Disability insurance

is for anyone who works.

Do you have a job and depend on your paycheck? Then you probably need disability insurance. It’s really as simple as that.

Whether you’re a salaried or hourly employee, freelancer or business owner, you rely on your income. Think of disability insurance as protection for your ability to earn a living.

1 in 4 of today’s 20-year-olds will become disabled at some point in their career,

according to the Social Security Administration.

Curious about how much disability insurance you might need?

The amount of disability insurance to buy depends on the monthly expenses needed to maintain your current standard of living.

What is disability insurance?

We have some answers to common questions about disability insurance so that you can make informed decisions about protecting your paycheck.

How do you get disability insurance?

The main ways to get disability insurance are through your employer, through a professional organization, or on your own by working with a licensed insurance agent. There are pros and cons to each.

Questions?

Do I need disability insurance if I work?

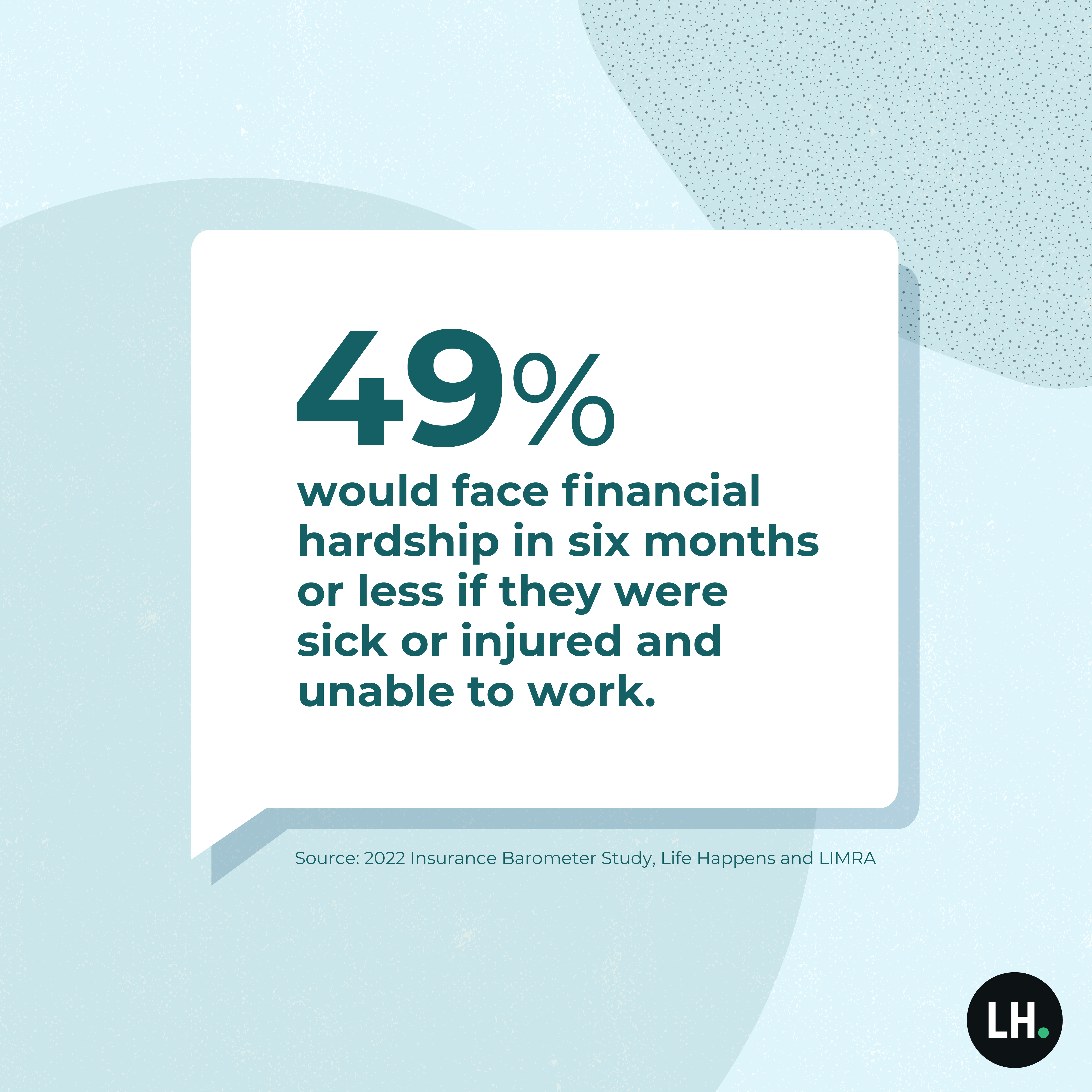

Disability insurance is something anyone who works and has earnings should consider. That’s because one in four people today will become disabled¹ and potentially face financial hardship at some point during his or her working life. Disability insurance income helps cover expenses if you can’t work because of an illness or injury. There are disability insurance policies tailored to workers in specific professions as well as disability insurance for self-employed individuals.

How much does disability insurance cost?

The cost of disability insurance depends on several factors. Just some include your benefit amount, benefit period, occupation, health status, age and terms of the policy. As a general rule of thumb, the disability insurance cost for a long term individual policy is 1% to 3% of your annual salary.

What are the types of disability insurance?

There are two main types of disability insurance: short-term disability insurance and long-term disability insurance. Short-term disability insurance covers lost income for about three months while long-term disability insurance typically pays a portion of your lost income for anywhere from one year to your entire life.