by Natalie Chambliss | August 30, 2023

Single Parents and the Financial Future

What is weighing on single parents’ minds? There’s one thing for sure: their children’s financial future.

According to a new survey by Life Happens—Single Parents and the Financial Future—single parents think about their child’s financial future on average five times a day.

And the average single parent says they’d need a minimum of $332,705 in savings to feel at ease about raising their child. That said, only half (52%) say they’ve purchased life insurance to protect their children’s financial future, if someone else had to raise them.

There are close to 11 million single-parent families in the US¹, accounting for 23% of all households.² Three quarters (75%) say they felt overwhelmed with becoming a single parent, and more than a quarter (27%) of those admit being very overwhelmed.

Here’s what else they’ve said:

- Four in 10 single parents (43%) hadn’t started planning for their child’s financial future until early childhood (ages of 4-6) or later. Only 10% started before their child was born.

- Sacrifices that single parents have made for their children include going into debt (42%) and altering their career or work choices (52%).

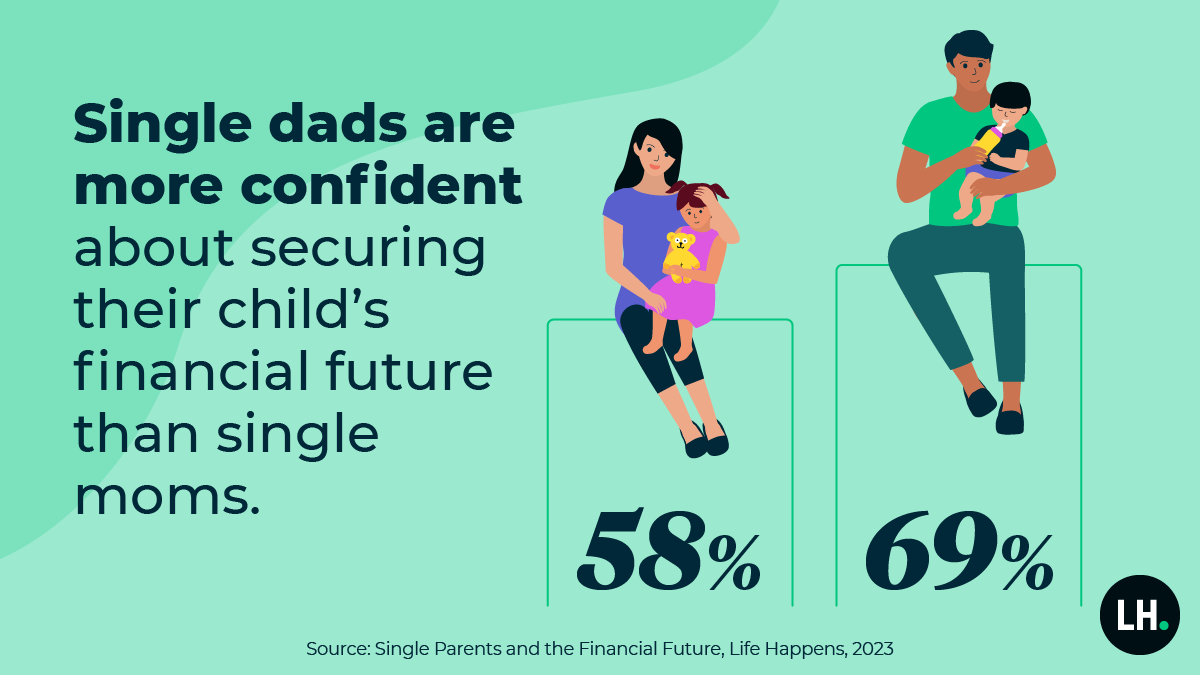

- Single dads are more confident about securing their child’s financial future than single moms (69% vs. 58%).

- 6 in 10 single parents say they felt comfortable using online communities to discuss how to plan for their financial future, edging out financial professionals.

Does life insurance play a role?

- Half of single parents (52%) said they bought life insurance to provide financial security for their children if they were to die unexpectedly.

- Single parents say they’re more likely to depend first on savings (59%) and family (57%) if they were to die than on life insurance (47%).

- A third of single moms (36%) and three in 10 dads (29%) say they don’t consider life insurance as a way to protect their child’s financial future.

- More than a quarter (28%) say they’d let others rely on a crowd funding site to help support their kids if they died.

Gen Z is very open to having financial discussions

Gen Z single parents, those age 18-26, are much more likely to feel comfortable talking about financial planning with others—from family to financial professionals—than older single parents are.

They are also most likely to say they value life insurance as a protection vehicle. Almost half of Gen Z said life insurance was very important (48%) to protect their child financially if something happened to them vs 33% in general.

Here is how comfortable Gen Z feels talking about financial planning vs the population as a whole:

Gen Z vs the general population

Family members: 86% vs 69%

Financial advisor: 79% vs 58%

Online communities or forums: 76% vs 59%

Accountant/tax professional: 74% vs 52%

Close friends: 65% vs 48%

To source this study, please use: Single Parents and the Financial Future, Life Happens, 2023

View the infographic from this study here. And for media inquiries, contact lifehappens@kwtglobal.com.

by Natalie Chambliss | August 29, 2023

2023 Insurance Barometer Study: Report 2

The Future of Life Insurance: Millennials, Gen Z and Technology

In this second report of the 2023 Insurance Barometer Study, by Life Happens and LIMRA, our aim is to highlight demographic differences and trends for Millennials and Gen Z in relation to life insurance and financial education.

The Destination for Financial Information: Social Media

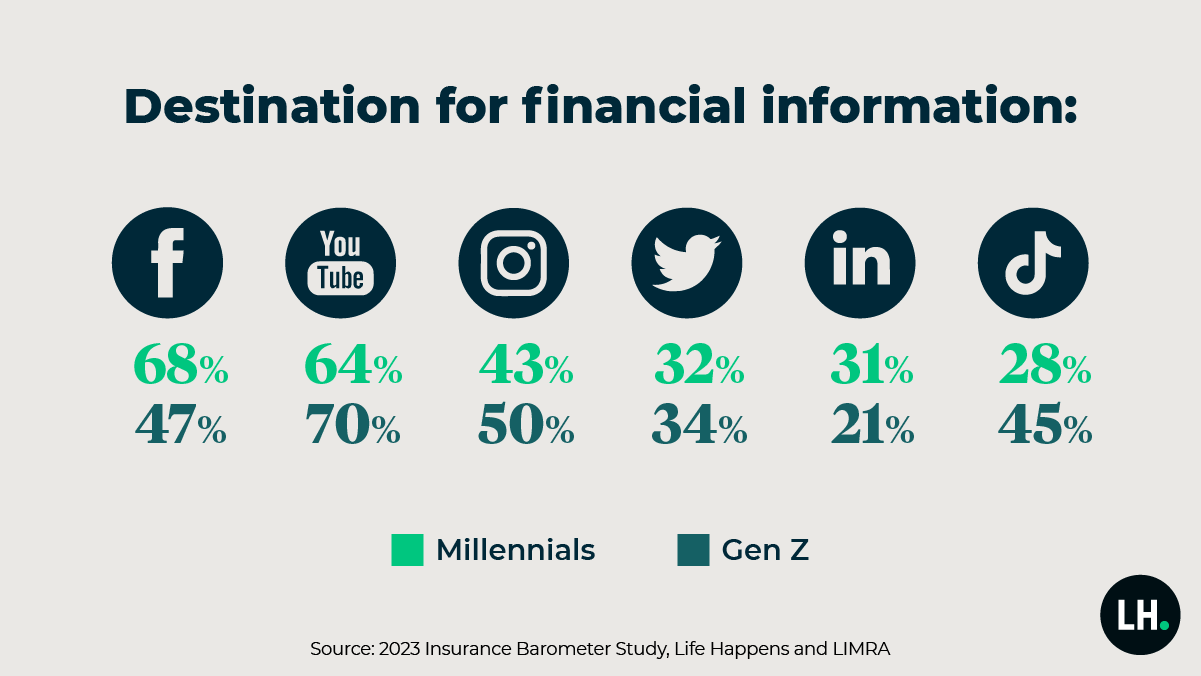

Younger generations rely heavily on social media for financial education: Of those ages 18-42, about two-thirds use YouTube for financial information, followed by Instagram, Facebook and TikTok. In addition, half of Gen Z sought information about life insurance online and have visited a life insurance company’s social media vs. 27% of all generations.

The Move to Buying Life Insurance Online

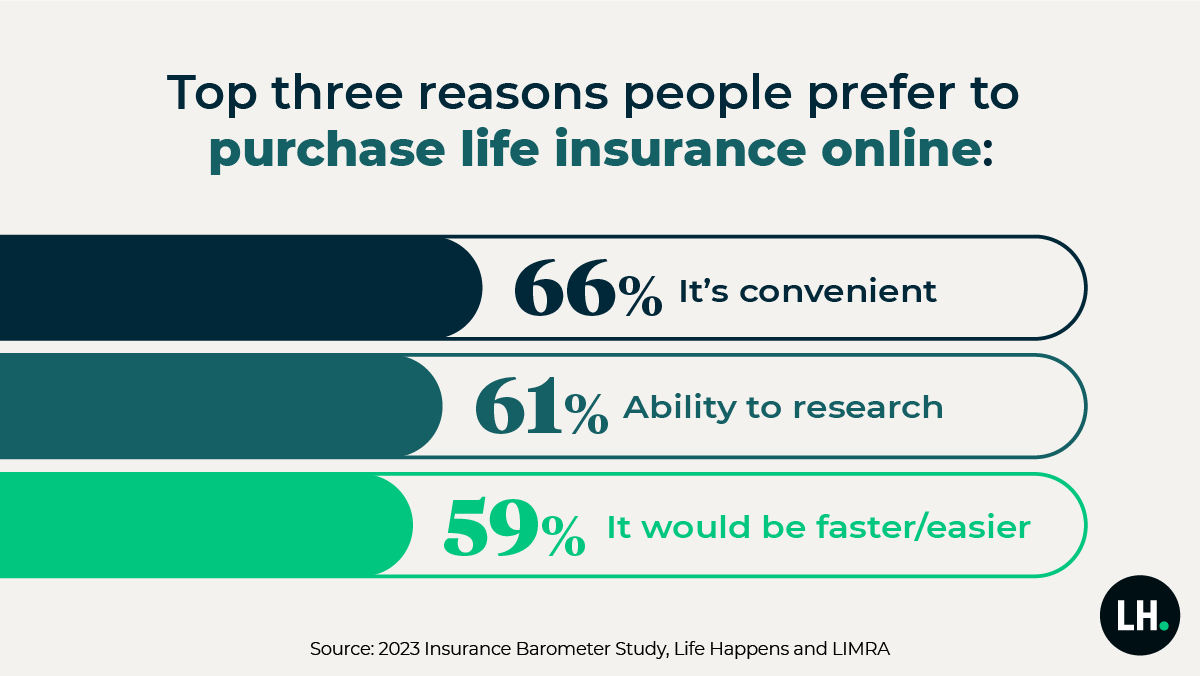

For the first time since the study began in 2010, people now say they prefer to research and buy life insurance online (32%) vs. in-person (29%). A quarter of people say they expect to complete a life insurance purchase entirely online. Ease and efficiency are top reasons people cite for wanting to purchase online, including: convenience (66%), ability to research (61%) and that it’s faster/easier (59%).

Misconceptions About Coverage

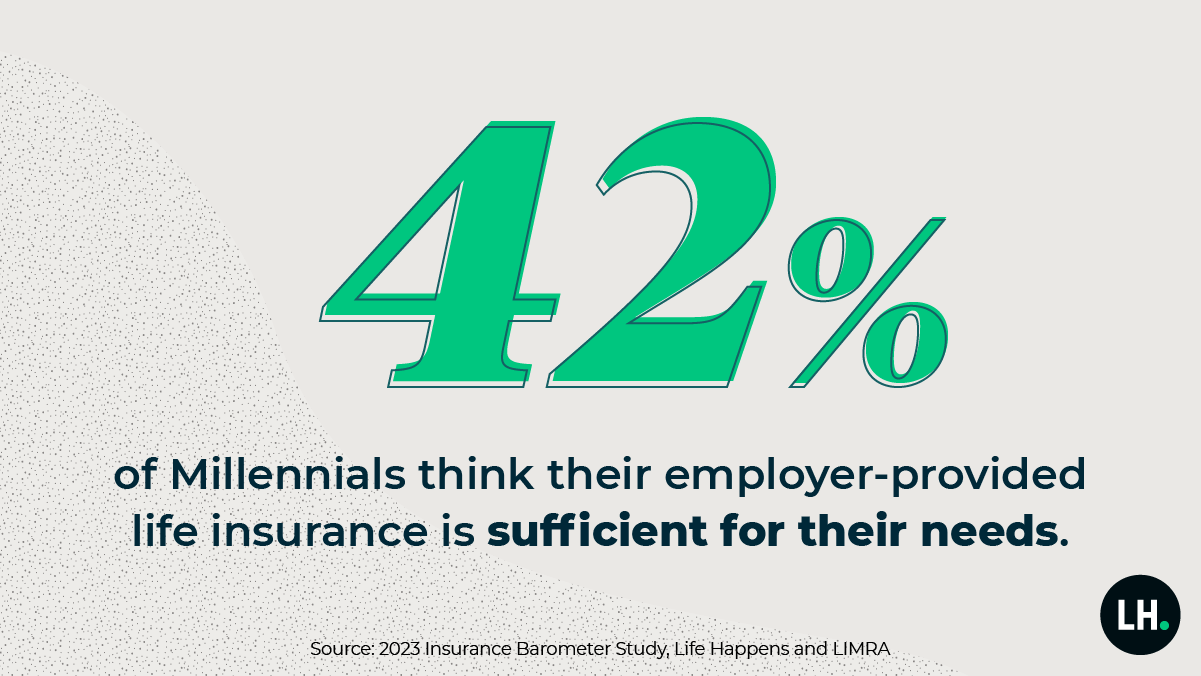

Common myths and misunderstandings keep Millennials and Gen Z from getting the life insurance coverage they need, including an overestimation of the adequacy of coverage employers provide and the true cost of life insurance. More than two in five Millennials believe the life insurance their employer provides is sufficient for their needs. While it often offers one to three times a person’s annual salary, it’s not generally viewed as sufficient for a family or family-to-be.

Financial Concerns and Privacy

Compared to older generations, Gen Z and Millennials say they face heightened financial worries, with their priorities centered around self-sufficiency, bill payments and managing expenses such as rent and mortgage. While these concerns tend to vary according to economic conditions and the job market, the levels of financial concern are higher than they were for those of similar age when the study started.

Maintaining privacy and establishing trust continue to be crucial considerations when purchasing life insurance: 50% of all respondents said they were “extremely” or “very” concerned about privacy. The numbers drop somewhat for Millennials (45%) and Gen Z (42%). Only 6% of respondents said they are “not at all concerned.”

For more information on this study and its methodology, view our press release.

by Natalie Chambliss | April 24, 2023

2023 Insurance Barometer Study

Millennials and Gen Z Lead Growing Need for Life Insurance in 2023

Education around ease and affordability of ownership is key to expanding coverage to those who know they need it, especially single moms.

The pandemic’s economic disruption altered people’s views on a wide range of money topics—from the feeling of financial insecurity, to the extra burden of debt, to how best to protect their loved ones, physically and financially. People’s interest in life insurance—knowing they have a need for it—was heightened during the pandemic and remains so, as people take a closer look at their financial security and well-being. The 2023 Insurance Barometer Study, by Life Happens and LIMRA, shows this trend is prevalent among the younger generations, as well as with single mothers.

Single Moms Need the Industry’s Help

Fewer women own life insurance than men, 49% vs 55% respectively. And that number is even starker for single moms: Just 2 of 5 single mothers (40%) own life insurance.

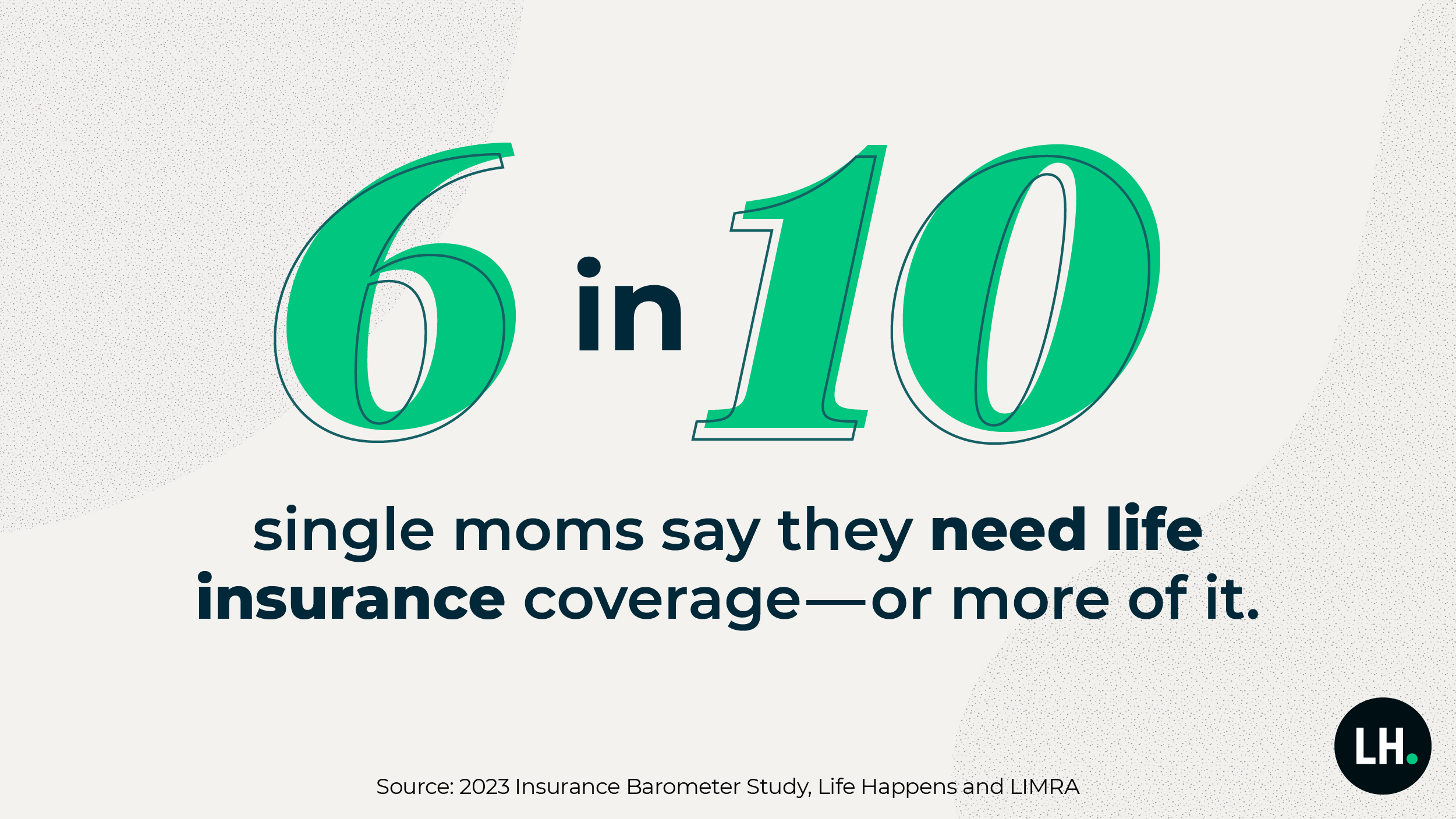

That said, 6 in 10 single moms (59%) know they have a life insurance need gap—meaning they need coverage or more of it (vs. 41% of all adults) equaling about 5 million households. And 4 in 10 (38%) say they intend to buy coverage this year. With 7.9 million single-mom households, according to the U.S. Census Bureau, there is a dire need for single moms to purchase life insurance, or more of it.

The primary reason single moms own life insurance (63%) is the same as the general population: to cover burial costs. However, only 26% say they have it to replace lost income. And more than half (51%) say they are “extremely concerned” about leaving dependents in a difficult financial situation if they died prematurely, vs 29% of the general population.

That’s not the only area of financial concern. In fact, single moms have increased levels of concern over a wide range of financial issues—often double-digits—over the general population.

- Having money for a comfortable retirement: 58% vs 44%

- Saving for an emergency fund: 56% vs 38%

- Paying monthly bills: 50% vs 32%

- Ability to afford college: 40% vs 22%

Owning life insurance makes people feel more financially secure: 69% of life insurance owners feel secure vs. 49% who don’t own. For single moms, this is 52% of owners feel secure vs 30% who don’t own.

The good news is that while only a third of single moms (35%) work with a financial advisor currently, more than half without one are looking for an advisor (52%) to help them navigate their finances.

Desire and Need Are on the Rise

Gen Z is growing up—they’re adults now who are in the weeds of financial responsibilities and stresses. Half of Gen Z is now 18-26 years old, which means 19 million young adults are ready for life insurance, most of whom are non-owners; and Millennials, at 27 to 42, are well into their careers and starting families. The study took a look at life insurance ownership among different age groups and found that half of all adults (52%) own life insurance, with 40% of Gen Z adults and 48% of Millennials currently owning it.

As Gen Z starts hitting life milestones such as finding a partner, buying a home and having children, half (49%) say they either need to get life insurance or increase their coverage. And Millennials are not far behind, with 47% saying so. And they are ready to take action: 44% of Gen Z adults and 50% of Millennials say they intend to buy life insurance this year.

They also want to purchase it where they have become comfortable—online—and that goes for all generations. In 2011, 64% of people said they preferred to buy life insurance in person; by 2020, just 41% felt this way. In 2023, it dropped to 29%.

Education Is Key for Gen Z

There is work to do on educating people about ownership: 42% of all adults say they’re only somewhat or not at all knowledgeable about life insurance.

A quarter of Gen Z and Millennials say that not knowing how much or what kind of life insurance to buy stops them from getting coverage. And 37% of Gen Z and 27% of Millennials say they “haven’t gotten around to it.”

Across generations, cost is cited as the top reason for not getting life insurance. But only a quarter (24%) of people correctly estimated the true cost of a policy for a healthy 30-year-old, which is around $200 a year.* More than half of Gen Z adults (55%) and 38% of Millennials thought it would be $1,000 or more.

With the current climate adding financial uncertainties to Gen Z and Millennials, including layoffs and inflation, it is imperative that the two age groups learn how to protect their loved ones financially. Education around finances in general, inclusive of life insurance, will be extremely beneficial, particularly for Millennials, who cite the highest overall level of financial concern (39%).

*Survey respondents were asked how much they thought a $250,000 20-year level term policy would cost per year for a healthy, nonsmoking 30-year-old, which is around $200.

Discover more

For more information on this study and its methodology, view our press release.