Celebrating 20 Years of Life Insurance Awareness Month

Life Insurance: For Anyone Who Lives

Reaching Single Parents

The average single parent says they’d need a minimum of $332,705 in savings to feel at ease about raising their child, and 75% say they felt overwhelmed with becoming a single parent.1

Yet just 2 in 5 single moms (40%) own life insurance, which is well below the U.S. average of 50%.2

And more than a quarter (28%) of single parents say they’d let others rely on a crowdfunding site to help support their kids if they died.1

Campaign + Execution

Life Insurance Awareness Month (LIAM), created and coordinated by the nonprofit organization Life Happens, takes place every September to remind Americans about the importance of life insurance for their financial security.

In 2023, Life Happens celebrated the 20th anniversary of LIAM with the campaign message, Life Insurance: For Anyone Who Lives. We focused specifically on reaching more single parents with the campaign, using owned research, influencer partnerships and content creation to maximize our reach.

We also activated our network of insurance company members and insurance professionals to help share the campaign message, focusing on our 20th anniversary as a cause for industry celebration and unification.

SURVEY: “SINGLE PARENTS AND THE FINANCIAL FUTURE”

We fielded market research with survey media company SWNS to develop a Life Happens owned survey, “Single Parents and the Financial Future.” This survey polled 1,000 single moms and 1,000 single dads for their thoughts on single parenthood and their financial challenges. The data highlighted the need for life insurance and further education on the topic.

52% of single parents

bought life insurance to provide financially for their children if they were to die unexpectedly.

More than a quarter

of single parents say they’d expect money from a crowd-funding site to support their kids financially if they died.

Single dads (69%)

are more confident about securing their child’s financial future than single moms (58%).

293

stories

945+ million

impressions

19

pieces of broadcast coverage

INFLUENCER PARTNERSHIPS

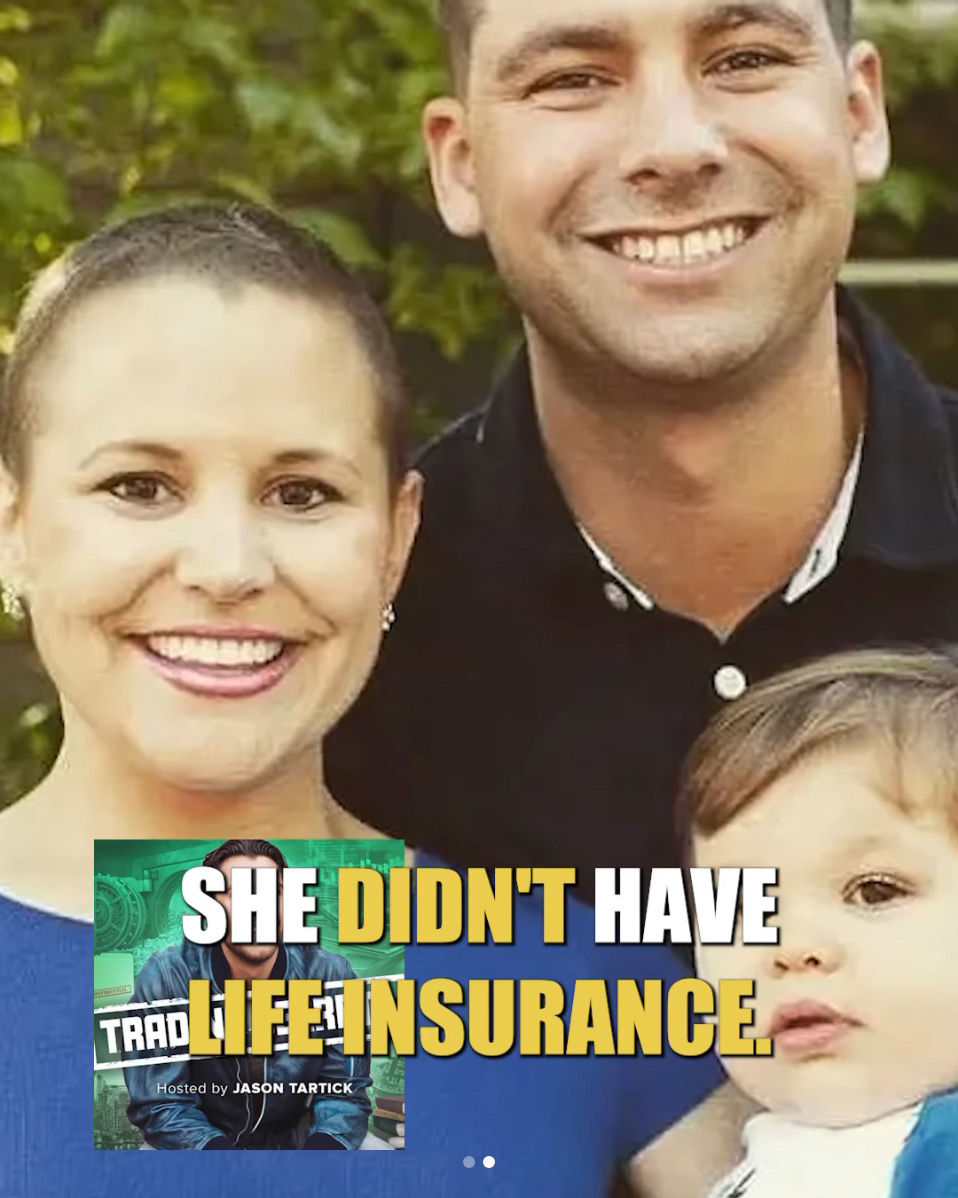

Michael Allio

Bachelor in Paradise and The Bachelorette star Michael Allio is a widower and father. His wife, who did not have life insurance, died in 2019 after a two-year battle with breast cancer at age 33. He shared more about his story and the impact not having life insurance had on his grieving process with his 390K+ followers.

Kim Williams

Single mom Kim Williams created Single Black Motherhood, a community dedicated to education and resources that enhance the quality of life for single mothers. She shared her story and why she has life insurance coverage with her 72K+ followers.

9 total posts

shared with 539k+ total followers

211k+

organic impressions

1.3+ million

potential consumer reach

2,500

engagements

600+

live viewers on Instagram Lives

CAMPAIGN CONTENT

Here are some of our partner companies who shared our LIAM assets:

A sizable group of Millennials and Gen Z adults are not seeking life insurance because they don't know how much it costs or what their options are. #LIAM23 pic.twitter.com/Xiz9GruyME

— North American Company (@NorthAmerCo) September 26, 2023

Life insurance is a way to continue taking care of your family, even if you aren’t there anymore. #GetLifeInsurance #LIAM23 pic.twitter.com/iBvP7Ld66T

— Kansas City Life (@KansasCityLife) September 26, 2023

Many people don’t know that life insurance can come with living benefits, including funds you can use while you’re alive to do things like buy a home, supplement your retirement income, cover an emergency expense and more. #GetLifeInsurance #LIAM23 pic.twitter.com/Uve2rxm413

— EMC National Life (@EMCNationalLife) September 27, 2023

If you are your children’s one-and-only, having life insurance is even more critical. It’s a financial safety net that can help alleviate some of the worries of the unknown. #GetLifeInsurance #LIAM23 pic.twitter.com/fkekiUPreV

— The John Dunn Agency (@TheJohnDunnAgen) September 28, 2023

AWARENESS

1.1+

billion

total impressions across all LIAM campaign touchpoints

211k+

impressions

from influencer partnerships

12.3+

million

potential impressions from LIAM on social media

1+

billion

impressions from total media coverage

34%

increase

in visitors to Life Happens’ Life Insurance Needs Calculator compared to September 2022