How We Protect Our Blended Family

“When we, as LGBTQ+ adults, make the decision to get into a relationship and start a family, it’s not always with the support of our own family.” That is a poignant statement that will resonate with a lot of people. This insight came from MyLin and SK Stokes Kennedy,...

How We Protect Our Blended Family

“When we, as LGBTQ+ adults, make the decision to get into a relationship and start a family, it’s not always with the support of our own family.” That is a poignant statement that will resonate with a lot of people. This insight came from MyLin and SK Stokes Kennedy,...

If you currently have a term life insurance policy, you may be wondering if it's possible to make the switch to permanent life insurance. The good news is you can, but there are some important factors to consider first.

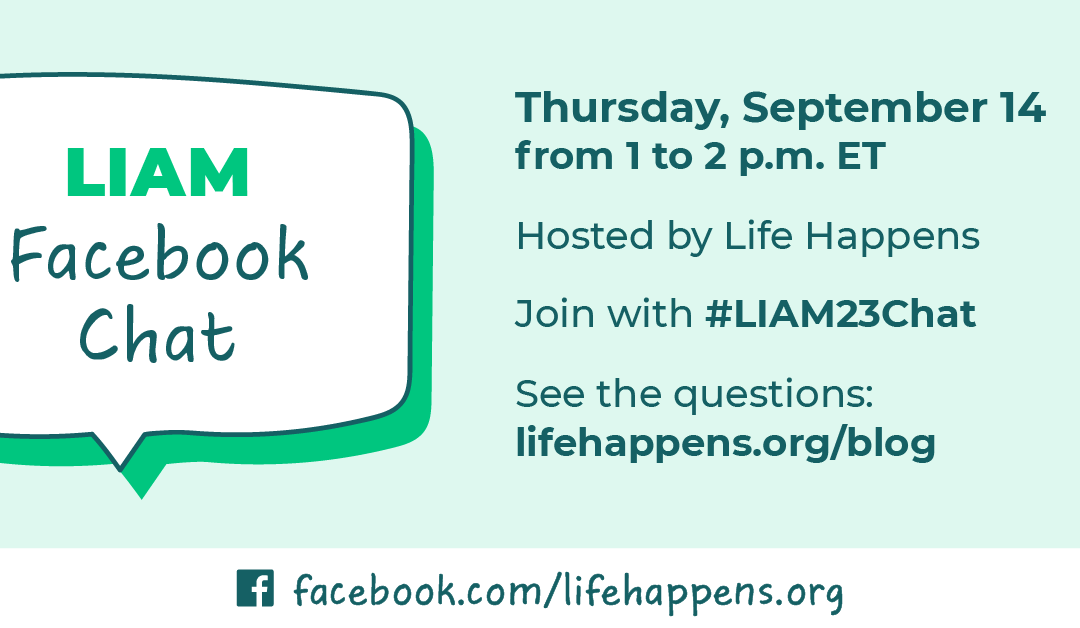

Join Life Happens for a Facebook Chat during Life Insurance Awareness Month this September. We’ll discuss all things life insurance and living benefits!

If someone depends on you, chances are you need life insurance. Why, then, do fewer women own life insurance than men? There are some misconceptions that prevent women from getting the coverage they need.

While getting disability insurance with a pre-existing condition can prove more challenging, it's still possible to qualify for coverage.

Using both annuities and life insurance as part of your retirement strategy can give you income during your retired years, as well as a death benefit after you die.

Life insurance may not seem like a priority right now, especially with competing financial concerns. But being a young adult means you’re entering a new stage of life. Here are a few reasons to consider purchasing life insurance now as a college graduate.

While Asian Americans represent the race and ethnic group with the smallest life insurance need-gap—35% say they need life insurance or more of it—that still represents 5 million people in the AAPI community who need more coverage.

Mike's life changed forever when he was hit by a drunk driver while crossing the street. Fortunately, he had disability insurance when he needed it most.

For single moms, 52% of those with life insurance feel financially secure vs. just 30% of those who don’t have it.

Are you considering a new job opportunity? If so, you’re not alone. The average employee stays at a job for just over four years, so people of all ages will likely see a job change at least several times in their lifetime. Whether it’s a voluntary move, switching ...

You may have heard of life insurance and thought you don’t need it, especially if you’re still young and don’t have any dependents. And yes, it can be considered an extra monthly or yearly cost, but it’s worth your while not only when you’re young, but as the ...

Getting life insurance is a no-brainer, as it can provide your family and loved ones with crucial financial protection if you pass away. But how exactly does it work? And by that, we mean how does it “kick in” and provide the benefits once you die? Let’s explore ...

No results found.