5 Advantages of Combining Annuities and Life Insurance for Retirement

Preparing for your retirement needs careful planning to ensure you get the right benefits after years of hard work. Combining annuities and life insurance can be one way to achieve a comprehensive plan that sets you on the right track for a relaxing retirement. You...

Featured

5 Advantages of Combining Annuities and Life Insurance for Retirement

Using both annuities and life insurance as part of your retirement strategy can give you income during your retired years, as well as a death benefit after you die.

Recent Posts

So much has happened in the last few days and weeks that I feel like months have passed. Social distancing is now on everyone’s lips. And the goal is noble: flatten “the curve” and prevent more people from getting sick from the Coronavirus.

The impact, though, is ...

Join us as we moderate a Twitter Chat during Insure Your Love Month along with NAIFA. We’ll discuss new data that shows Americans are delaying traditional life milestones and following alternative paths in favor of financial security.

We hope the chat helps ...

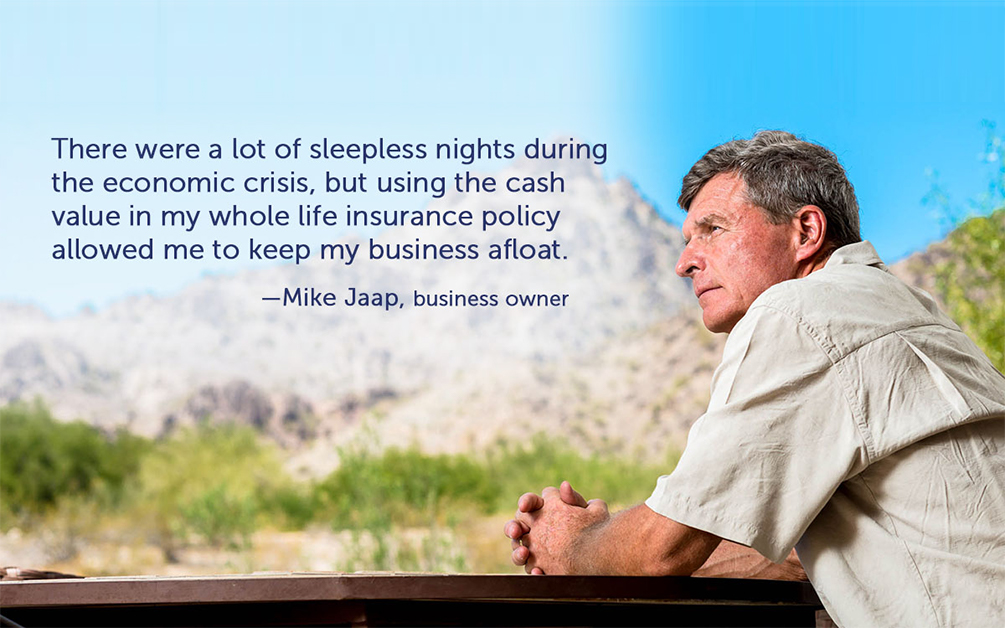

We get it: No one wants to think about death—for us or the ones we love. And a lot of people equate life insurance with death. And while it IS there if the worst were to happen, it can also do so many other things, and doesn’t have to break your budget while doing ...

Most of us aren't keen to think about the end of life—especially our own. But discussing the need for and understanding end-of-life planning documents is important for all of us. So, what are these documents and why do you need them? Here’s a summary:

1. Durable ...

The summer lemonade stand is a rite of passage for all kids. It is usually the first time a child gets to create their own business. They learn about the hard work it involves but also learn of its rewards, monetary and other. For my two girls, it was a lemonade ...

After feeling a lump in her breast earlier this year, my wife, Julie, who’s 35, had a 3-D mammogram. The radiologist reviewed the results with her and scheduled a biopsy for the following week. That’s when we found out that she had high-grade ductal carcinoma in ...

More Posts

No results found.