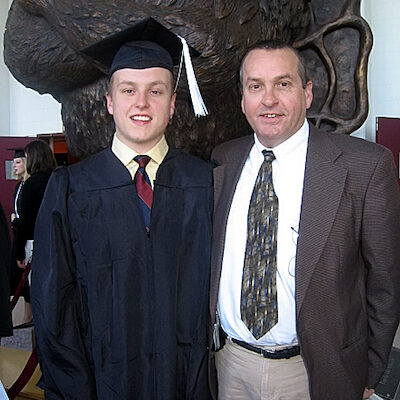

For Scott Rider, it wouldn’t be a stretch to say that running was his life. In college he was a three-time Big Ten Champion, two-time All American, and later competed in the Olympic trials. His running sustained him as he charted out his career in financial services. It was also a constant as he and his high-school sweetheart, Kelly, married and raised their three children.

Running is also how he found out his life was changed forever.

It began subtly, when Scott’s toes didn’t “work as they should.” It eventually interfered with his running, and after several years of being misdiagnosed, he learned he had Parkinson’s disease.

“I remember the day I found out. As I stood outside the doctor’s office, on the sidewalk on a warm fall day, I knew my life—and my family’s—was changed forever,” says Scott.

The Life They Knew …

His day-to-day routines have changed drastically since being diagnosed at 47. Cognitive and physical limitations mean he had to give up the profession he loved. And he now relies on Kelly to help him with tasks most people take for granted, like tying his shoes.

One thing in his life has not changed, however. He and his family have been able to maintain their lifestyle, thanks to the disability insurance he purchased. He got it when he was just starting out in his career and added to it as his salary grew.

His disability insurance now replaces a significant portion of the income he once earned. It has allowed Kelly to remain a stay-at-home mom and now be a caregiver. Plus it helps them meet Scott’s growing medical needs.

In addition, the couple has been able to put their three children through college and give their daughter the wedding of her dreams. They’ve even reached a retirement goal of moving to a warmer climate. All of this was made possible by Scott’s disability insurance.

“Without it, I don’t know where we’d be,” says Scott. “I feel fortunate that I understood early on that my income was my most valuable asset, and that I needed to insure it.”