Disability Insurance Saves a Family—Twice :30

Valerie King was not a believer. When she transitioned from her medical residency to practicing as an emergency room physician, she didn’t think she needed disability insurance. “I could never envision a life without working,” she says. Her insurance professional convinced the young doctor otherwise.

It was wise advice. Although Valerie never thought she would need it, a condition called ulcerative colitis made the decision for her. The disease and a series of surgeries made it impossible for her to carry out her duties, and she found herself unable to practice the profession she loved. It was her disability insurance coverage that allowed her to survive financially and care for her three young daughters who she was raising as a single mother.

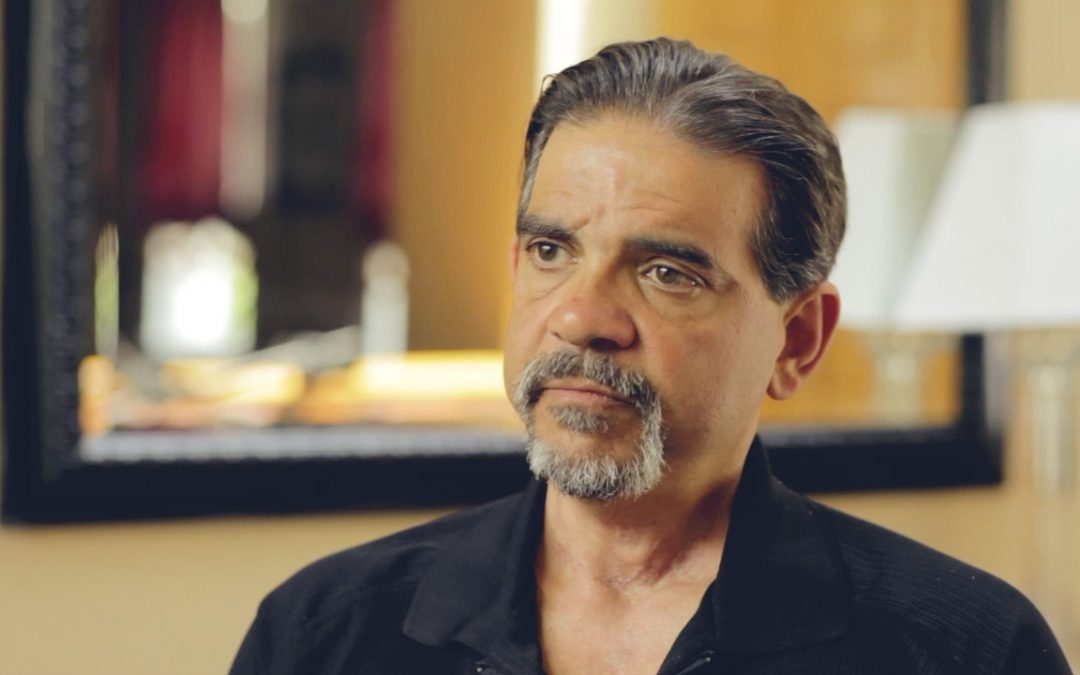

Life also had a second chapter for Valerie. She met and married Tim, also a divorced parent. They looked forward to raising their blended family together and sought the advice of insurance professional Larry Ricke, CLU, ChFC. In addition to the life insurance he had recommended, Larry made sure Tim understood the importance of disability insurance. Tim didn’t believe he’d ever need it, but with Valerie’s urging he finally agreed to get coverage.

“No one thinks lightening will strike twice,” says Larry, “but in this case it did.” Tim, who had a high-profile position in the printing business, came close to dying from an undiagnosed aneurism and valve issue with his heart. A risky operation saved his life but ultimately left him unable to return to work. Again, disability insurance made it possible for the family to go on financially.

“Most people think, ‘It will never happen to me,’” says Valerie. “But the truth is it can—and does. Everything else goes away if you don’t have disability insurance coverage and you can’t work.”