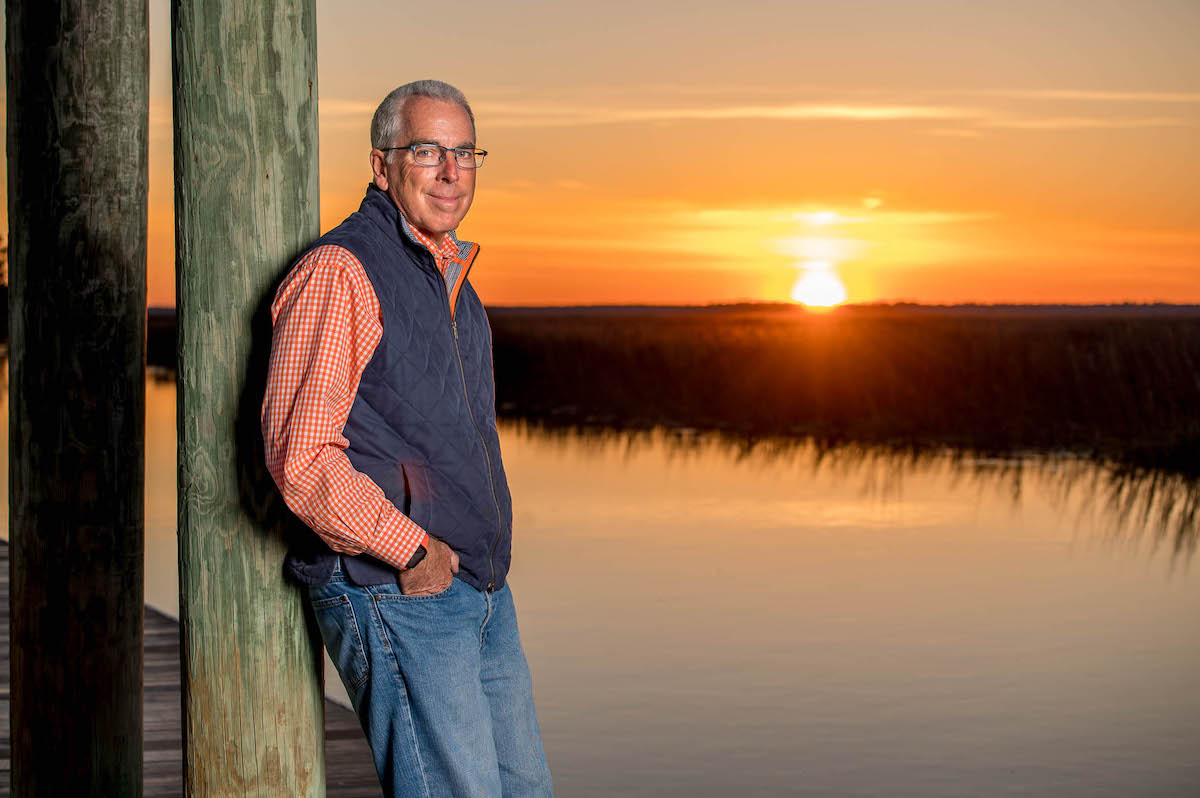

Scott Rider is one of the most optimistic and energetic people you could meet. He’s an avid biker, engaged in his community, and loves nothing more than to spend time with his family.

He also needs help tying his shoes.

At 47, this Olympic-caliber runner, athlete, businessman, husband and father found out he has Parkinson’s disease. So much in his life has changed in the years since he’s been living with this degenerative disease. But one thing hasn’t: his financial well-being. He credits disability insurance with making that possible. You can watch his story here.

You see, disability insurance is there if you get sick or injured and are unable to work. It replaces a portion of your income until you recover and can return to work. Or in Scott’s case, the payments continue for the rest of his working career since he will never be able to return to the job he loved.

Many people don’t think about getting this important—but often overlooked—insurance. Scott is a big advocate for disability insurance because it allows him to really live his life and enjoy it.

Here’s what he says about his coverage:

- Disability insurance allowed me to protect my most valuable asset, which wasn’t my house or car or investments, but my ability to earn a living.

- When I had to scale back and then quit working, the bills kept coming. Disability insurance payments stepped in so that I could meet those obligations.

- My wife didn’t have to head into the workforce after being a stay-at-home parent because we had an income stream.

- We are still in our dream home, and we could pay for our daughter’s wedding because I had disability insurance.

- My wife’s and my retirement are secure because we didn’t have to touch our retirement savings when I became ill.

“Parkinson’s disease changes life enough, but disability insurance makes it as close to normal as possible. I’m so incredibly grateful that my income continues and makes life possible for my family. It would look so different without disability insurance,” says Scott.

If you work and rely on your income, then you need disability insurance.

You can check with your benefits administrator to find out what coverage you may have through work and then talk with an insurance professional about the benefits of having an additional individual disability policy. Scott had a combination of both, which he says helped him maintain his family’s lifestyle.