For the last decade, Life Happens and LIMRA have come together to understand the “financial pulse” of consumers as part of the annual Insurance Barometer Study. This year’s study reviews 10 years of consumer data on life insurance and related financial issues, providing a point of view from January 2020, before COVID-19 significantly impacted the U.S.

Life insurance acts as a vital protective blanket for loved ones when the unexpected happens. But for many, this realization comes too late.

The Insurance Ownership Gap

Before the pandemic, close to half (46%) of U.S. adult consumers did not own life insurance. While 36% of respondents said they intended to purchase life insurance in the next 12 months, many were without it during the height of COVID-19 in the U.S. Lack of ownership may be adding to mounting financial stress Americans are facing. Almost half (44%) of those surveyed state that they would feel a financial impact within six months if the primary wage earner were to pass away. More than a quarter (28%) would feel it within one month. This doesn’t need to become a reality, but as more consumers delay taking action they are putting their loved ones at risk.

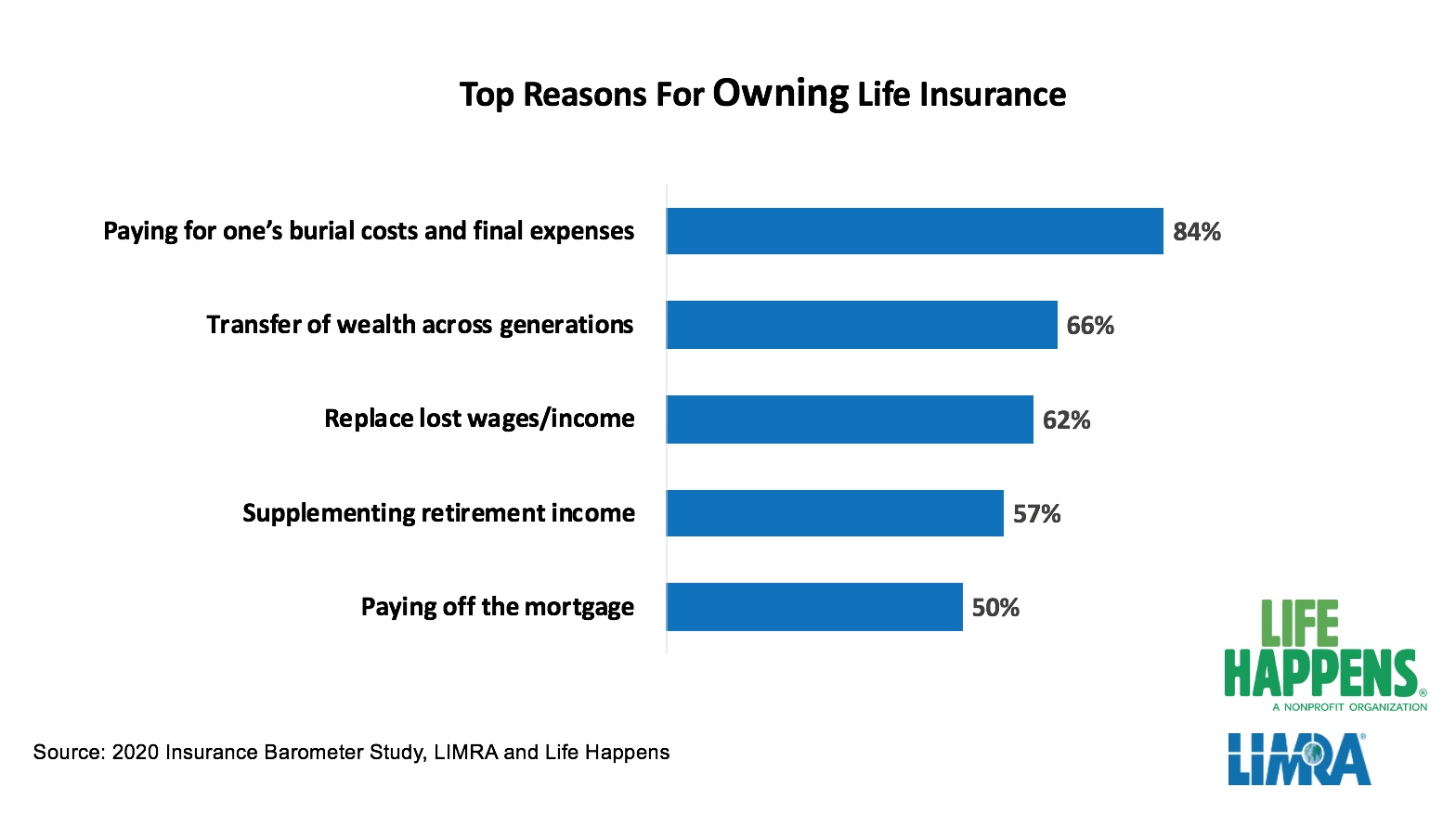

Ownership of life insurance this year fell among households in the lower and middle-income categories (i.e., under $100,000), declining by 25% over the past 10 years. For those who do own life insurance, the top reasons are:

Life Insurance: (Not) Something for Tomorrow

Be smart, buy life insurance when you’re young. Results show that 40% of people who own life insurance wish they had purchased policies at a younger age. While it’s best to get a life insurance policy when you’re young and healthy, research shows that many do not take action when they can typically secure a more affordable rate.

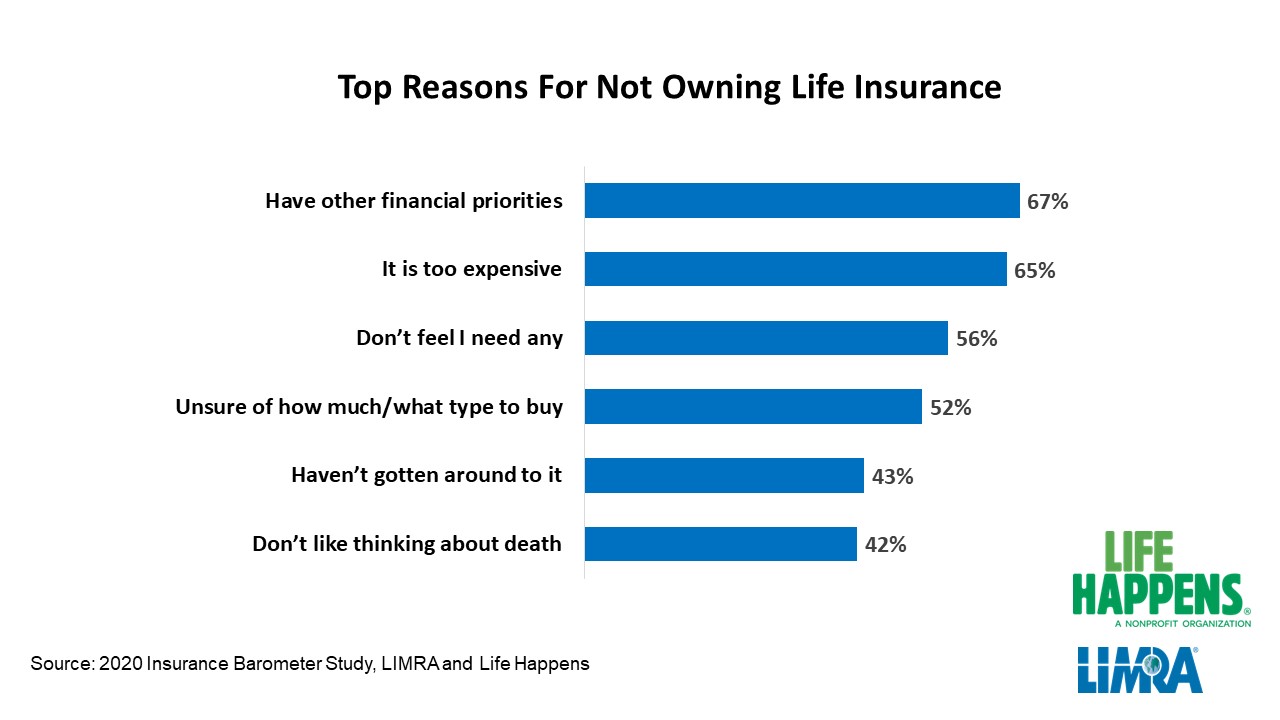

However, perception of cost may be the most significant barrier. Half (50%) of Millennials believe the estimated yearly cost for a $250,000 level-term life insurance policy for a healthy 30-year-old is $1,000 or more when in actuality, it’s closer to $160 per year. Other top reasons people do not own (more) life insurance are: