Education Is Key to People Getting the Life Insurance They Need

2024 Insurance Barometer Study

Education Is Key to People Getting the Life Insurance They Need

Half of Americans own life insurance. That’s the good news: They see the value in protecting their family’s financial future. However, many people who don’t own it say they need it (62%), as well as those who do have coverage but say they need more (22%). Together, this need gap represents 102 million Americans.

For more information on this study, view our press release.

These statistics are from the 2024 Insurance Barometer Study, by Life Happens and LIMRA, which is now in its 14th year. It tracks consumer perceptions and attitudes towards life insurance and other financial products.

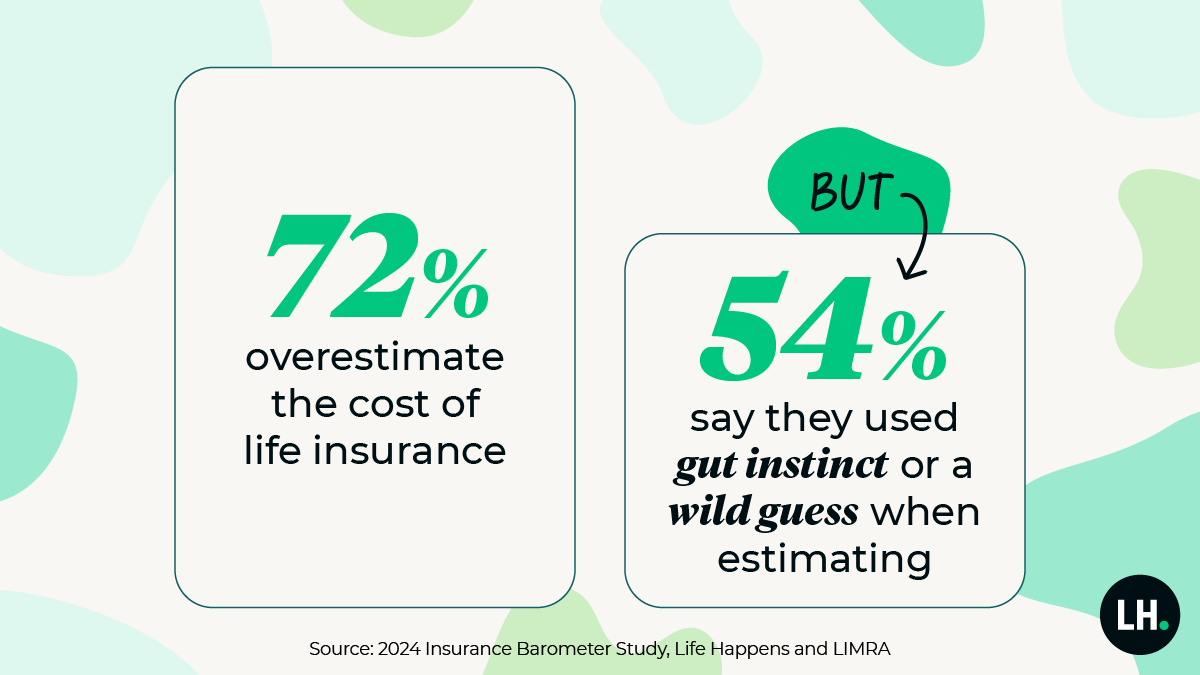

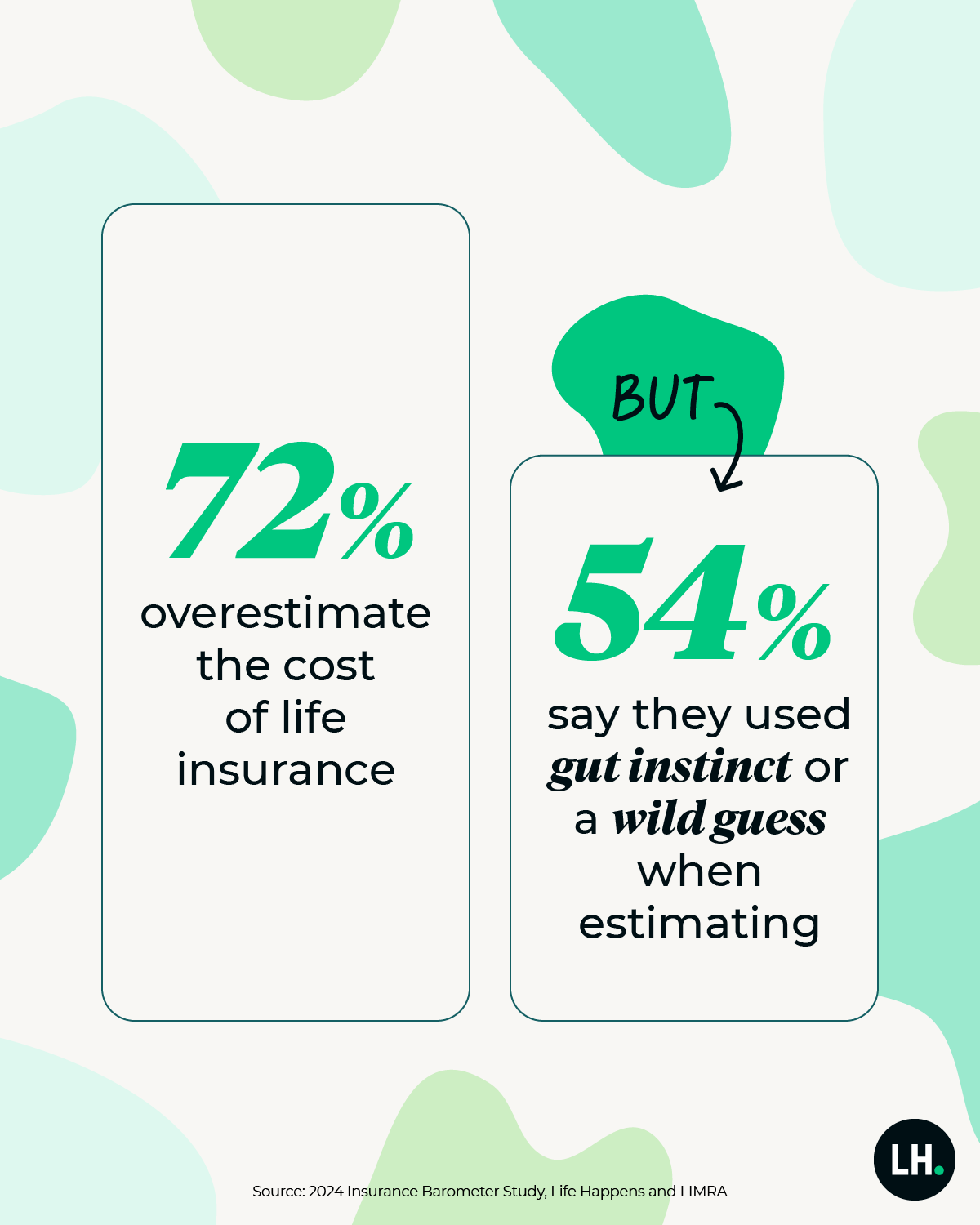

So, what’s stopping people from getting the coverage they know they need? The No.1 reason is they think it’s too expensive. But is it, really? The truth is that 72% of people overestimate the true cost of life insurance.* That’s a huge figure. And most are not basing their estimates on reality. In fact, more than half of people (54%) who overestimated the cost said that they used either a wild guess or gut instinct.

All this price guessing is standing in the way of protecting their family—the solution: education. And people do admit they lack understanding: 44% say they aren’t very knowledgeable about life insurance, with more than half of women (51%) saying so.

This stands at the heart of Life Happens’ nonprofit mission to educate more Americans about this important topic.

Reaching the LGBTQ+ Community

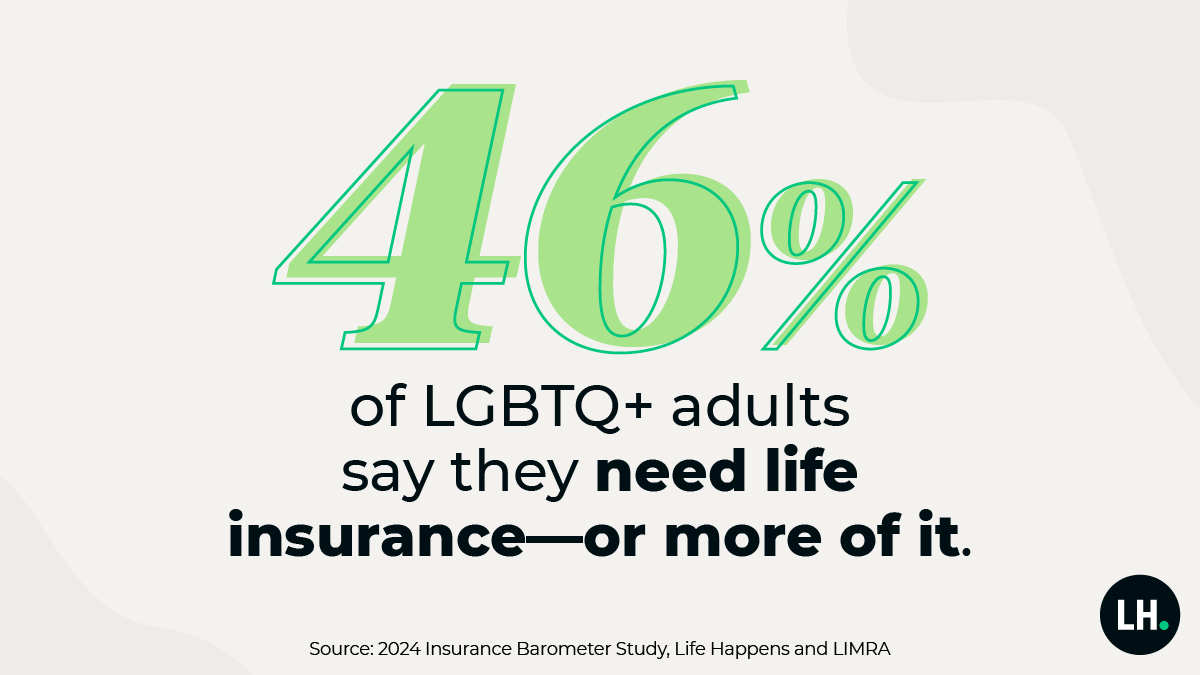

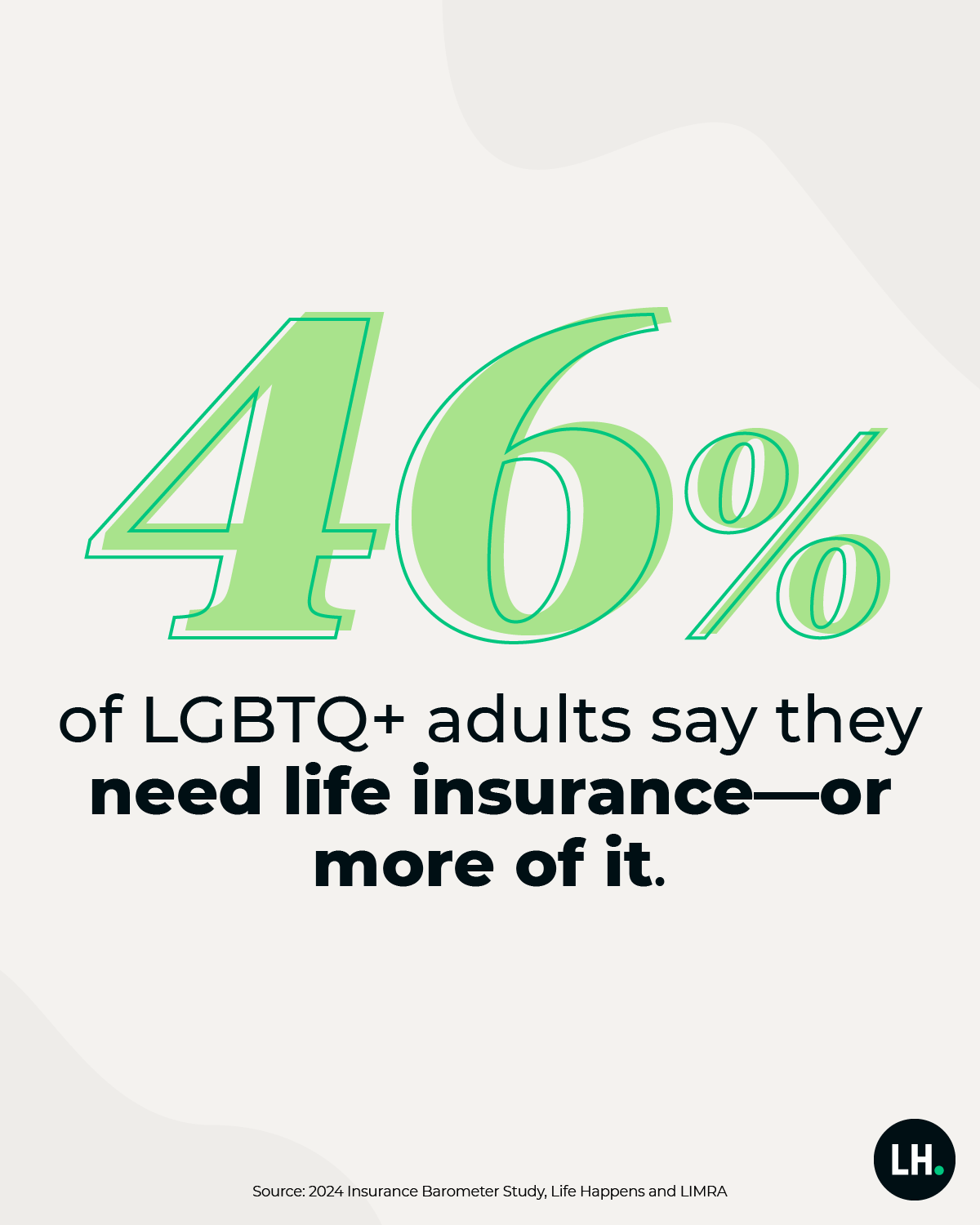

This year the study focused on better understanding the LGBTQ+ community and found that the life insurance need gap (46%) is greater than for the population in general (42%). This means there is an awareness among those who don’t own it that they need it, as well as those who do own it and recognize that they need more. This is true of other minority communities the study has delved into in years past. The need gap in 2024 for Black Americans is 49% and Hispanics 53%, well above the average.

When looking at general financial concerns, they were more elevated across the board for the LGBTQ+ community than for Americans in general. This includes top concerns like money for a comfortable retirement (52%) and being able to save for an emergency fund (47%), as well as job security/steady income (39%), which was above the general population (30%). However, those in the LGBTQ+ community with life insurance express less financial concern (56%) than those who don’t own it (41%). This is in keeping with the general population. Those who own life insurance feel more financially secure (62%) than those who don’t own it (46%).

Interestingly, when asked if they felt potential discrimination when buying life insurance, the answer was the same as everyone else (5%). However, when asked if “life insurance companies prioritize fairness and equality in their practices,” only 28% said they agreed or strongly agreed with this statement.

A Generational Shift

The “Middle Years” may bring life events such as marriage, raising children, buying a home, etc. The study has found that Gen X is no longer the most worried about finances; Millennials are. It appears a generational shift is underway that may be precipitated by societal changes, such as getting married and having children later than previous generations.

Millennials’ financial worries top all generations, including having enough money for retirement (54%), being able to support themselves if they couldn’t work due to a disabling illness or injury (45%), and paying for long-term care services (40%).

These issues can be addressed in part or in whole with insurance-based solutions. And yet, one of the things that can bring them most financial peace of mind—life insurance—is something that fewer Millennials own it (48%) than their older Gen X counterparts (56%). This may be exacerbated by the fact that almost half (47%) admit that they took a wild guess or used a gut feeling to estimate the cost.

Combination Products

An area that appears to be growing in popularity with the public is combination products, specifically in this study, life insurance with long-term care benefits.

The study first asked about combination products in 2016, and interest has grown. This year, almost seven in 10 adults of all ages say that if they were in the market for life insurance, they would be “somewhat” likely to buy a combination product (41%) to “very” or “extremely” likely (28%) to help them to address the need for life insurance and long-term care. A key reason they give is the concern about long-term care services depleting their savings (36%).

And this is good news, as more than a third are worried about paying for long-term care—and this concern weighs on the younger Millennials (39%) as well as Gen Xers (37%). Overall, six in 10 say they need long-term care coverage, yet only 18% say they own it.

Please source all statistics: 2024 Insurance Barometer Study, Life Happens and LIMRA

The full 2024 Insurance Barometer Study is available to Life Happens member companies and can be accessed here. If you have issues accessing it, please contact partnerships@lifehappens.org. For media inquiries, contact lifehappens@kwtglobal.com.

Discover more

For more information on this study and its methodology, view our press release.