3 Questions to Ask When It Comes to Life Insurance

Your life insurance needs will ebb and flow throughout your lifetime. Buying a term policy early in your career or taking a basic employer-issued life insurance policy is a common course of action.

However, deciding how much and what type of life insurance you need at each stage of your life will serve you and your loved ones much better.

One simple thing to keep in mind throughout this process is that the more responsibility you have, the more life insurance you need. Here are a few questions to consider:

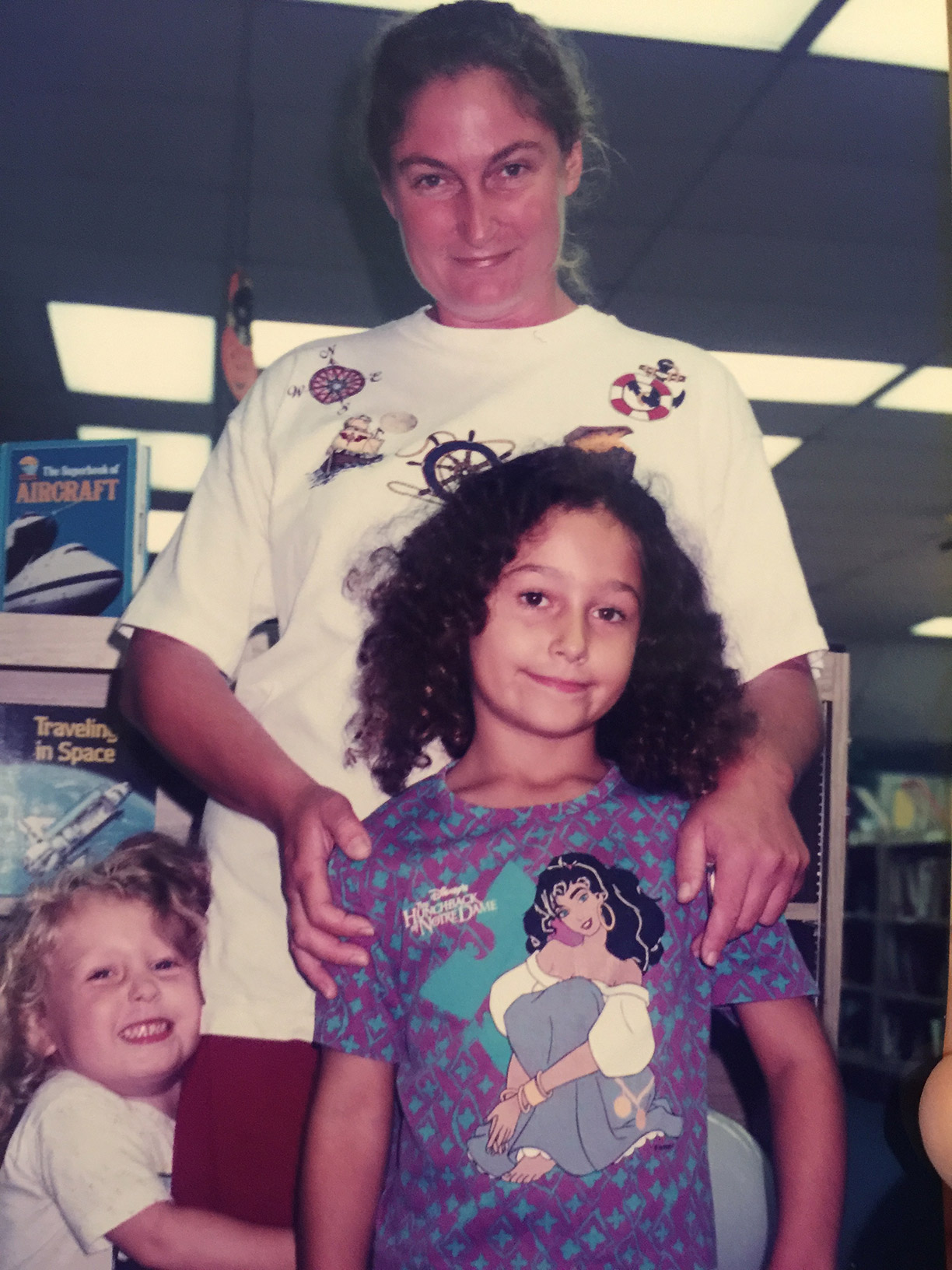

1. Who depends on me?

Of course, if you have children, a term life insurance policy that is large enough to pay off your home and debts with some money left over to support your family while your spouse or partner grieves and recalibrates the new financial situation is the option that gives everyone peace of mind.

Many times, it’s easy to overlook the other people who depend on you. The care of elderly parents or grandparents, siblings, or people in your family with special needs should also be considered carefully when deciding how much basic life insurance to buy. You can also get a working idea of how much you might need with this Life Insurance Needs Calculator.

2. How much insurance can I afford?

A term life insurance policy that covers the care of your loved ones in the event of your untimely death is an inexpensive option, if you are under 40 and in reasonably good health.

Permanent life insurance insurance is worth researching if you know you have a permanent need for life insurance, such as caring for a special needs child or sibling. It also makes sense if you’d like certain benefits beyond a guaranteed death benefit for your loved ones, like premiums that do not increase with age or changing health conditions, and a cash value that you can borrow against.

If you can afford the additional premium amount and expect your financial situation and income to remain stable long-term, whole life insurance policies offer living benefits that may outweigh the temporary pain of higher premiums.

3. How healthy am I?

People in great health who have only a little bit of wiggle room in their monthly budget may want to consider a combination of term and permanent life insurance coverage.

Your clean bill of health will keep premiums for both types of insurance lower than if you have major health issues. If you have a term life insurance policy but want more coverage, adding a permanent policy to the mix may be the ideal answer.

By adding a permanent policy with a cash-value element to your portfolio, you also open a world of options that could help add to your nest egg in retirement, start a business, or pursue a second career, among other benefits.

It is possible to have multiple policies and customize your life insurance to your changing wants and needs. Choosing a policy or combination of policies that gives you and your family the greatest potential benefit may seem tricky. So, simplifying the process by asking these three questions will set you on the right track.