articles

Roselyn Sánchez comparte tips sobre cómo hablar de finanzas en familia

Many Hispanics are missing out on this key wealth-building tool

Roselyn Sanchez Has a Brilliant Trick For Teaching Her Kids Negotiation Tactics

Roselyn Sánchez On Life Insurance - “Family Is Everything”

Roselyn Sánchez nos revela la decisión inteligente que hizo para asegurar su futuro y el de los suyos

Changing how Black Americans use life insurance could help shrink the racial wealth gap

How to find a woman financial planner

People Are Sharing Their Best Low-Cost Valentine's Day Ideas, And It's So Cute I'm Sobbing

Talking About Money Could Be Good For Your Love Life

Download a PDF of this report

For membership inquiries: partnerships@lifehappens.org

For media inquiries: lifehappens@kwtglobal.com