With 102 million adults living with an uninsured or underinsured need gap, there is a chance you need more life insurance coverage. Now is your opportunity to learn from financial experts and companies about the facts and benefits of life insurance during Life Happens’ Life Insurance Awareness Month (LIAM) Twitter Chat. You can also ask questions, reply to other comments and engage in the greater conversation.

We hope this chat educates Americans about how life insurance is a simple and affordable way to protect their loved ones’ financial futures. It allows you to say to your loved ones, “I’ve got you” … and mean it.

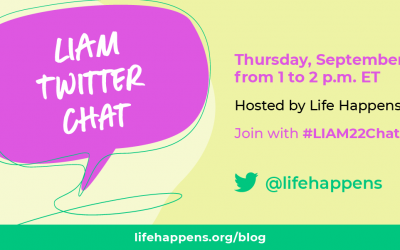

Date: Thursday, September 9 from 1 to 2 p.m. EDT

Where: Join us on Twitter using your personal handle or your company’s handle.

Hashtag: Use and follow #LIAM21Chats during the above timeframe

Life Happens will moderate the discussion and drive the conversation on Twitter using the questions and statistics below. Remember, if you want to participate in the conversation, you’ll have to use the #LIAM21Chats hashtag in each tweet.

All statistics below come from the 2021 Insurance Barometer Study, Life Happens and LIMRA, 2021.

Q1: Respondents of the 2021 Insurance Barometer Study were asked how the pandemic affected their financial concerns. Out of the top five seen here, which concern(s) directly relate to some of the benefits of life insurance? #LIAM21Chats

-

- Paying my monthly bills (26%)

- Being able to save money for an emergency fund (23%)

- Having enough money for a comfortable retirement (22%)

- Job security/maintaining a steady income (21%)

- Losing money on investments (20%)

Q2: Almost half (46%) of Black Americans live with a life insurance need gap. How does your organization educate and engage the Black community to help close this insurance gap? #LIAM21Chats

Q3: Two distinct reasons uninsured Americans say they do not own life insurance are 1) a lack of trust with insurance companies and 2) a lack of trust with insurance agents, brokers, and/or financial advisors. How can we build trust with these Americans? #LIAM21Chats

Q4: More than half of the population thinks term life insurance is over three times more expensive than it is. What do you think causes this misconception? How can we better educate the masses about its true cost? #LIAM21Chats

Q5: From 2011 to 2021, life insurance ownership has decreased from 63% to 52%. What do you think is the cause of this decline? #LIAM21Chats

Q6: Nine in 10 adults report using social media generally and half report using social media to gather information on financial topics, companies, or advisors. How are you raising awareness about life insurance this month? #LIAM21Chats

Help us share the importance of life insurance during Life Insurance Awareness Month by participating in the Twitter Chat and join us all September long by using #GetLifeInsurance and #LIAM21 on social media.